Eloise Lau

2nd December 2025 - 6 min read

*As Told To RinggitPlus

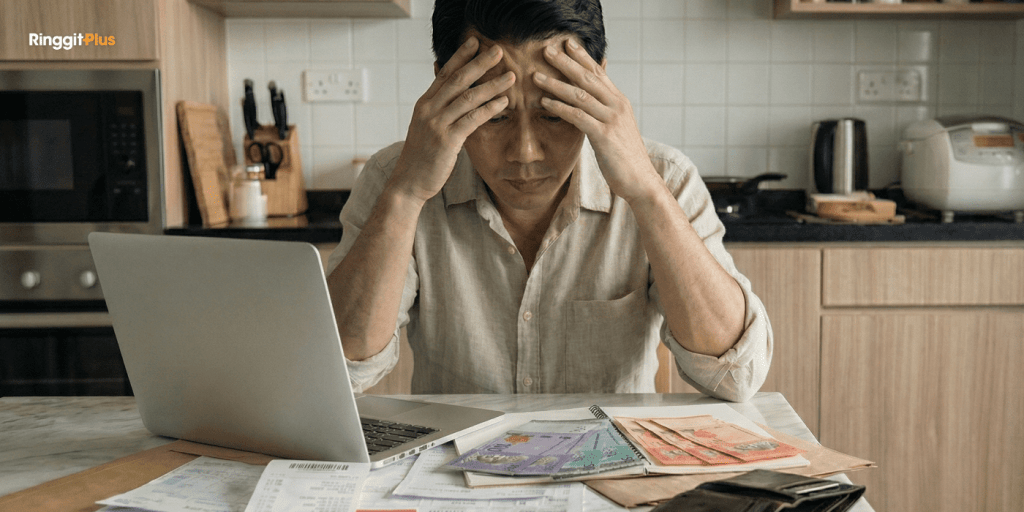

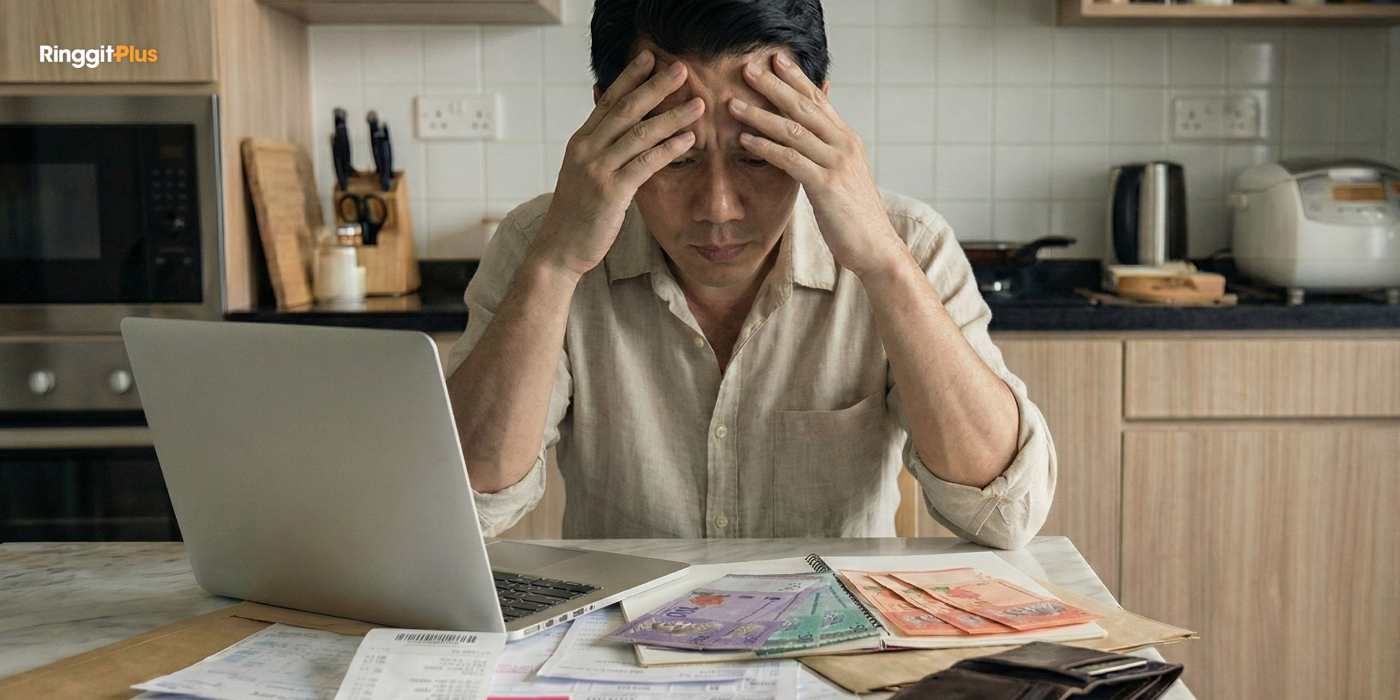

The resignation email was sent at 11:47 PM on a Tuesday. I remember the exact time because I kept staring at my laptop screen, my finger hovering over the mouse, feeling a tightness in my chest that had nothing to do with excitement.

When I finally clicked “Send,” I expected relief. What I got instead was three hours of staring at the ceiling, mentally calculating how many months my EPF savings would last if I withdrew for emergencies. The answer wasn’t comforting.

