Alex Cheong Pui Yin

29th July 2020 - 2 min read

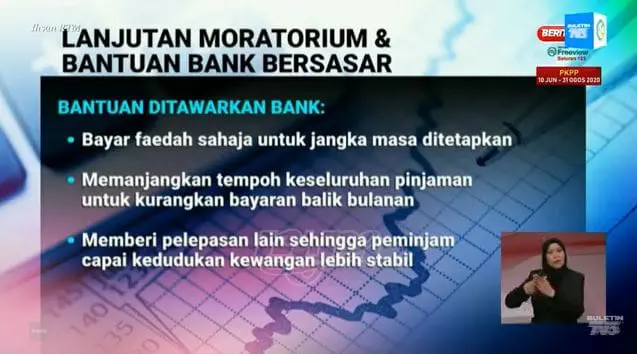

Prime Minister Tan Sri Muhyiddin Yassin has announced that local banks have agreed to provide financial aid in a targeted manner for SMEs, businesses, hawkers, and self-employed individuals who are still negatively affected by Covid-19 post-moratorium.

According to Tan Sri Muhyiddin, local banks have expressed their commitment to aid their affected customers once the moratorium ends in September, and are ready to provide assistance via a few different arrangements. Depending on the borrowers’ financial situation, the banks may offer one of the following options:

- Paying only for interest for a specified period

- Extending the loan repayment period to reduce instalment payments

- Other suitable exemptions until the borrower gains a more stable financial footing

These aids for SMEs and self-employed individuals are some of several initiatives introduced as part of the extended loan moratorium. The extended loan moratorium is expected to benefit 3 million Malaysians, and eligible borrowers can start contacting their respective banks by 7 August 2020.

Tan Sri Muhyiddin Yassin also said that since the start of the moratorium in April, 7.7 million individual borrowers and 243,000 SME borrowers have benefited from the ongoing moratorium, which is valued at RM20.7 billion.

Additionally, the Malaysian public has shown some recovery in their finances as there are less people and businesses taking up the current moratorium. The prime minister said that the number of individual borrowers who opted out from the moratorium rose from 331,000 in April to 601,000 in July. Meanwhile, the number of SME borrowers who opted out also increased from 5,000 to 13,000 during the same period.

Comments (0)