Pang Tun Yau

27th May 2024 - 7 min read

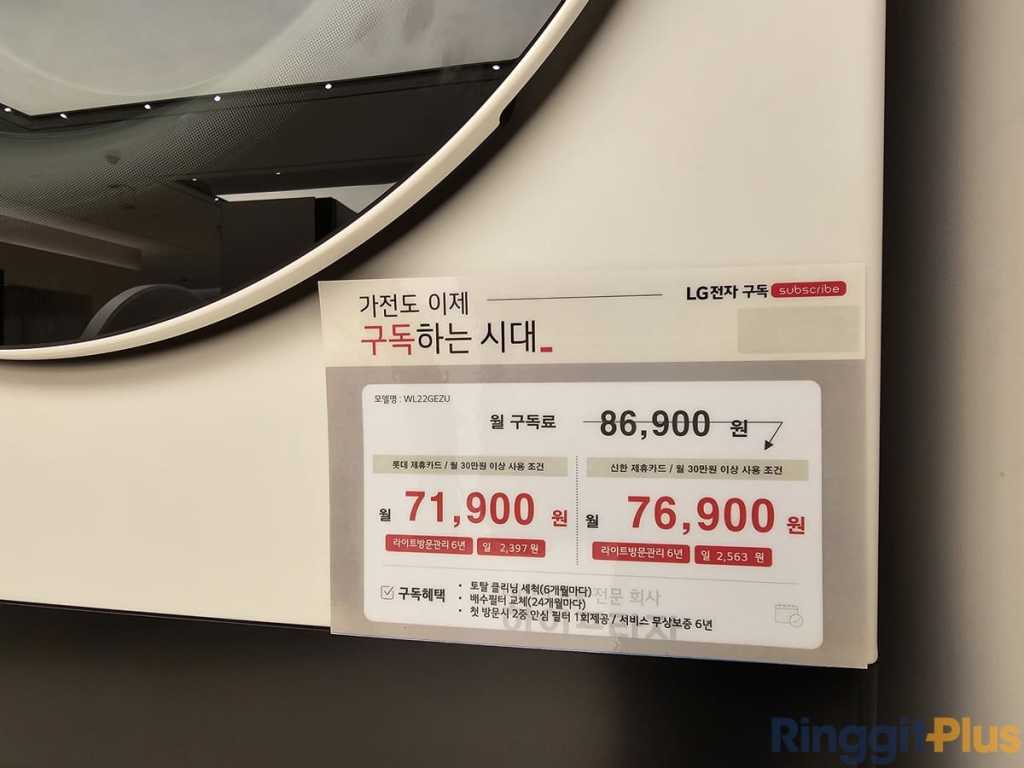

In July 2023, LG Electronics announced a new proposition for its home market in South Korea: a “home as a service” model, transforming the company’s existing home appliance rental service into a comprehensive “subscription”-based model that also covers care and maintenance.

The idea behind it was straightforward: with flexible payment or instalment plans now easily and widely available either from credit cards or directly from retailers, its existing basic rental service will need to evolve. LG’s solution was to take a leaf out of its hugely successful PuriCare business by offering maintenance and after-sales service throughout the subscription period, providing customers financial flexibility and peace of mind.

Creating Value

LG’s Life Soft Research Customer Lab found that the main house chore that customers wish to outsource was surprisingly not everyday tasks or even bathroom cleaning, but rather, it was Home Appliance Maintenance. After all, with different appliances needing regular servicing, cleaning, or maintenance at different schedules, it may not be easy for homeowners to stay on top of these in addition to everything else in their busy lives.

As such, LG’s evolution of its home appliance rental service to a subscription-based one is designed to improve the overall customer experience:

- First, by offering the widest range of appliances available, both in appliance type as well as model variants.

- Second, by offering every type of after-sales support customers need, from basic cleaning services to servicing and repair at little to no cost to the customer.

- Third, by offering all of these at rates that are transparent and with various flexibilities (including subscription tenures and upgrade options).

Combined, LG believes that the new subscription service will appeal to a much wider range of consumers. For example, early adopters and tech savvy consumers may be keen to subscribe to the flagship models without being tied to the same model – by subscribing, they have the option to upgrade to the latest flagship models without penalties (or, in traditional ownership models, having to offload their existing model by selling them to an interested buyer first). At the same time, those who prioritise safety and convenience can rest assured that maintenance and care is arranged by LG automatically at regular intervals throughout the product’s lifespan.