I was 35, ten years into my marketing career. My wife and I had been married for eight months. We lived in a rented condo in PJ, drove a Myvi that still had three years of loan payments left, and owed about RM28,000 on my PTPTN. My salary had been RM6,500 a month. Now it was zero.

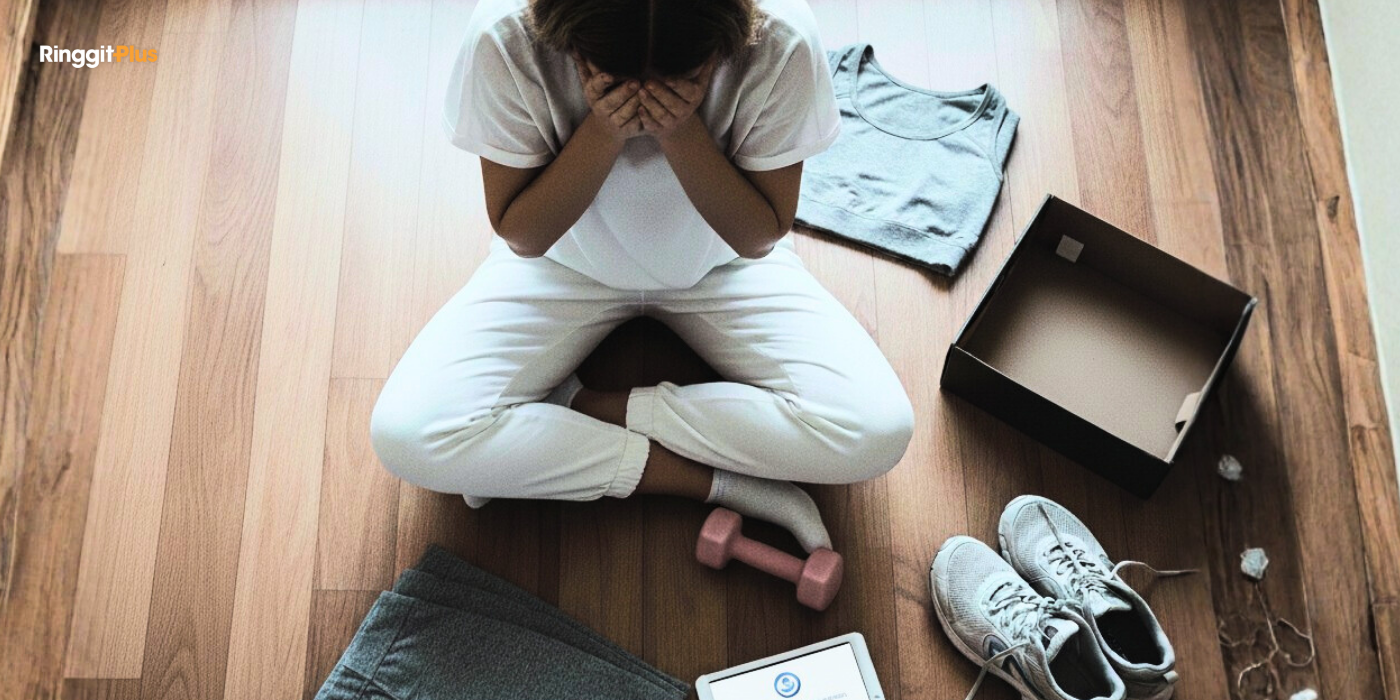

The story I’d told myself was about mental health, about burnout, about “choosing myself for once.” And sure, those things were real. But what nobody tells you is that quitting without a plan doesn’t just sever your income stream. It cuts the financial lifeline supporting your entire lifestyle and everyone depending on it.

