Alex Cheong Pui Yin

31st March 2023 - 5 min read

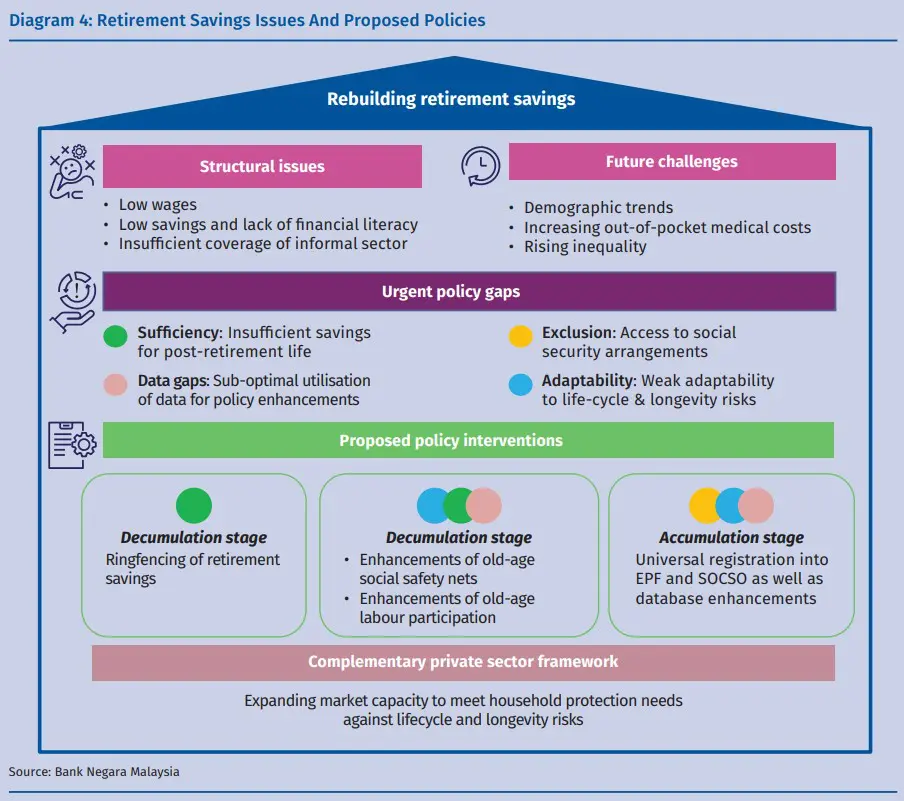

Bank Negara Malaysia (BNM) has cautioned that the retirement savings of an average Malaysian may likely dry up 19 years before their deaths. Given this forecast, it is crucial for the country to implement several “immediate priorities” to remedy the situation, as drafting social reforms to address the matter will require a longer timeframe.

In its Economic & Monetary Review 2022, BNM laid out how it came to the conclusion, stating that prior to Covid-19, the median savings for retirees aged between 51 to 55 years old can usually hold out for approximately five years. Following the numerous Covid-19-related withdrawals, however – which caused the median savings of certain segments in the society to drop drastically – the savings will now only last them around three years.

To further complicate things, average global life expectancies are also expected to increase, rising to above 77 years old by 2050, as indicated by a United Nations study in 2022. These facts all add up to contribute to BNM’s belief that the average Malaysian will deplete his or her retirement savings 19 years before their deaths. As such, it has suggested several shorter-term policies that can be implemented immediately to help rebuild the resilience and adequacy of the people’s retirement savings in a post-pandemic landscape.

BNM’s first idea involves the ringfencing and reinvestment of retirement funds to lengthen the accumulation stage, which it says, “needs to be urgently instituted”. “This involves reinvesting a portion of savings that would otherwise have been withdrawn upon the withdrawal age, thereby extending the accumulation period,” said BNM, adding that Employees Provident Fund (EPF) members in the B40 income group (aged between 50 to 54) can potentially gain up to an additional RM36,800 savings if they defer withdrawals and continue contributing up to the age of 60.

Aside from that, BNM also proposed enhancements to old-age social safety nets (usually in the form of targeted cash assistance programmes) to ensure that the basic needs of retirees are taken care of. In Malaysia, approximately 19.5% of individuals aged 60 and above are already receiving old-age benefits; this percentage is only expected to grow with Malaysia slowly becoming an aging society. To support this potential development, BNM said that the government must enhance the adequacy and reach of Malaysia’s old-age safety nets.

“Adequacy can be enhanced by ensuring that assistances are linked to standard of living measures. For example, the minimum pension for public sector employees at RM1,000 per month could be used as a benchmark for cash assistance, similar to how it is used by EPF as the basis for Basic Savings. The reach of programmes can be widened by consolidating assistances towards a single flagship programme (such as Sumbangan Tunai Rahmah), thereby maximising ease of access,” said BNM.

Yet another suggestion by BNM is to tap into old-age productivity and social mobility to enhance income. This revolves around crafting suitable job opportunities for senior individuals who may want to work again. At present, BNM said that there is a lack of suitable occupations for such individuals as there is low employment demand for old-age workers. Some initiatives that can be implemented immediately include providing contract hiring incentives, as well as leveraging on existing platforms such as myFutureJobs.

BNM’s final proposal is to ensure that comprehensive social protection data is made readily available to all relevant parties so that policy intervention can be carried out in a timely manner. The central bank specifically pinpointed the informal sector of the Malaysian workforce as a segment that will benefit from this. At present, information gaps exist in the informal sector because current social security arrangements and data are only captured via formal employment. Capturing data on informal and gig workers will allow the government to better assist them with boosting their retirement funds.

“As a start, automatic registration of all 18-year-olds into EPF and Social Security Organisation’s (SOCSO) databases can be explored. This is in line with the government’s pursuit of building a harmonised social protection database (Pangkalan Data Perlindungan Sosial – PDPS),” said BNM.

Ultimately, BNM acknowledged that reforming the old-age protection system is a broad and highly complex policy challenge for Malaysia; it needs to be addressed over a longer time frame as most of its obstacles encountered are structural in nature, such as the country’s low wage structure. However, it stressed that shorter-term policies can be executed in the meantime to address urgent needs.

“It is worth emphasising that these enhancements are no substitute for necessary long-term economic reforms that can raise current income levels. A labour market underpinned by robust productivity and high financial literacy are vital complements for a better pension system. Therefore, enhancements over both short- and long-term horizons are needed concurrently to ensure continued strengthening of the economy, supported by an effective social protection system,” the central bank said.

(Source: BNM)

Comments (1)

Increase the retirement age. Simple obvious solution.