Alex Cheong Pui Yin

26th February 2020 - 2 min read

(Image: The Star)

Bank Negara Malaysia is set to introduce eKYC (electronic Know Your Customer) technology for banks in the near future, to ease application and verification processes. This comes as banks and financial institutions become increasingly involved in digital and mobile banking.

eKYC is essentially a paperless security and verification technology used to confirm the identity of customers for all digital transactions. It reduces the risk for the customers and banks involved, as well as simplifies the process for customers as they will no longer have to visit the bank for certain transactions, such as opening an account or verifying an application with their MyKad.

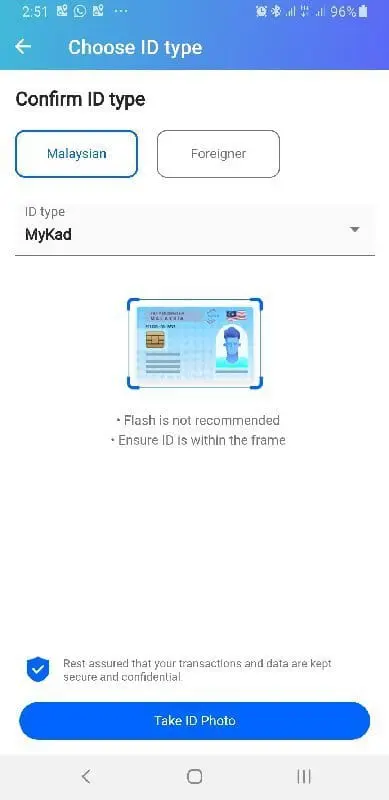

If eKYC sounds familiar to you, it’s because this isn’t the first time eKYC is being used in Malaysia. e-wallets such as Touch ‘n Go eWallet, Boost, and GrabPay require its users to go through an eKYC process when they wish to make use of the premium versions. If you’ve ever been asked to snap photos of your MyKad and a selfie when setting up your e-wallets, that’s eKYC at work. Newer eKYC processes may even involve a video selfie for verification.

eKYC process on TNG eWallet (source: LYN Forums)

The introduction of eKYC for banks is now even more important given that Bank Negara intends to issue up to five digital banking licences to qualified applicants some time this year. Axiata Group has recently confirmed its interest in making a bid, among several other potential bidders as well.

Prior to this, Bank Negara had issued an exposure draft on e-KYC on 16 December 2019, seeking feedback from industry players regarding its implementations. The exercise, which ended on 17 February 2020, involved institutions such as banks, insurers, takaful operators, as well as money changers.

(Source: The Edge Markets)

Comments (0)