Alex Cheong Pui Yin

6th January 2022 - 3 min read

Credit reporting company Experian has urged Malaysians to carefully re-evaluate their financial positions in 2022, especially in light of the financial impact of Covid-19 over the past two years. This is following the publication of its inaugural annual State of Credit 2021 (For Consumers) report.

In the document, Experian stressed that consumers must be proactive in securing immediate assistance if they need help in overcoming immediate financial difficulties. One such support comes in the form of the Financial Management and Resilience Programme (URUS), aimed at eligible borrowers who were impacted by Covid-19.

Lenders, too, must play their role by innovating new ways to provide refinancing assistance to consumers in difficult times, said the credit reporting agency.

Aside from this, Experian’s report also shared some noteworthy findings with regard to how Malaysians aged between 22 to 65 years old have fared financially in 2021, as compared to the pre-pandemic years of 2018 and 2019. One key finding is that the average consumer credit score recorded by Experian (Experian i-SCORE) has improved by 18 points, from 601 in 2019 to 619 in 2021. This implies that most borrowers have managed to maintain their credit repayments over 2020 and 2021 despite financial difficulties.

The report further noted that Malaysians aged 35 and below have the lowest i-SCORE among the age groups studied. This is attributed to the possibility that they may not have the same income security as the other age groups, and also higher financial commitments as they begin to build their families.

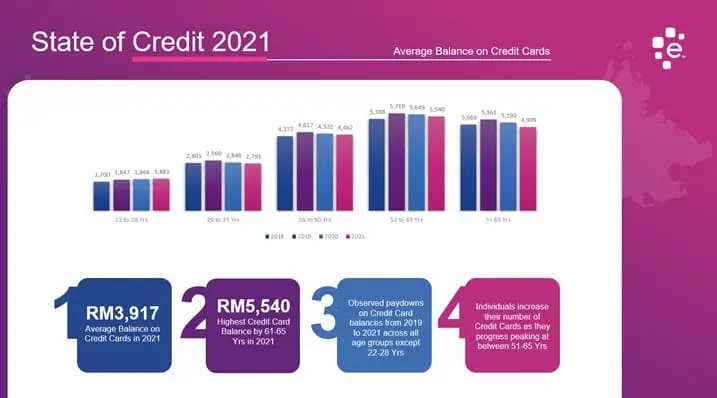

Additionally, Experian said that Malaysians recorded a lower average balance in credit cards in 2021 (RM3,917) as compared to 2019 (RM4,101). Average credit card utilisation also decreased to its lowest level at 22.8% in 2021 during the same period.

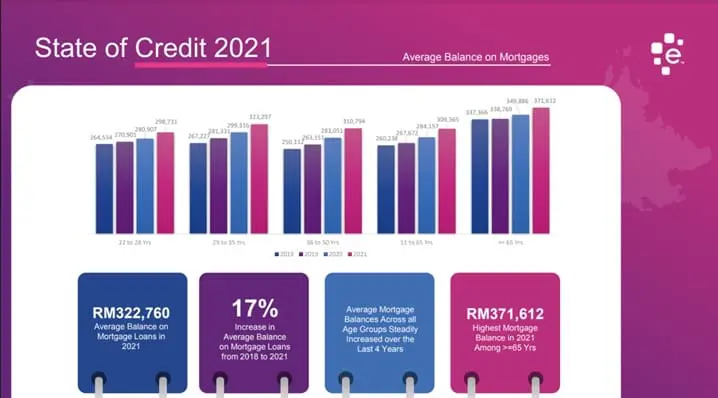

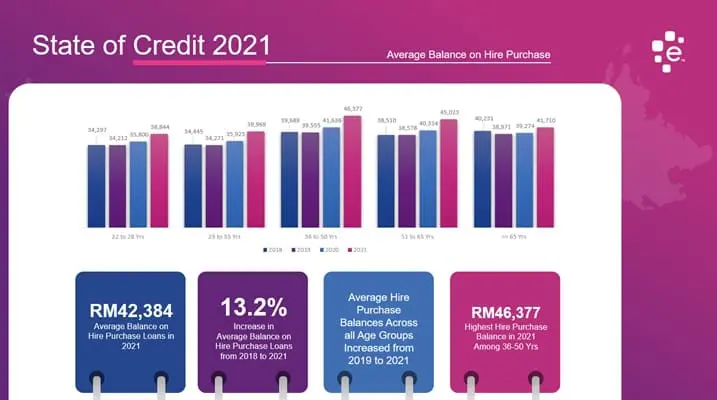

By contrast, Malaysian households appeared to have taken up more mortgages and hire purchase loans during the pandemic years. This could be due to the various government initiatives introduced through stimulus packages, including the Home Ownership Campaign (HOC) and vehicle sales tax exemptions. In line with this, there has been a 17% increase in the average outstanding balance for mortgages from 2018 (RM275,895) to 2021 (RM322,760), and a 13.2% increase in the average balance of hire purchase loans during the same period of time (from RM37,434 to RM42,384).

Ultimately, Experian said that its report underlines the need for greater financial literacy, especially for younger Malaysians who did not fare as well as the other age groups in scores and payments. Only through education will they be able to take control of their credit health and learn to make better financial decisions in life.

(Source: Experian)

Comments (0)