Samuel Chua

25th November 2025 - 6 min read

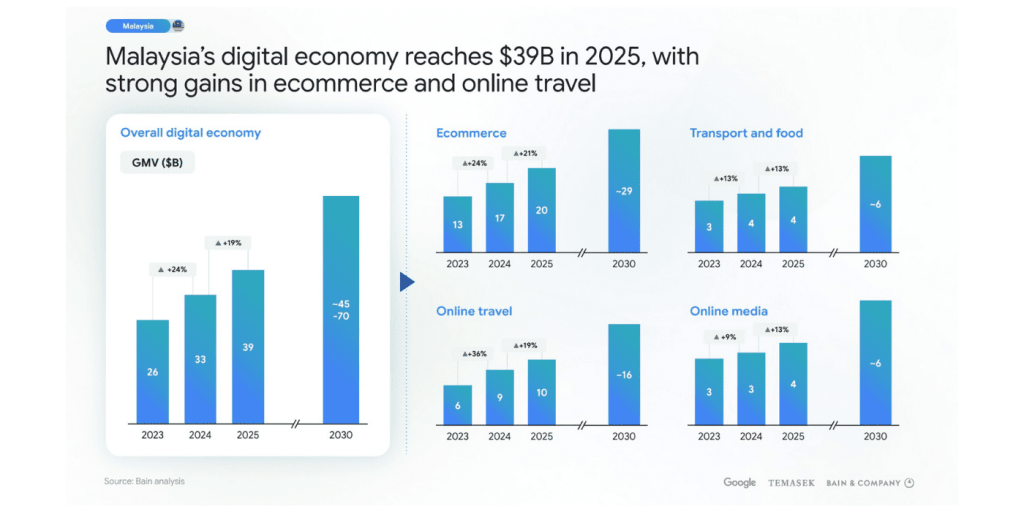

Malaysia’s digital economy is expanding faster than any other market in Southeast Asia. According to the latest e-Conomy SEA 2025 report by Google, Temasek, and Bain & Company, Malaysia is expected to reach a gross merchandise value of US$39 billion in 2025, which is roughly RM161 billion. Gross merchandise value refers to the total worth of goods and services sold through online platforms. It is a measure of overall digital activity rather than company profits.

This growth reflects strong digital adoption among Malaysians, steady investment activity, and a generally stable economic environment. Together, these factors are supporting Malaysia’s position as one of the region’s most dynamic digital markets.

Malaysia Maintains Strong Momentum In Southeast Asia

The report indicates that Malaysia’s internet economy is rising from US$26 billion in 2023 to US$39 billion in 2025. Longer term, the sector is projected to reach between US$45 billion and US$70 billion by 2030. This outlook aligns with the country’s broader economic performance, where inflation eased to 1.8% in 2024 and foreign direct investment remained on an upward trend. Consumer spending has also been resilient, which helps sustain digital sector expansion.

This performance places Malaysia in a favourable position within Southeast Asia. The region’s digital economy as a whole is expected to pass US$300 billion in 2025, driven by a population that now relies on online services in daily life.

Ecommerce Growth Accelerates Through Video-Led Shopping

Ecommerce continues to be Malaysia’s largest digital sector and is projected to reach US$20 billion in 2025. The sector is growing at about 21% year on year, which is among the fastest rates in the region. Large regional platforms are consolidating the market and improving logistics, customer experience, and recommendation systems powered by artificial intelligence.

Video commerce is an important contributor to this expansion. About 350,000 Malaysian sellers use video formats to reach customers, generating an estimated 700 million orders each year. The average order value of US$8 to US$10 is higher than the regional average. Fashion, beauty, personal care, household essentials, and electronics remain the most popular categories.

Online Travel Rises Ahead Of Visit Malaysia 2026

Online travel is another strong performer. The sector is expected to grow from US$6 billion in 2023 to US$10 billion in 2025, making it the fastest-growing online travel market in Southeast Asia. Malaysia recorded about 25 million tourist arrivals in 2024, and inbound travel increased by more than 20% in the first half of 2025.

