Alex Cheong Pui Yin

19th January 2021 - 4 min read

(Image: The Edge Markets)

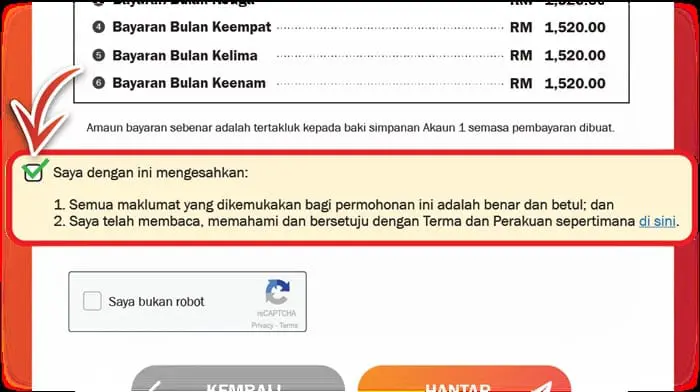

The Employees Provident Fund (EPF) has announced that members applying for the i-Sinar facility under Category 2 will be able to receive an interim payment of up to RM1,000 from the total amount applied starting from 26 January 2021. This came following Prime Minister Tan Sri Muhyiddin’s announcement of this new aid during the reveal of the PERMAI special assistance package yesterday.

But how exactly does the interim payment feature for i-Sinar (Category 2) works, and does it affect your future i-Sinar payment schedule? Here’s a quick guide to help you understand.

What is the interim payment feature for i-Sinar (Category 2)?

The interim payment is an advance payment of RM1,000 that will be provided to EPF members who are applying for the i-Sinar facility under Category 2. According to the EPF, the interim payment is intended to help lessen the financial burden of applicants who are affected by the current Covid-19 pandemic and the flooding in several states in Malaysia. It is also meant to be an immediate assistance to members while their applications are being approved and verified by the EPF.

To clarify, the advance payment of RM1,000 is included as a part of the overall i-Sinar amount that was applied for by the applicant. It will be deducted from the first payment amount disbursed to members.

Who is eligible?

Only EPF members who fall under Category 2 will be eligible to tap into the interim payment feature. Those who fall under this category are those whose total income has been reduced by 30% and above from March 2020 onwards. Total income includes your base salary and other benefits, such as allowances and overtime.

EPF members who are classified under Category 2 are already able to apply for the EPF i-Sinar facility since 11 January 2021.

Why the need for an interim payment?

According to the EPF, it could take two to three weeks before a member’s application status is approved or rejected. If approved, they will only get their first payment by the end of the following month.

As you can see, there’s quite a big gap between application and disbursement of money, and the interim payment is designed to address this.

When and how will the interim payments be disbursed?

For eligible EPF members who have already submitted their i-Sinar applications, they will be able to get the RM1,000 interim payments starting from 26 January 2021. Meanwhile, those who have yet to apply and wish to do so now will be able to get their payments within 7 days starting from their date of application.

Depending on your preference, the RM1,000 interim payment will either be credited straight to your bank account, or disbursed to you via payment order (PO). If you opt for PO, you will need to pick up the PO from your preferred EPF branch before cashing it in at an RHB Bank branch.

An illustration of how the interim payment feature works

To help the public better understand how the interim payment feature works and how it affects the overall i-Sinar payment structure, the EPF has shared the following examples:

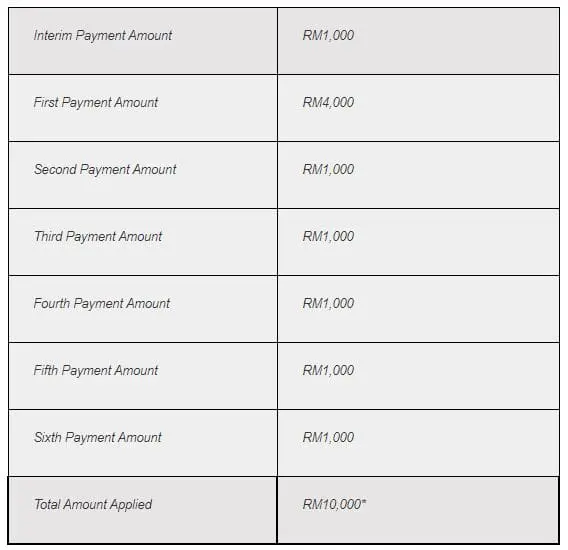

Example 1: Fatimah applied to withdraw a total of RM10,000 via the i-Sinar facility, with RM5,000 as her first payment. With the interim payment feature implemented, the payment schedule for her i-Sinar application will be as follows:

Example 2: Ali applied to withdraw a total of RM700 via the i-Sinar facility as he only has RM800 available in his Akaun 1 (it is necessary to maintain an account balance of RM100 after your i-Sinar withdrawal). With the interim payment feature implemented, the payment schedule for his i-Sinar application will as follows:

***

For more information about the EPF i-Sinar facility and the interim payment feature, you can head on over to the official EPF i-Sinar website. Alternatively, you can read up on our coverage of the topic here. You can also check out our write-up on the pros and cons of taking the EPF i-Sinar withdrawal facility in order to make a better informed decision.

Comments (0)