This is what I wish someone had told me before I hit “Send.”

Your Commitments Don’t Care About Your Mental Health Break

The first reality check came exactly 14 days after my last day. My car loan payment was auto-debited. So was my PTPTN. Rent was due in two weeks. My phone bill, car insurance, my wife’s birthday gift I’d ordered weeks ago… all of it kept coming.

My monthly fixed expenses came to RM3,580 before petrol, eating out, or anything fun:

| Expense Type | Monthly Amount (RM) |

| Car Loan | 850 |

| PTPTN Repayment | 380 |

| Rent | 1,200 |

| Utilities | 250 |

| Car Insurance (average) | 150 |

| Phone + Internet | 150 |

| Groceries | 600 |

| TOTAL Fixed Costs | 3,580 |

I had about RM42,000 in savings. At RM3,580 monthly, that’s roughly twelve months. But most financial advisors say fixed expenses shouldn’t exceed 50% of your available funds. That dropped my comfortable runway to six months.

Your Savings Aren’t Actually Your Emergency Fund

Six weeks in, my wife and I sat down to review our finances. We’d always kept our money separate. It was easier that way. But now “my” savings were becoming “our” only cushion.

That RM42,000 wasn’t just random savings. RM15,000 was earmarked for our house down payment. Another RM8,000 was set aside for future kids. Now I was eyeing that money for groceries.

Watching yourself drain savings meant for your future home, your future family. That’s a particular kind of torture. I felt like I was robbing the version of us who’d be ready to move into our first place in two years.

What I realised too late: you need two separate pools. An Emergency Fund covers six months of total expenses (not just fixed costs, but actual living expenses). This stays untouchable except for genuine survival. Your Life Goals Fund should never be your first line of defence. Dipping into them creates damage beyond the immediate hit.

If you’re building this safety net now, comparing high-yield savings accounts can help your emergency fund grow faster. The difference between 2% and 3.5% on RM40,000 is about RM600 a year, nearly two months of my grocery budget back then.

