Alex Cheong Pui Yin

20th February 2020 - 2 min read

(Image: Tech In Asia)

Malaysians may soon be able to pay for their purchases via a new interest-free installment payment option as hoolah has announced its entry into the Malaysian market. The Singaporean fintech company offers a buy-now-pay-later (BNPL) solution to its merchant-partners, letting customers split the sum of their purchases into three monthly installments without any interest charges or hidden fees.

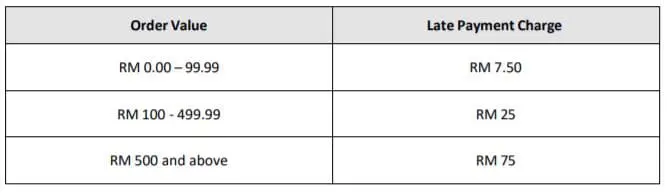

The BNPL payment service accepts both debit and credit cards issued by any banks, allowing for a seamless and convenient checkout. However, customers who fail to meet their obligations on time will be charged a late payment penalty. According to hoolah, the penalty is calculated by the order value, and will range from RM7.50 to RM75.

As of now, hoolah has partnered with two luxury fashion e-commerce platforms, Novelship and BlinQ, to introduce its payment solution to the Malaysian market. It marks the company’s entry into Malaysia, as well as its first foray into a foreign market after setting up in 2018. hoolah is also planning to expand across the Southeast Asian region.

“Malaysia was always a key market for our expansion given the proximity to Singapore as well as the growth in e-commerce. Both BlinQ and Novelship are fantastic partners and we are very excited to work with them in Malaysia and across the region to help drive more conversion,” said the chief executive officer of hoolah, Stuart Thornton.

(Image: Tech In Asia)

Within Singapore, hoolah has collaborated with more than 300 merchants, including global brands such as Sennheiser and Skin Inc, as well as local brands like HipVan. The company claims that it has delivered an average of 20% to 30% increase in conversion and basket size.

(Source: FintechNews Malaysia, Tech In Asia)

Comments (0)