Samuel Chua

23rd July 2025 - 4 min read

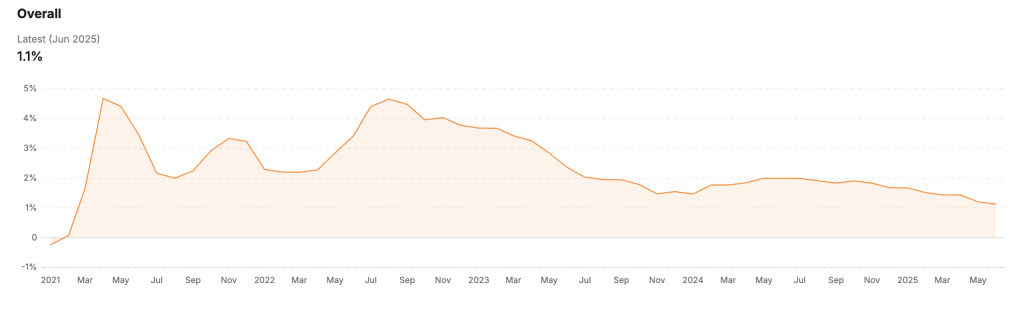

Malaysia’s inflation rate eased to 1.1% year-on-year (y/y) in June 2025, reflecting more stable consumer prices driven by declines in several key categories. According to the Department of Statistics Malaysia (DOSM), the Consumer Price Index (CPI) rose to 134.5, compared to 133.0 in the same month last year. The Producer Price Index (PPI) for local production also declined by 3.6% y/y in May 2025, continuing a downward trend from April. This slowdown signals continued moderation in cost pressures across both supply and consumer levels.

Food-at-Home Prices Continue Downward Trend

Food-at-home prices, which cover essential groceries and daily cooking needs, declined by 0.4% y/y in June 2025, continuing a deflationary trend seen earlier in March (–0.1%) and April (–0.4%). The easing helped cushion the broader 2.1% y/y increase in overall food and beverage prices.

Among the most affected items, vegetables recorded the largest drop at 7.2%. Tomatoes fell 20.6%, cucumbers by 19.8%, and cabbage by 13.0%. Milk, dairy products, and eggs declined by 1.8%, with eggs down 4.4% and other milk products falling as well. Meat prices dropped 1.1%, largely due to falling chicken prices. Nationally, the average price of standard chicken was RM10.57/kg, down from RM10.63 in May.

This continued drop in food-at-home prices stands in contrast to rising restaurant prices, highlighting a clear cost advantage for Malaysians preparing meals at home.

Eating Out Continues to Get More Expensive

In contrast, the food-away-from-home category continued to push upward. It rose by 4.7% y/y in June, up from 4.4% the previous month.

Several popular food items saw notable increases[PDF]: burgers were up 10.6%, satay rose by 5.0%, rice with side dishes increased by 3.7%, while noodle-based meals and fried chicken went up by 3.4% and 3.2%, respectively. These changes reinforce the cost gap between eating in and dining out.

Personal Care and Education Lead Core Inflation

Core inflation, which excludes volatile items such as food and fuel, remained at 1.8% y/y in June 2025.

The increase was largely driven by higher prices in personal care, social protection, and miscellaneous goods and services, which rose 4.2% year-on-year. Education costs increased by 2.2%, while the restaurants and accommodation group saw a 2.8% rise, indicating ongoing cost pressures in services-related sectors.

Meanwhile, prices for information and communication services continued to decline, falling 5.4% y/y, the sharpest drop among all major groups. Clothing and footwear also saw a slight decrease of 0.3%.

Transport Prices Rise More Slowly

Transport-related costs rose at a slower pace of 0.3% y/y in June, compared to 0.7% in May. The deceleration was supported by lower fuel prices across the country.

Diesel prices dropped by 3.4%, with Peninsular Malaysia recording an average of RM2.78 per litre, down from RM2.81 in May. Prices in Sabah, Sarawak, and Labuan remained unchanged at RM2.15.

Unsubsidised RON97 petrol also fell 10.4% y/y, averaging RM3.11 per litre in June 2025, compared to RM3.47 during the same month in 2024.

Kelantan Records Lowest Inflation Among States

Across Malaysia, inflation rates differed by region. Ten states recorded inflation below the national average, with Kelantan at the lowest rate of 0.2%. On the other end, Selangor and Negeri Sembilan each recorded 1.6%, followed by Johor at 1.5%.

Kelantan was also the only state to see a drop in food and beverage prices, registering a decline of 0.1%, while Negeri Sembilan saw the highest food inflation at 3.3%.

Malaysia’s Inflation Remains Lower Than Regional Peers

Malaysia’s inflation of 1.1% in June compares favourably to several regional peers. It was lower than Vietnam (3.6%), South Korea (2.2%), Indonesia (1.9%), and the Philippines (1.4%).

However, the rate was higher than China’s 0.1% and Thailand’s deflation rate of –0.3%. This comparison provides useful context for understanding Malaysia’s cost-of-living trends within the broader regional economic environment.

Follow us on our official WhatsApp channel for the latest money tips and updates.

Comments (0)