Alex Cheong Pui Yin

14th June 2023 - 3 min read

The Employees Provident Fund (EPF) has officially launched the Belanjawanku expenditure guide for Malaysians (2022/2023 Edition), along with the Belanjawanku mobile application. Both items were rolled out in hopes to help the public better manage their budget and finances by providing minimum monthly expenditure estimates based on households.

Produced in collaboration with the Social Wellbeing Research Centre (SWRC) of Universiti Malaya, this new Belanjawanku guide is actually an updated and enhanced version of the first Belanjawanku guide – which was first introduced back in 2019. While the 2019 Belanjawanku guide only provided estimates for Klang Valley residents, the latest version has been expanded to cover 11 major cities across the country, including Kota Kinabalu (Sabah) and Kuching (Sarawak).

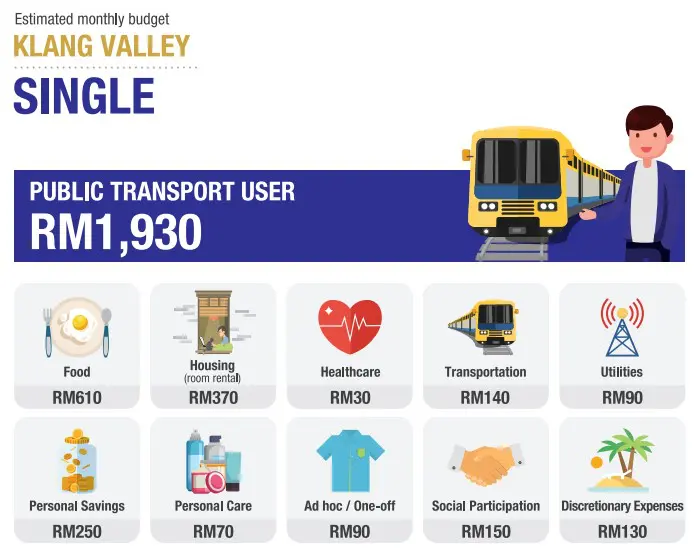

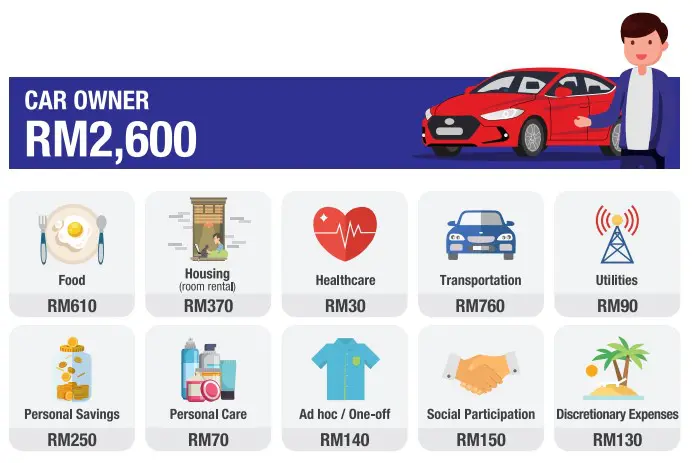

As was the case before, the guide highlights the estimated minimum monthly budget that is required by various households to enjoy a reasonable standard of living. It also breaks down the estimated budget into the various expense categories that each individual or household is expected to spend on.

So for instance, the Belanjawanku guide estimated that single individuals who take the public transport will need an estimated minimum monthly budget of RM1,930 to survive in the Klang Valley, whereas single individuals who are also car owners are expected to spend an approximate minimum of RM2,600 each month. Meanwhile, the estimated minimum monthly budget for married couples range between RM4,630 to RM6,890, depending on how many children they have.

Aside from the Belanjawanku guide, the EPF also rolled out the Belanjawanku app, which contains interactive features for users to track their monthly expenses. They also have the flexibility to monitor their expenses using either the estimates provided in the Belanjawanku guide or the Rule of Thumb method. Briefly, the Rule of Thumb (45/35/20 Rule) states that you should allocate 45% of your budget for necessities, 35% to commitments, and 20% to savings.

To note, the Belanjawanku app has actually been rolled out much earlier for a pilot test – as early as in August 2022. Since then, it has recorded almost 12,000 downloads.

Chairman of the EPF, Tan Sri Ahmad Badri Mohd Zahir said that the launch of both the Belanjawanku guide and app is part of the provident fund’s efforts in helping Malaysians to improve their financial literacy and to improve at managing their finances.

“According to the National Financial Literacy Strategy 2019-2023, developed by the Financial Education Network (FEN), of which the EPF is a member, a total of 76% of Malaysians have a budget, but not all adhere to the budget. The data also shows that 47% find it difficult to set aside RM1,000 for emergency use,” said Tan Sri Ahmad Badri, adding that the Belanjawanku guide will be used by EPF’s Retirement Advisory Service (RAS) officers in providing advice to members.

Individuals can download the Belanjawanku guide for free from the EPF’s official website. Meanwhile, the Belanjawanku app can be downloaded from Google Play, the App Store, and the Huawei AppGallery.

(Source: EPF)

Comments (0)