Alex Cheong Pui Yin

27th October 2021 - 3 min read

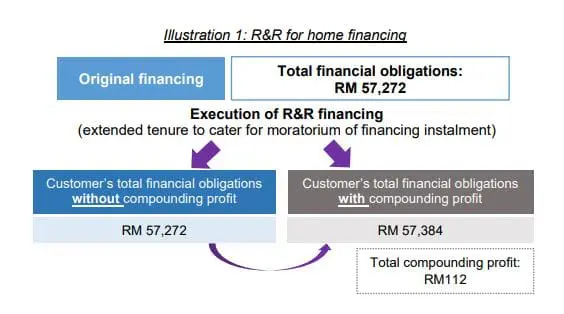

The Shariah Advisory Council (SAC) under Bank Negara Malaysia (BNM) has officially made a ruling regarding the treatment of compounding profit for Islamic financing facilities that are subjected to restructuring and rescheduling (R&R). Specifically, Islamic financial institutions are not permitted to include and calculate any accrued profit from the original financing into the new principal amount provided under the R&R financing.

According to BNM, the SAC’s decision is justified by the fact that this practice of including accrued profit into the new principal amount will amplify the amount of profit on debts (in other words, resulting in compounding profit). To note, Islamic financing facilities are prohibited from compounding profit under shariah laws as it is considered to be a breach against fair treatment.

“Therefore, Islamic financial institutions shall ensure that in executing R&R financing, the new principal amount of the R&R financing shall be equivalent to the outstanding principal amount of the original facility, if there is no additional involved. [In addition], the amount of accrued profit and late payment charges (where applicable) from the original financing can be added to the total new debt obligation, but this amount cannot be capitalised in the calculation of the new profit,” BNM explained.

BNM also stressed that Islamic financial institutions must ensure that this prohibition is applied to all customers (both musir and mu’sir), adding that several institutions have independently taken steps to avoid compounding profits for R&R financing even prior to this.

For context, the SAC had previously already ruled to prohibit financial institutions from charging compounding profits for Islamic financing that are going through R&R, but this was only applicable to the facilities for the difficult period of the Covid-19 pandemic. The earlier ruling was made at SAC’s 214th meeting on 30 June 2021. This latest update by the SAC, meanwhile, will see the ruling being extended to post-pandemic circumstances as well.

“In light of the challenging economic situation that continues to affect customers during the Covid-19 pandemic, the SAC has ruled to prohibit Islamic financial institutions from charging compounding profits for R&R financing with the objective to ease the financial hardship of customers affected by the pandemic. Although initially, the SAC’s ruling relating to the prohibition on compounding profit was made due to the Covid-19 pandemic, but taking into account the broader aspect of maslahah (benefits) including the dharar (harm) to the customers, there is a basis for the ruling to be retained and extended to all Islamic financial institutions’ customers under the business-as-usual situation,” said BNM.

(Sources: BNM, The Edge Markets)

Comments (0)