Samuel Chua

7th August 2025 - 3 min read

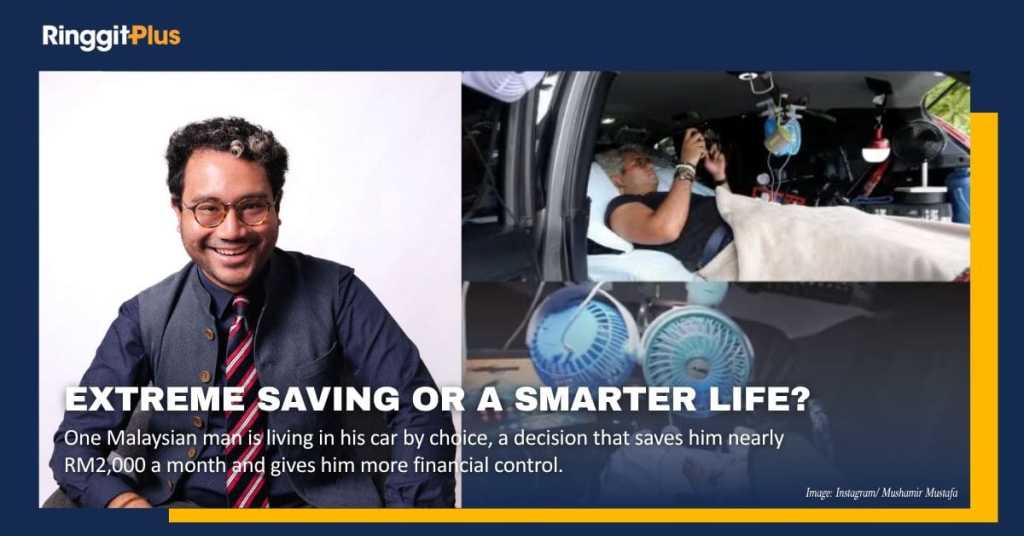

Mushamir Mustafa is a full-time marketing professional in Kuala Lumpur who has turned his Proton Iriz into a home to reduce expenses. He calls it his “palace on wheels”.

For over a year, he has lived and slept in his car by choice. With access to office facilities, public toilets, and solar-powered electricity, he has removed most of his major living expenses, including rent, utilities, and daily commuting.

Although he earns over RM10,000 a month, much of it used to go toward housing and transport. By living in his car, Mushamir now saves nearly RM2,000 every month.

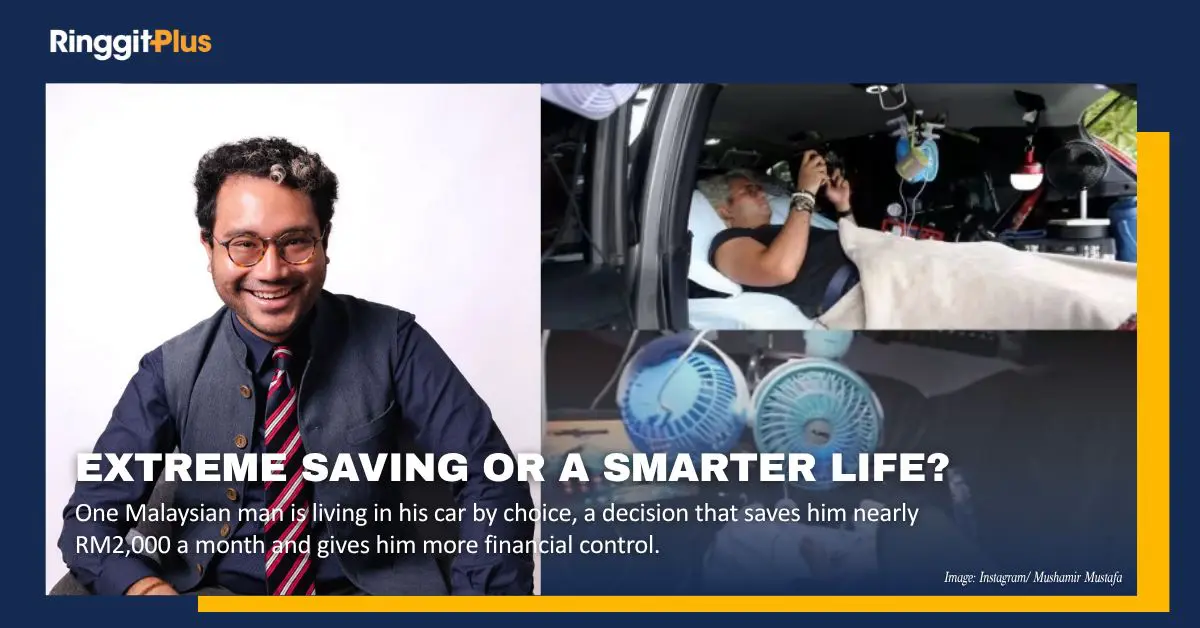

Converting a Car into a Liveable Space

To make the space comfortable, Mushamir folded down the rear seats and used a cooler box to level the base. He added memory foam pillows for support and installed roof bars to hold lights, fans, and a tablet. Items like books, chargers, and sleeping gear are stored within easy reach.

This setup allows him to rest, work, and relax in the same space, with minimal overhead.

Living With Less and Spending Smarter

Limited space means less room for unnecessary purchases. Mushamir says this lifestyle has helped reduce impulse spending and made him more focused on essentials. He now reinvests the money saved into upgrading his mobile living space.

He is also working on a small kitchen setup inside the car. With groceries stored at the office and basic appliances like a rice cooker and air fryer in progress, he hopes to reduce his food expenses even further.

Staying Clean and Organised

Mushamir showers at a public toilet near his office, using free soap and toilet paper. He washes his clothes by hand at night and dries them using heat from the car engine.

Although unconventional, this routine helps him maintain hygiene and cut laundry costs without needing access to a home washing machine.

Dealing With Social Reactions and Safety Concerns

After posting about his lifestyle online, Mushamir received messages from friends, ex-colleagues, and former bosses who were concerned about his well-being. He explained that this was a personal choice, not a result of financial hardship.

Safety is a practical concern. Finding a secure and quiet place to park is not always easy. While he uses curtains for privacy, he knows some visibility remains. He has occasionally been asked to move by security personnel or the police.

A More Flexible, Low-Cost Way of Life

Despite the trade-offs, Mushamir finds value in this lifestyle. With no rent or utility bills, his fixed costs are limited to food, mobile data, and entertainment subscriptions.

Looking ahead, he hopes to upgrade to a larger vehicle for more space. For now, he remains focused on saving money, reducing stress, and living with greater financial control.

Follow us on our official WhatsApp channel for the latest money tips and updates.

(Source: CNA)

Comments (1)

WOW