Samuel Chua

25th June 2025 - 4 min read

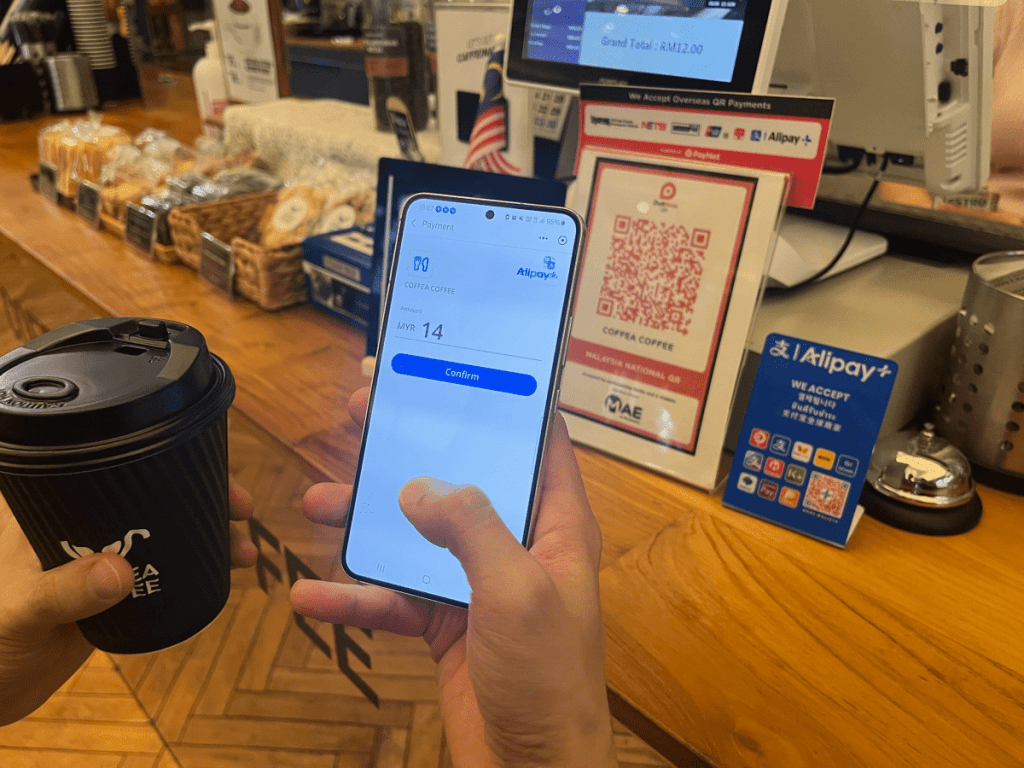

Payments Network Malaysia (PayNet) has announced a new partnership with Alipay+ and Weixin Pay (commonly known as WeChat Pay in Malaysia), allowing international visitors to pay at Malaysian businesses using their home e-wallets. Tourists from China and other parts of Asia can now scan DuitNow QR codes at over 2.5 million merchant locations using apps such as AlipayCN, Weixin Pay, or other Alipay+ partner wallets.

This initiative is designed to improve payment convenience for travellers while enabling more local businesses to tap into foreign spending.

Enabling Global Wallets for Local Spending

The partnership allows international visitors to use familiar mobile apps to make purchases, without the need for currency exchange or new app installations. Whether paying for a cup of coffee, booking hotel stays, or shopping at local stores, tourists can complete transactions using apps they already use at home.

According to PayNet Chief Marketing Officer Gary Yeoh, the integration benefits more than 2.5 million Malaysian businesses, many of which are small and family-run. By accepting trusted foreign wallets through DuitNow QR, these merchants can now access a wider pool of global consumers.

Part of Malaysia’s Cashless Tourism Strategy

This initiative aligns with Malaysia’s efforts to promote itself as a cashless destination. Tourism Malaysia’s Director General, Datuk Manoharan Periasamy, highlighted that ease of spending is essential for attracting more international arrivals. He also noted that such collaborations offer meaningful economic opportunities for local businesses, particularly in the tourism sector.

The government aims to welcome six million Chinese visitors to Malaysia in 2025. Making payments easier and more familiar for tourists is expected to support that goal.

DuitNow QR Growth Supported by Travel Trends

PayNet reported that DuitNow QR transactions through Alipay+ saw a six-fold year-on-year revenue increase during the December 2024 holiday period. Building on that momentum, the projected growth in DuitNow QR usage via Alipay+ and Weixin Pay in 2025 exceeds 130 percent.

This reflects broader travel and spending trends as tourists increasingly expect contactless, app-based payment options.

Tourist Campaigns Rolling Out This Summer

Several summer campaigns have been launched to encourage tourist engagement with Malaysian merchants through DuitNow QR.

The Alipay+ Lucky Draw campaign runs from 26 June to 14 July. Tourists using AlipayCN or Alipay+ apps at DuitNow QR merchants will stand a chance to win an all-expenses-paid trip to Hong Kong, including flights, hotel accommodation, and tickets to the Arsenal versus Tottenham Hotspur football match on 31 July.

A separate campaign called Eat, Play & Save is ongoing from 15 June to 30 September. It offers discounts to AlipayCN and Alipay+ users spending at selected food and beverage outlets and attractions across Malaysia. Full campaign details are available in the respective payment apps.

Weixin Pay is also launching an interactive campaign from 15 July to 15 September. Users can collect digital badges that showcase Malaysian cultural elements with each DuitNow QR transaction. These badges can be redeemed for discount coupons. Weixin Pay users will also continue to enjoy preferential foreign exchange rates throughout the year.

Part of a Regional Payment Network

This collaboration builds on DuitNow QR’s existing interoperability with payment systems in Singapore, Thailand and Indonesia. It reinforces Malaysia’s role in supporting regional digital payment infrastructure.

As the national payments network, PayNet operates services including DuitNow for QR and transfers, JomPAY for bill payments, and MyDebit for domestic debit card transactions. These services aim to make digital payments more secure, accessible, and widely accepted throughout the country.

The ongoing focus is to make Malaysia not only easier to visit, but easier to spend in. This initiative supports that objective by making payments seamless for travellers while connecting Malaysian businesses with international consumers.

Comments (0)