Samuel Chua

15th April 2025 - 3 min read

Malaysia is expected to navigate the impact of recent United States trade measures with relative resilience, bolstered by solid economic fundamentals, sustained investment inflows, and a strategic role in the global semiconductor supply chain. This outlook comes as the broader Asean+3 region braces for its weakest growth performance since the Covid-19 pandemic.

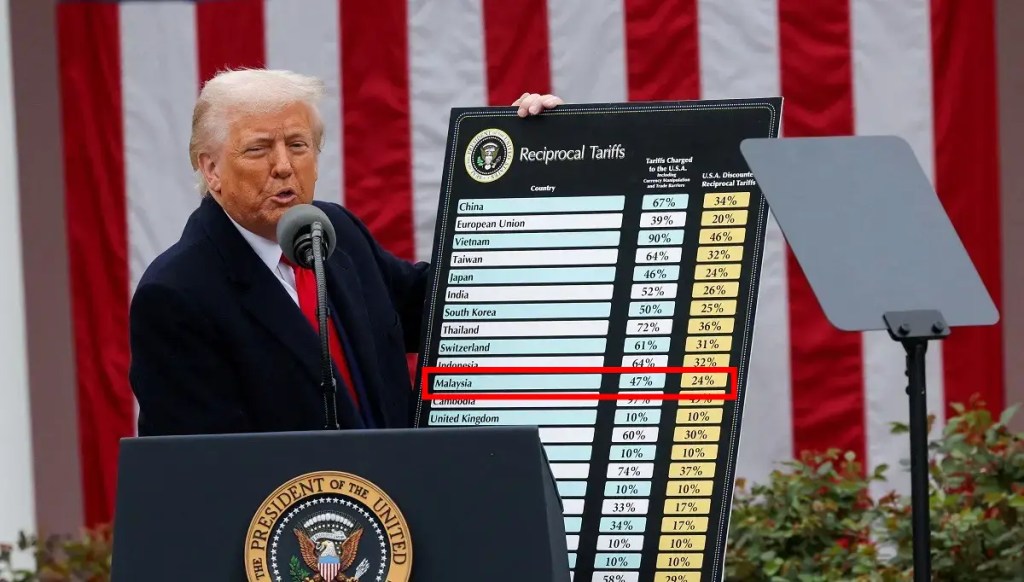

In its Regional Economic Outlook 2025, the Asean+3 Macroeconomic Research Office (AMRO) noted that the US tariffs announced on April 2 , currently suspended for most countries except China, have introduced new downside risks. However, Malaysia’s diversified economy and limited dependence on the US market provide a buffer against external shocks.

“Malaysia has been doing very well in attracting investment recently because it has a very strong electronics and semiconductor cluster,” said AMRO’s Chief Economist, Hoe Ee Khor, during a virtual media briefing today.

Hoe highlighted Malaysia’s long-standing appeal to global tech firms, citing Intel’s presence since the 1970s. He also pointed to recent developments, such as the country’s push into higher-value sectors through investments in data centres and cloud infrastructure. A notable step includes Malaysia’s US$250 million (RM1.1 billion) agreement with Arm Holdings plc to secure semiconductor-related licences and know-how, signalling its intent to move further up the value chain.

The semiconductor industry, which is currently exempt from the new US tariffs, is expected to remain a key driver of Malaysia’s economic growth. “This exemption has effectively softened the blow, compared to more affected sectors like furniture and low value-added manufacturing,” said Hoe.

Malaysia’s real GDP growth is projected to remain steady at 4.7% in 2025, before easing slightly to 4.5% in 2026, as global trade challenges persist. In contrast, the Asean+3 region is forecast to grow just above 4% in 2025, down from 4.3% in 2024. Under AMRO’s worst-case scenario, regional growth could fall below the 4% threshold.

The new US tariff framework—described by AMRO as a “massive shock”—imposes an average rate of 28% on Asean+3 economies, a level higher than the tariffs applied to India or the European Union. Although Malaysia is not among the most heavily exposed, several of its non-tech sectors, particularly furniture and other manufacturing exports, are likely to be affected.

“Some industries are already scrambling to ship their products out before the full tariffs take effect,” Hoe added. “However, the economy is flexible, and with proper support and policy measures, these sectors can restructure and adapt.”

(Source: The Edge)

Comments (0)