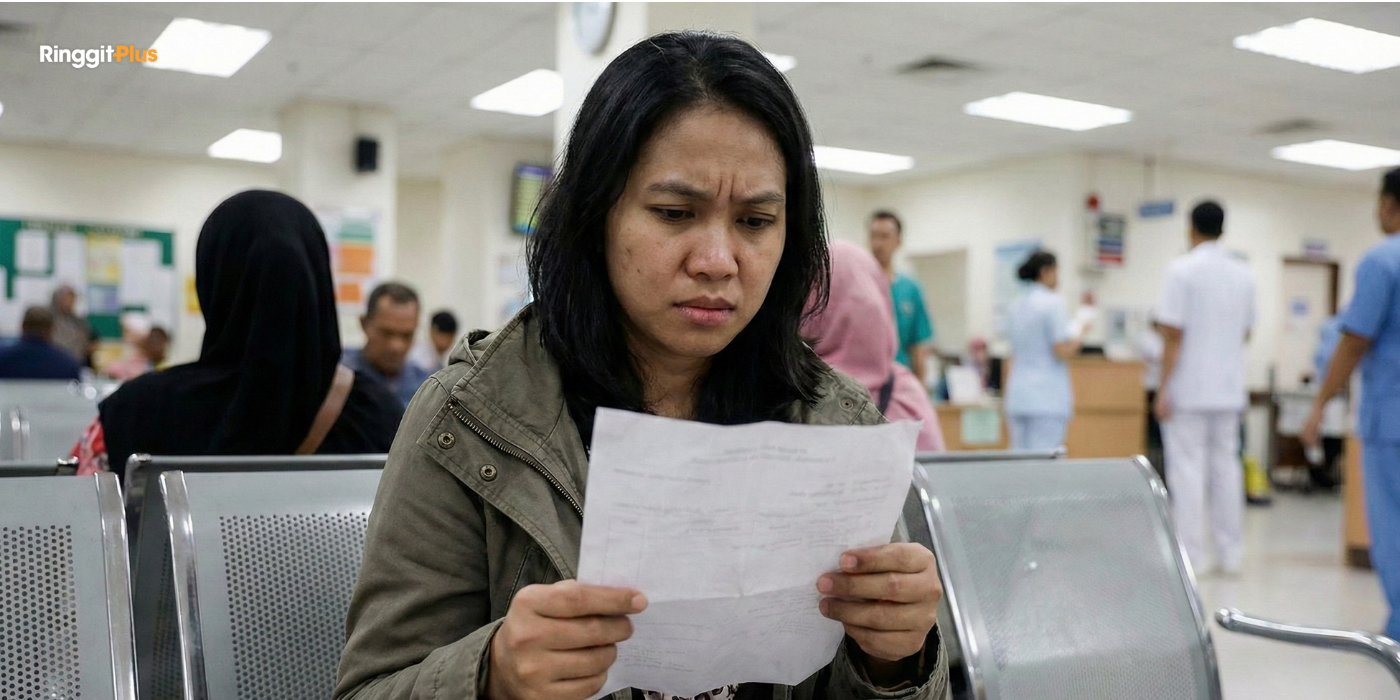

The Seniority Trap

I’d spent ten years building digital marketing expertise. Managed teams, ran six-figure campaigns, and reported to C-suite executives. In my resignation fantasy, recruiters would be fighting over me.

The reality was humbling. I sent out 47 applications in two months and heard back from 12. Eight companies brought me in for first-round interviews. Three made it to the final rounds. None of them converted to offers.

One position took six months from posting to hire. They interviewed me in month two. Final round in month three. Then silence while they “finalised headcount approval.” By month six, they picked someone else.

Senior roles paying RM8,000 to RM12,000 don’t close in a month. For most candidates at my level, three to six months is normal.

Poverty Stress vs Work Stress

About four months in, I realised I hadn’t actually reduced my stress. I’d replaced Sunday evening dread with something worse: a low-grade anxiety about money that never switched off.

I remember standing in Jaya Grocer, holding a pack of salmon my wife liked, doing mental arithmetic about whether we could afford it that week. We could, technically. But I put it back anyway.

The shame was the hardest part. When my younger brother, who earned less than I, quietly offered to lend me money over lunch. When I made an excuse to skip a friend’s bachelor party weekend because I couldn’t justify the hotel costs. When I saw my wife pretending not to notice that we’d stopped eating out.

Mental health is important. Burnout is real. But choosing yourself needs to include financial security, because poverty doesn’t care about your journey to self-discovery.

What I Should Have Done

Six months after quitting, I finally got an offer. RM7,800 monthly, slightly less than what I was expecting but with better work-life balance. By then, my savings were down to RM18,000. Most of our house downpayment fund was gone. We’d pushed back our property timeline by at least two years.

The biggest mistake was treating all my savings as one pool. I should have built a proper Emergency Fund first, six months of actual expenses, which for me meant about RM39,000, kept completely separate from our house and family savings. That money would exist only for career transitions, and I wouldn’t touch the life goals fund until the emergency fund was truly empty.

I also underestimated how long senior hiring takes. Three to six months is normal at my level. If I wasn’t prepared to survive eight months without income (six months of expenses plus a buffer), I had no business quitting without another offer. Job hunting while employed is exhausting, but it’s nothing compared to job hunting while watching your savings evaporate.

There were alternatives I never explored. A longer notice period to buy time for interviews. Unpaid leave or a sabbatical. Even a lateral move to a less demanding role within the same company. Some employers offer mental health accommodations if you ask. I didn’t ask. I just quit.

Check Your Parachute First

I’m glad I left eventually. I needed out of that job, and I’m happier now. But I wish I’d been smarter about it by giving myself enough financial runway to actually rest during my time off, instead of spending it in constant panic.

If you’re thinking about quitting, it’s okay to take the leap, make sure you’ve researched and packed a parachute before you jump.

Follow us on our official WhatsApp channel for the latest money tips and updates.

Comments (4)

thank god he didnt bought that house in the 1st place, or else he’d be in red instead of 18k cash left

Yeah, that really puts it into perspective. The important thing is to make sure that your emergency fund and your house savings fund is separate!

The salary was 6500 at first, then got a new job at 7800 per month, that’s higher instead of “slighty lesser” right?

Hi there! Just checked with the person in the story and he clarified that it was slightly less than what he was expecting, but definitely more than his previous salary.