Alex Cheong Pui Yin

30th September 2021 - 3 min read

Bank Negara Malaysia (BNM) has revealed that there has been an increase in the number of household loan accounts that were under repayment assistance plans as of June 2021, as compared to December 2020. This was disclosed in the central bank’s latest Financial Stability Review, for the first half of 2021 (1H21).

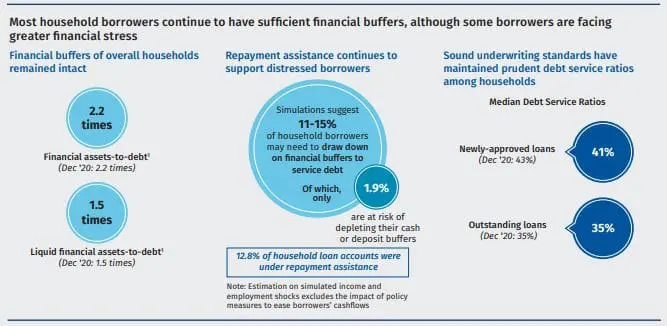

According to the review, 12.8% of household loan accounts – or 16% of outstanding household loan exposures – were under repayment assistance plans up to June 2021. This is higher than the 8.9% of household loan accounts and 11.1% of outstanding household loan exposures that was previously recorded in December 2020. BNM further highlighted that there was a subsequent sharp increase in the figures at end-July 2021, which saw the share of household loan accounts and exposures under repayment assistance skyrocket up to 25.4% and 30%, respectively.

That said, the central bank also reassured that based on its conservative simulations, only 11% to 15% of these borrowers will likely need to draw on pre-existing savings to pay off their debts or sustain themselves over the next 18 months if they lost their source of income. Moreover, only 1.9% of them are at risk of depleting their cash or deposit buffers during this period of time.

“About two-thirds (65%) of such at-risk borrowers comprise those earning less than RM5,000 monthly, who are also more highly leveraged compared to other income groups pre-Covid-19. Exposures of banks to these most vulnerable borrowers are estimated to account for only 1.3% of banking system loans,” said BNM, maintaining that most borrowers are therefore still reasonably resilient, with assistance plans providing additional reserves against potential shocks.

Aside from that, the central bank also noted that borrowers who opted for the latest assistance packages were spread across all income groups. This – along with the relaxed eligibility criteria for the aids – implied that the recent rise in the number of loan accounts under repayment assistance plans is not driven solely by financial distress. Rather, surveys and anecdotal evidences have indicated that one-third of borrowers that applied for repayment assistance did so to build up precautionary buffers and to invest in the equity market.

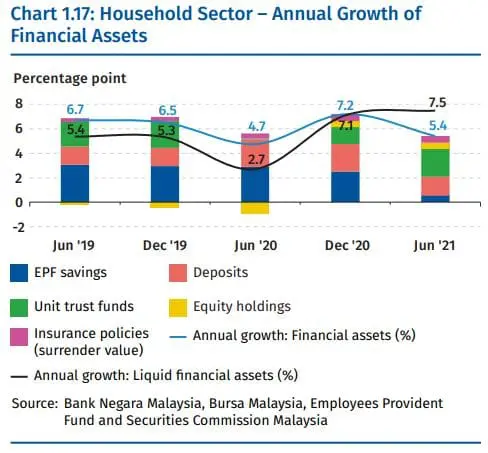

Finally, BNM noted that there had been a lower annual growth of household financial assets between the end of 2020 and the first half of 2021, with June 2021 logging in 5.4% in comparison with 7.2% back in December 2020. This translates to a decline in aggregate financial assets of RM3 billion between December 2020 and June 2021. BNM attributed this to the withdrawal of retirement savings via the i-Sinar and i-Lestari facilities, adding that this could lead to longer-term difficulties for households that are already likely to have insufficient savings for retirement.

“While access to repayment assistance is helping to temporarily support borrowers’ debt-servicing capacity, a more entrenched economic recovery remains key to restoring the longer-term financial health of borrowers,” said the central bank in its report.

Comments (0)