Pang Tun Yau

23rd April 2021 - 3 min read

AIA Malaysia is looking to work towards a stronger 2021 with its digital transformation efforts and Total Health Solution mission, while also assisting Malaysia in its economic recovery process along the way.

Despite the horrors of the Covid-19 pandemic, there were a few silver linings. For instance, an AIA study last year revealed that Malaysians who had no plan to purchase protection plans before the pandemic are now more interested to do so. Meanwhile, AIA and other insurance and takaful companies swiftly added Covid-19 protection in existing policies at no extra charge. In 2020, AIA added free Covid-19 protection to over 7 million policies, and paid out over RM10 million in Covid-19 claims.

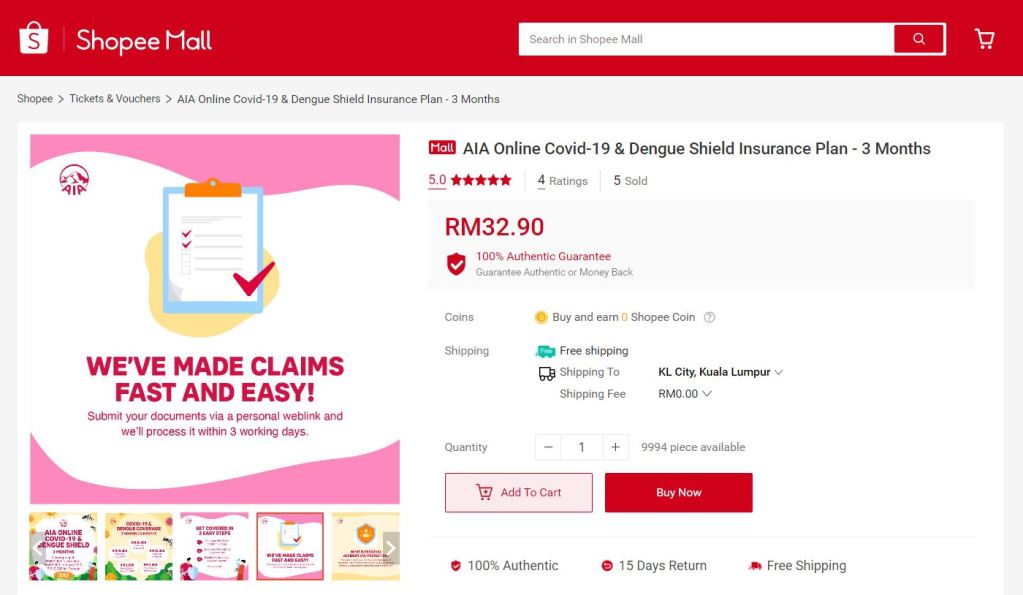

There was also a fundamental change in how Malaysians worked, as the new norms encouraged less physical engagements. As a result, Malaysians are now more comfortable with conducting more things online, from groceries shopping to client meetings. This complements AIA’s digital transformation efforts, alongside offering new products to better fit today’s lifestyles such as the AIA Online Shield which was exclusively sold in Shopee, as well as a mental health benefit in some of AIA’s medical plans.

AIA General Berhad CEO, Eric Chang also noted that there will be more innovative solutions on their way, such as protection for smartphones and electronic devices, goods in transit protection, as well as third-party extended warranty protection. AIA General is also actively looking at forming partnerships to form these new products, such as e-wallet companies, telcos, and e-commerce websites.

AIA’s health and wellness app, AIA Vitality, also served as an example of AIA’s mission to help Malaysians “stay out of the hospital”, as AIA Malaysia CEO Ben Ng puts it. With the belief that a balanced lifestyle and good health complements medical protection needs, AIA Vitality promotes good lifestyle habits via gamification techniques and earn rewards.

Meanwhile, AIA Public Takaful Berhad (APTB) is aiming to increase the takaful penetration rates in the country this year in light of the heightened awareness of protection in Malaysia. APTB CEO Elmie Aman Najas noted that family takaful penetration rates is only around 16.9%, compared to 35-40% for general insurance in Malaysia.

On that front, APTB is looking to increase the penetration rate with a mix of innovative solutions including new products that follows the Value-Based Intermediation principles and meets the needs of today’s customers. In addition, APTB is also investing in the expansion of its agency network to drive financial inclusion.

On a related note, AIA is also aiming to assist Malaysians affected by the economic effects of the pandemic. The company noted that there are great talents seeking employment and is now actively hiring both internal staff for its Technology, Digital, & Analytics plan, as well as AIA and APTB Life Planners through its AIA Elite Academy and its various development programmes.

Comments (0)