Home-As-A-Service

A subscription-based model is more commonly used by software companies, where companies like Microsoft and Adobe have shifted away from selling their products as a single suite of tools and instead offer them as separate items available on a subscription basis (commonly known as “software as a service” or SaaS). This dramatically reduces the upfront costs for customers and allows them to only subscribe to what they need. These companies further sweeten the deal by offering regular product updates for free, and various bundle discounts – creating a win-win scenario for the business and customers.

By switching to a subscription model, LG’s business will now have a recurring and visible revenue stream that’s not impacted by sales figures. Sacrificing one-time profits to a subscription-based model gives LG the same benefits that software companies enjoy, from predictable and low-volatility revenues, increased customer lifetime value (CLV), scalability, and the opportunity to cross-sell or upsell additional services (in LG’s case, additional product subscriptions).

However, as a manufacturer of physical products, a subscription-based model creates a new set of challenges that software companies never have to worry about. For example, the risk of potential theft, repairs, and cost of repossession of defaulted customers need to be quantified and protected. As such the monthly subscription fee will comprise various components: instalment based on the price of the product, insurance to cover loss or damage of the product, care and maintenance over the product’s lifecycle, other operating costs, and of course, profit margins.

For consumers, the flexibility offered by a subscription service means that homeowners don’t need to fork out huge sums of money upfront to purchase home appliances. This pain point is becoming increasingly burdensome as cost of living continues to go up across the world, which is why some consumers believe that the financial flexibility and additional benefits of a subscription outweigh the fact that the total cost of ownership increases.

Success Begins At Home

So, can a consumer electronics manufacturer sell its products like a software company? As LG’s subscription business enters its first full year of operations, the signs are certainly promising – and surprising.

The company recently announced that it is on track to register KRW1 trillion in unit sales from the subscription business in South Korea alone for the current financial year, achieving KRW345.6 billion in Q1 2024 – a huge 71.9% quarterly growth. This was largely due to its multi-channel approach, where every customer sales touchpoint – from physical retail outlets to online channels – allows a customer the option to subscribe to the product besides purchasing it outright. In fact, almost 1 out of every 3 customers at its flagship LG Best Shop outlets in April 2024 chose to subscribe.

And, perhaps most tellingly, its biggest competitor is now rumoured to be considering its own home appliance subscription business.

One may presume that key to the success of this subscription business stems from the appeal of the younger generation, who have grown comfortable with a “rental over ownership” mindset for everything from homes to games. However, data from LG shows that the various advantages offered has resulted in a diverse customer base across different age groups. We were told that one of the first subscribers was actually a lady in her 60s.

Expanding The Revolution

The success of LG’s home appliance subscription business thus far in South Korea has given further encouragement that it may work in other markets. Malaysia is among the first few overseas markets for LG with the launch of LG Rent-Up in March 2024. According to the company, its strong PuriCare business in Malaysia was one of the key factors behind the decision. Interestingly, LG Malaysia chose the term “rent” over “subscribe” as it believed Malaysians are more comfortable with the more familiar term, with the extra benefits seen more positively compared to other rental businesses.

For the Malaysian market, LG Rent-Up is largely similar to LG Subscribe in South Korea: the widest range of home appliances available (nine product lines); complimentary consultation, delivery, installation, and extended warranty; and the option to upgrade to a new product at the end of the rental term. Rates start from RM40 a month with some appliances having the option of lower monthly rates for “self-service” maintenance.

LG Electronics Malaysia is also leveraging its PuriCare network of agents and brand shops and kiosks across the country as physical touch points for consumers, as well as a dedicated website for potential customers to view available models, check for rental rates, and submit their orders.

A Sign Of Things To Come

It is rare for a company to disrupt the industry in which it is already one of the leaders, but LG appears to have done so – the numbers certainly support this statement. And with competitors reportedly planning to follow suit, this concept looks to be a norm in the coming years.

What does the future hold for LG Rent-Up in Malaysia? Can it replicate the success of its home market and gain first mover advantage? We’re about to find out.

Comments (0)