Alex Cheong Pui Yin

1st July 2020 - 3 min read

(Image: The Star)

Bank Negara Malaysia (BNM) has published its policy document on electronic know-your-customer (e-KYC) technology, intended to accelerate and streamline the adoption of digital onboarding for various services in the financial sector. The new policy takes effect immediately.

In short, e-KYC is a security and verification technology employed to confirm the identity of customers when conducting digital transactions, such as when you need to open financial accounts online. It offers convenience as the digital onboarding process of customers can now be carried out anytime and anywhere, without requiring you to visit the physical premises of financial service providers. You may have already experienced e-KYC processes when unlocking premium versions of local e-wallets in the last 12 months.

BNM also said that e-KYC will help lower costs for both users and providers, as well as increase competition in the financial sector in the long run. “This is expected to pave the way for greater innovation in the financial sector, including end-to-end offering of digital financial services for customers,” said the central bank, adding that the adoption of e-KYC technology by the industry is in line with its push for greater digital financial services.

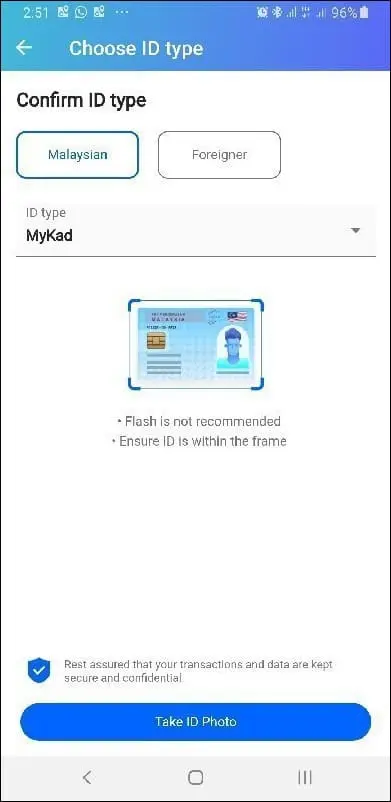

(Image: Amanz)

BNM further commented that the policy document seeks to promote the safe and secure application of the e-KYC technology in the financial sector by clarifying desirable outcomes in its use. Additionally, it aims to set out best practices and parameters to safeguard the security and integrity of the onboarding process for e-KYC users.

“It also forms part of a series of measures adopted by the bank in ensuring that regulatory requirements support the country’s agenda for the digital economy,” the central bank elaborated.

One of the details highlighted in the policy document is that financial institutions must obtain prior approval from BNM before they can implement e-KYC. This will require them to submit information demonstrating their ability to comply with BNM’s stipulated risk management guidelines and other relevant regulations.

In addition to that, financial institutions are allowed to decide on any combination of methods to conduct identification/verification through e-KYC, such as facial recognition and video calls. However, the methods should match the assessment of risk and level of assurance needed for the specified product.

Prior to this, the central bank had issued an exposure draft on e-KYC in December 2019, in preparation for this policy document and a wider implementation of the e-KYC technology. The exercise involved a range of industry players, including banks, insurers, takaful operators, and money changers.

You can read the full policy document on e-KYC from BNM here, along with its FAQ.

(Source: The Edge Markets, Regulation Asia)

Comments (0)