Alex Cheong Pui Yin

24th December 2020 - 3 min read

(Image: Malay Mail/Yusof Mat Isa)

Deputy Minister in the Prime Minister’s Department (Economy), Arthur Joseph Kurup has commented that the government is taking various approaches in its attempt to increase the income and purchasing power of B40 households.

Speaking during a parliament session, Arthur said that one such approach is the offering of programmes that can boost this group’s income and capability to secure higher-paying jobs. Examples include the Urban Economic Empowerment Programme and Income Increment Programme. The two programmes provide various initiatives and services – such as trainings, financial assistances, and management support – to empower their targeted audience in obtaining better earnings. The Income Increment Programme, for instance, is aimed at participants from the rural area, particularly in agriculture and economic planning.

(Image: Malay Mail)

Aside from the programmes, Arthur pointed out that the government has also improved access to basic needs – such as education, health, and housing – to assist the B40 households. Moreover, it promoted entrepreneurship and access to financing such as the microcredit financing facility provided by TEKUN Nasional.

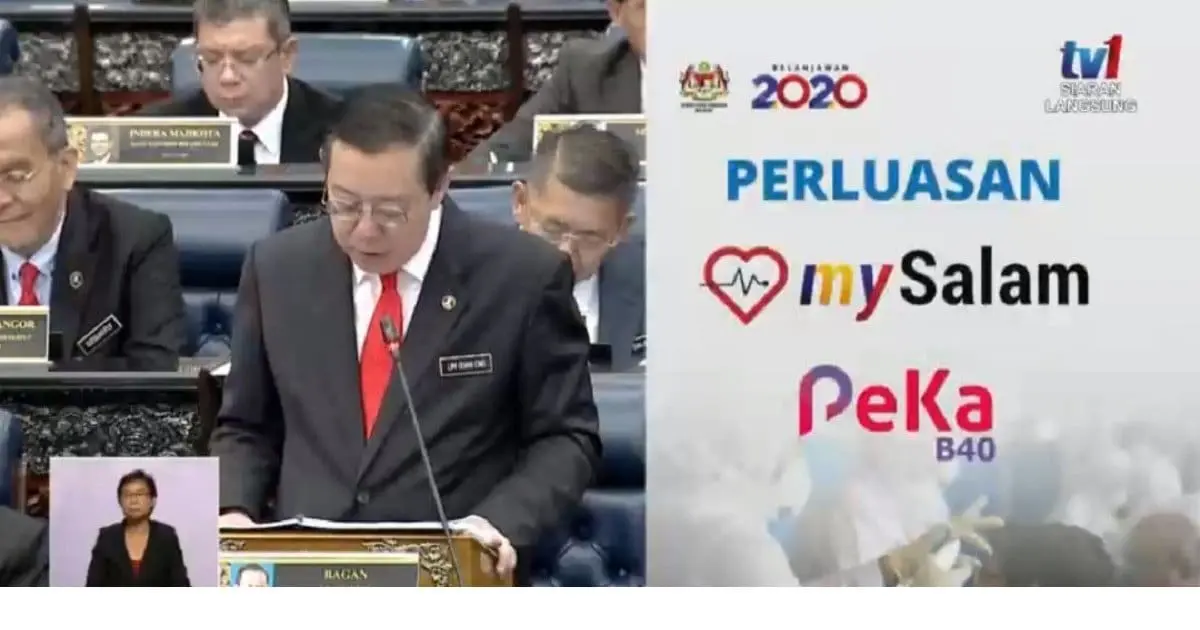

“(Another approach is) improving the social protection system by introducing an integrated and comprehensive social protection system framework, including the PeKa B40 healthcare protection scheme,” added Arthur. For context, the PeKa B40 programme is a healthcare protection scheme that was introduced in Budget 2019 and was further upgraded in Budget 2020. Intended for the B40 group, the scheme covers a range of common medical treatments, and offers benefits such as the purchase of medical equipment.

On top of these initiatives, Arthur said that the government is also currently drafting policies and strategies in the 12th Malaysia Plan to help tackle poverty and improve the people’s wellbeing.

“To tackle poverty and upgrade the service delivery mechanism at the grassroot level, the government will strengthen the bottom-up approach among the stakeholders. The approach will therefore be improved through the involvement of the public and community-based organisations. The authorities will also be empowered to identify and reduce pockets of poverty at the community level,” Arthur explained.

(Image: Aliran)

Arthur had listed these efforts in response to a question regarding the number of Malaysian households that fell under the national poverty line income (PLI), as well as the measures that are being taken to help them. Earlier this year, Malaysia had revised its national PLI from RM980 to RM2,208 following the reveal of the Household Income And Basic Amenities Survey Report 2019.

“Using the 2019 PLI, the absolute poverty rate was 5.6% comprising 405,441 households in 2019 compared with 7.6%, involving 525,743 households in 2016,” clarified Arthur.

(Source: The Sun Daily)

Comments (0)