Alex Cheong Pui Yin

30th March 2023 - 3 min read

Bank Negara Malaysia (BNM) said that up to 25% of household borrowers have a high debt service ratio (DSR) of more than 60% as of December 2022. Revealed in its Financial Stability Report for Second Half 2022 (2H22), the central bank nevertheless maintained that the risk of these borrowers defaulting on their loan repayments remain low.

Briefly, DSR is the ratio of a person’s total debt to their household income, used by banks and lenders to measure someone’s ability to settle their debt obligations; the lower your DSR, the better. According to Perbadanan Insurans Deposit Malaysia (PIDM), borrowers with a DSR of between 20% to 40% are considered to be safe, although many lenders are generally willing to consider offering loans to borrowers with a DSR of less than 60%.

BNM said that with 25% of household borrowers having a DSR of more than 60% – which accounted for 33.9% of total banking system loans – this means there is one borrower with a risky DSR out of every four. However, the central bank also noted that a majority of these borrowers are from middle to high income households, with larger buffers to meet the high loan commitments. As such, it believes that the risk of them defaulting on their repayments is low.

“As the bulk of these credit exposures are held by middle- and high-income borrowers (69%), credit risks are assessed to be contained by their large buffers available to support loan repayment in the event of financial difficulties,” said BNM in its report.

Aside from that, the central bank also said that other indicators of Malaysians’ debt-servicing capability remained sound as well. “The median DSR of newly approved and outstanding household loans remained prudent at 43% and 37%, respectively (as compared to 42% and 35%, respectively, in June 2022),” it said, adding that two-thirds of newly approved loans in 2022 had DSRs of less than 60%. This proportion has remained unchanged since 2018.

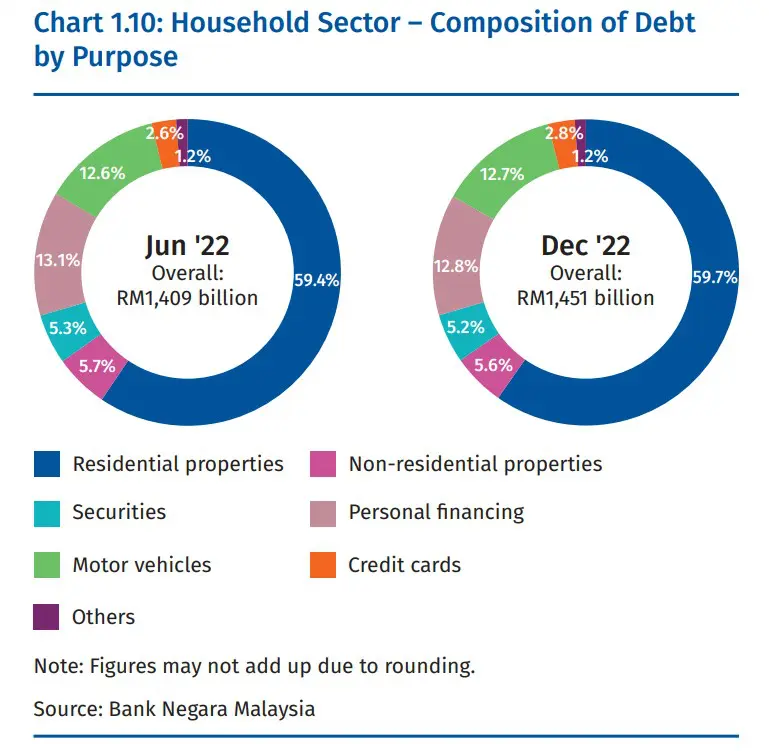

Another key highlight that was also shared by BNM in its Financial Stability Report for 2H22 is the fact that household debt has been expanding at a faster pace of 5.5% in 2022, as compared to 5.3% in June 2022. This expansion is driven primarily by housing loans (59.7%), followed by personal financing (12.8%) and motor vehicle loans (12.7%).

Additionally, loans continued to grow in the second half of 2022 (2H22) as Malaysia recovered from the economic impact of Covid-19, increasing from 5.7% in June 2022 to 5.9% at the end of 2022. The country’s loan growth also recovered closer to pre-pandemic levels in the whole of 2022. For comparison, Malaysia’s loan growth stood at an average of 6.2% between 2015 to 2019.

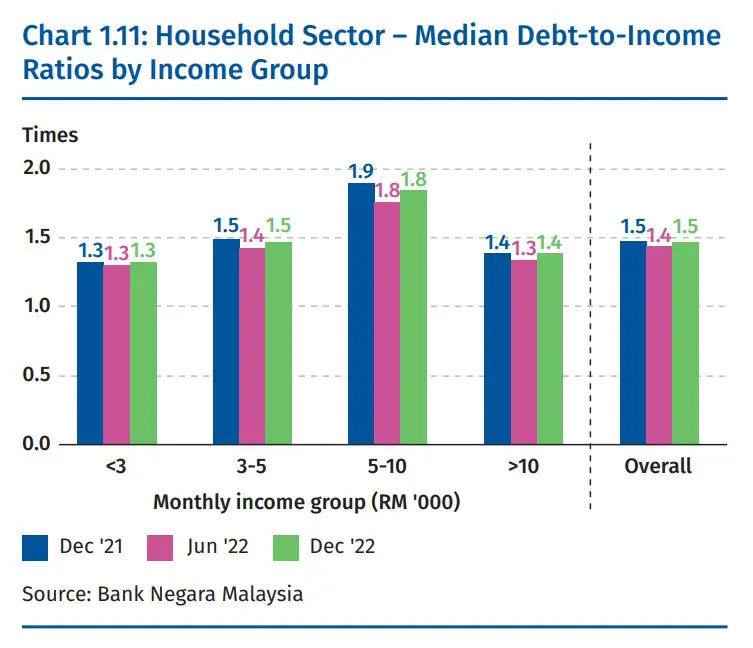

That said, BNM maintains that this trend does not pose a major concern as Malaysian household’s credit growth is also complemented by the growth in household incomes. This is indicated by the relatively stable median debt-to-income (DTI) ratio of 1.5 times, as compared to 1.4 times in June 2022.

(Sources: Bank Negara Malaysia, Malay Mail)

Comments (0)