This increase is linked to visa-free access for selected markets, improved air connectivity, and the early rollout of digital tourism campaigns in preparation for Visit Malaysia 2026. Average airfares and hotel rates in Malaysia and Singapore remain higher than before the pandemic, which increases the overall value of the travel sector.

Everyday Digital Services Continue To Grow

Food delivery services have become part of daily life for many Malaysians. Platforms are enhancing their delivery networks and building advertising tools to support more sustainable business models while keeping meals and essentials accessible.

Transport platforms are expanding their service tiers to serve different types of users. These platforms also support Malaysia’s electric vehicle goals through incentives and pilot programmes involving electric fleets.

Online media, which includes digital advertising, gaming, and streaming, is projected to reach about US$4 billion in 2025. Short videos and locally produced micro-dramas continue to gain popularity, supported by the rise of retail media networks that place advertisements at key moments in the shopping process.

Cashless Payments Lead Malaysia’s Digital Finance Growth

Digital financial services continue to grow across the board. Digital payments remain the largest segment and are expected to reach a transaction value of US$213 billion in 2025. Bank Negara Malaysia reported a 28% increase in digital payment usage in 2024. DuitNow QR has also expanded its cross-border compatibility, allowing Malaysians to make payments in more Southeast Asian markets.

Digital lending is forecast to rise from US$10 billion in 2023 to US$14 billion in 2025. Digital wealth is expected to grow from US$8 billion to US$13 billion, while digital insurance is set to increase from US$0.5 billion to US$0.7 billion during the same period.

The Consumer Credit Act has been passed but is not yet fully in force. Once implemented through phased gazette announcements, it will introduce licensing requirements for Buy Now Pay Later providers and other non-bank lenders, improving consumer protection.

Malaysia Strengthens Its Role As A Regional AI And Cloud Hub

Malaysia is also becoming one of the region’s key locations for AI-ready digital infrastructure. Data centre capacity increased from about 120 megawatts in 2024 to 690 megawatts in the first half of 2025. There are plans for a further rise of about 350%, which would represent roughly half of all planned capacity in Southeast Asia.

Google has committed a US$2 billion investment to Malaysia, which includes the development of the country’s first Google data centre and Google Cloud region. These facilities are intended to meet rising demand for AI-enabled services within Malaysia and the wider region.

Malaysia also attracted US$759 million in AI-related private funding, representing 32% of ASEAN’s total. This indicates strong confidence in the country’s AI ecosystem and innovation landscape.

Funding Activity And Startup Growth Show Positive Signs

Malaysia’s private funding environment has improved in the past year, supported by a significant investment in digital financial services in late 2024. IPO activity is also strong, with Malaysia contributing about half of all listings in Southeast Asia over the past year. This indicates that companies see both local and regional markets as viable paths for long-term growth.

Across Southeast Asia, private funding reached about US$7.7 billion in the past twelve months, with investors showing sustained interest in AI, software, and digital finance.

What Malaysia’s Digital Growth Means For Consumers

For Malaysian consumers, digital growth translates into more convenience, better access to services, and more competitive prices. Food delivery and transport platforms now offer a wider range of service tiers, allowing users to choose options that match their budget and needs. Ecommerce and video commerce give customers more ways to compare prices and take advantage of real-time promotions.

The expansion of cashless payments makes everyday transactions easier to track, although it also highlights the need for financial awareness and responsible borrowing as digital lending grows. The incoming Consumer Credit Act will provide additional safeguards once fully in effect.

Malaysia Moves Toward An AI-Enabled Future

The e-Conomy SEA 2025 report describes a shift from a primarily digital economy to an intelligent economy supported by AI. This next phase of growth is expected to enhance personalisation, improve business efficiency, and create new opportunities in areas such as AI development, cloud technology, and digital skills.

Malaysia’s strong AI adoption, expanding startup ecosystem, and rapidly growing infrastructure place the country in a promising position for this transition. Ensuring that this progress remains inclusive, trusted, and secure will be essential as Malaysia continues to strengthen its digital leadership in the region.

Follow us on our official WhatsApp channel for the latest money tips and updates.

Comments (0)