Samuel Chua

3rd March 2025 - 3 min read

The Employees Provident Fund (EPF) is expected to see withdrawals amounting to RM5 billion from Akaun Fleksibel (Account 3), a development that economists say could provide a boost to the national economy. They believe that the higher dividend payout, combined with the ability to access funds through Akaun Fleksibel, makes EPF accounts more attractive than traditional bank savings. However, they caution against relying on withdrawals as a key driver of economic growth.

Bank Muamalat Malaysia Bhd chief economist, Mohd Afzanizam Abdul Rashid, noted that private consumption already accounts for 61% of Malaysia’s gross domestic product (GDP), with the country’s marginal propensity to consume (MPC) standing at around 0.60.

“If EPF members spend their Account 3 withdrawals, it will be a boost to the GDP. But certainly, we should not rely on such withdrawals as the primary tool to grow the economy,” he said.

Afzanizam added that past data suggests higher dividends and an expanded Account 3 have not led to irresponsible withdrawals. “The EPF has revealed that 70% of its members tend to keep their savings with EPF under the Akaun Fleksibel. So only 30% withdrew from it for various purposes. I suppose it is the opportunity cost for spending the Account 3 withdrawal versus keeping the money with EPF,” he said.

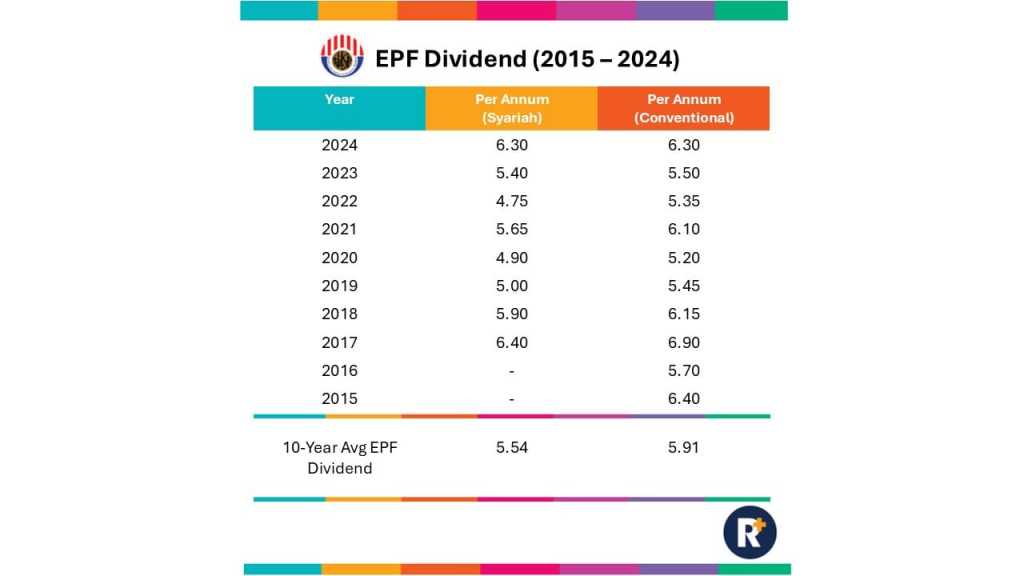

He emphasised that EPF has consistently delivered high dividends, which have remained above the long-term inflation rate of 2.5%. “In that sense, EPF contributors would really need to do their due diligence before deciding to withdraw and spend, versus what they stand to gain if they just let their savings grow until retirement,” he added.

Afzanizam also pointed out the benefits of compounding, which accelerates the accumulation of funds through reinvested savings and continuous contributions, ultimately increasing total returns for contributors. He stressed the importance of financial literacy, stating that a proactive approach by EPF would raise awareness of the need for retirement savings. He cited the EPF’s latest Belanjawanku report, which includes the Retirement Income Adequacy (RIA) framework as a benchmark for contributors to measure their savings adequacy.

“This will help contributors benchmark themselves with their existing savings and on how much they should keep in order to align themselves with the savings benchmark,” he said.

Economist Geoffrey Williams noted that with the total dividend payout amounting to RM73.24 billion, approximately RM7.3 billion would be allocated to contributors’ Akaun Fleksibel.

“That could be RM7.3 billion in potential extra consumer spending if it was all transferred and spent,” he said.

Williams, the founder and director of William Business Consultancy Sdn Bhd, said this could contribute to consumer spending and economic growth. “Since there is a multiplier effect, this could add between 1% and 1.2% to the GDP,” he added.

However, he pointed out that this shift represents a reallocation from savings to spending, rather than an actual increase in economic productivity. “It is a demand push increase in GDP, not supply side growth,” he said, adding that EPF’s high dividends are risk-free and “very attractive compared to normal deposits.”

“The Akaun Fleksibel allows withdrawals and it makes EPF accounts more attractive than savings accounts in banks. So, we can expect and we are seeing an increase in voluntary contributions,” said Williams.

On Saturday, EPF announced a 6.3% dividend for both conventional and syariah accounts in 2024, its highest since 2017. The total payout for conventional savings stood at RM63.05 billion, while RM10.19 billion was allocated for syariah savings, bringing the total dividend distribution to RM73.24 billion.

(Source: The Star)

Samuel writes about personal finance and financial news, focusing on how banking updates, policies, and promotions affect everyday money decisions. He enjoys making complicated financial topics easier to follow. Outside of writing, he spends his time watching TV shows and occasionally convincing himself he will only watch one episode.

Comments (0)