Pang Tun Yau

3rd March 2024 - 2 min read

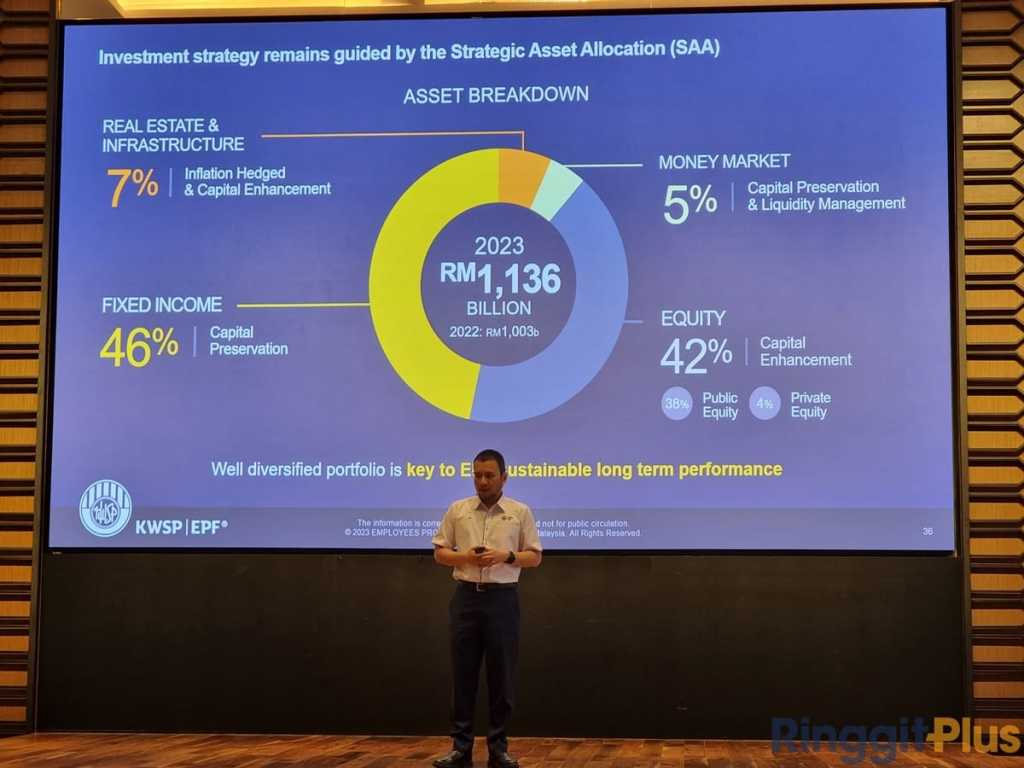

The Employees Provident Fund (EPF) has no plans to invest in digital assets under its Strategic Asset Allocation (SAA), mainly due to a lack of visibility or forecast in cash generation.

Speaking in a Q&A session after announcing the EPF dividends for 2023, Chief Executive Officer of the provident fund, Ahmad Zulqarnain Onn said that the EPF has to prioritise prudence in its investment strategy, and that at its core, the EPF invests in businesses across all asset classes. Its well-diversified portfolio comprising of good and solid businesses allow the EPF fund managers to have visibility and forecast into future cash generation that ultimately increases portfolio value.

In fact, it is for this reason that the EPF also does not invest in commodities. Their cyclical and sometimes volatile nature makes them harder to predict their value and cash-generating ability down the line.

Digital assets have had much higher regulatory oversight in recent times, and seen a resurgence in investor confidence and interest – including from institutional funds. The US earlier this year approved Bitcoin Spot ETFs, allowing institutional funds to invest in Bitcoin through Exchange Traded Funds, making them accessible to investors in the US stock market. Approvals for Ethereum Spot ETFs are expected to be on their way as well.

At the same time, digital asset prices continue to demonstrate high volatility; since 2021 prices of Bitcoin – the largest cryptocurrency token by market capitalisation – have hit highs of US$69,000 (RM327,000) before plunging below US$16,000 (RM76,000) and is now trading back at US$60,000 (RM285,000) levels.

Comments (0)