Alex Cheong Pui Yin

21st May 2024 - 2 min read

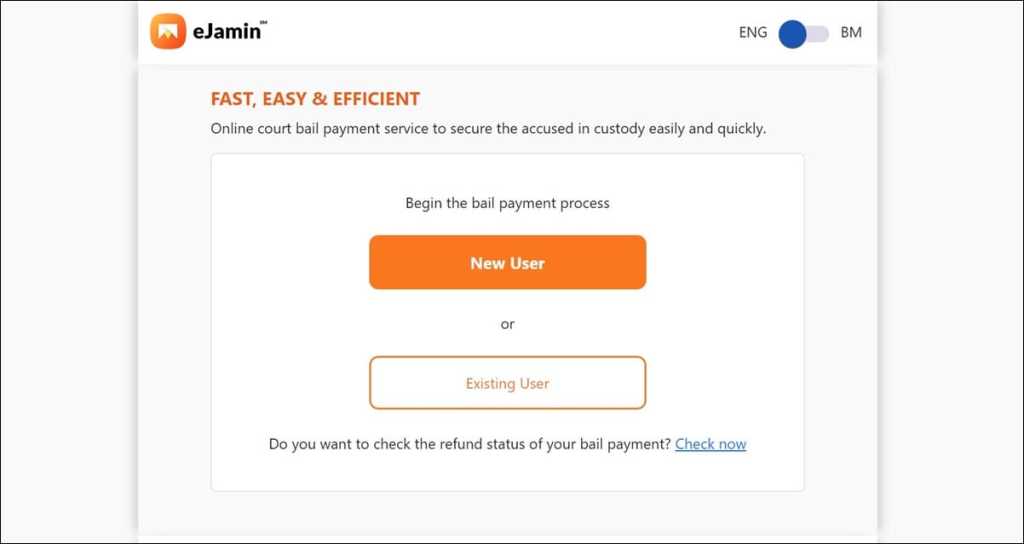

Malaysians will continue to be able to use the digital e-Jamin system for the payment of court bail, following Pertama Digital’s success in obtaining approval to continue operating the system via its subsidiary, Dapat Vista. This came following a sudden announcement by the Chief Registrar of the Federal Court last week, ordering the cessation of the electronic bail management system.

According to Pertama Digital, it received the approval from the Legal Affairs Division of the Prime Minister’s Department (BHEUU JPM) last Friday, who explained that “the (previous) cancellation decision was taken without any knowledge and discussion with this department”.

The division also stressed that it should have been consulted, with the views of all relevant parties taken into account. “As such, the Prime Minister’s Department has decided to continue using the e-Jamin bail system in line with the aspirations of the Madani government,” it noted in a statement posted on its social media account.

For context, the Chief Registrar of the Federal Court had unexpectedly ordered on 16 May for the e-Jamin system to be phased out, stating that the judiciary will revert back to its manual bail practice from 20 May onwards. It also ordered Pertama Digital to transfer all the bail funds in the system to the Prime Minister’s Consolidated Fund.

In response to this abrupt news, a group of lawyers had submitted a memorandum to seek for an explanation, and to request for e-Jamin to be maintained until another solution is found – if necessary. Pertama Digital also said that it will work towards obtaining approval from the relevant regulatory authorities to continue providing the services.

The e-Jamin system was first introduced back in 2020, and was rolled out as a collaboration between Dapat Vista with Bank Islam and Bank Muamalat. It sought to simplify the bail posting process, making it faster and more convenient.

(Sources: The Edge Malaysia, New Straits Times)

Comments (0)