Alex Cheong Pui Yin

10th August 2022 - 3 min read

Deputy Finance Minister I Datuk Mohd Shahar Abdullah has once again highlighted the worrying level of savings of Employees Provident Fund (EPF) members, revealing that 52% of the total 12.78 million EPF members aged under 55 had savings of less than RM10,000 as of 30 June 2022. This is equivalent to 6.62 million members.

Of the number, 75% (4.99 million members) are bumiputera members. At the same time, 3.2 million members under the age of 55 are also at a very critical level of savings, with less than RM1,000; 81% of these members (2.58 million) are bumiputera members.

“As a relative comparison, the number of bumiputera members of 8.22 million people is 64% of the total of 12.78 million EPF members under the age of 55. This shows that most bumiputera members are concentrated among members who have a low level of EPF savings compared to other races,” Datuk Mohd Shahar further elaborated.

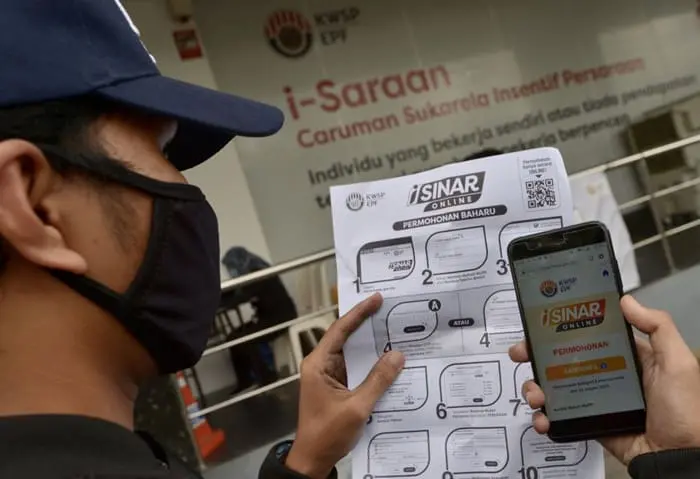

The deputy minister said that this worrying level of savings was exacerbated by the implementation of four Covid-19-related withdrawal facilities, namely i-Lestari, i-Sinar, i-Citra, and the RM10,000 special withdrawal. This is on top of a reduced statutory contribution rate for members for a period of 27 months, from April 2020 to June 2022.

“Overall, the impact of these programmes related to Covid-19 on members’ savings is estimated at RM155 billion, which consists of RM145 billion withdrawn by members under the four withdrawal programmes, and almost RM10 billion from the impact of the employee share statutory contribution rate reduction programme,” said the minister.

In an effort to help members increase and rebuild their retirement savings, Datuk Mohd Shahar said that the EPF has prepared numerous channels to make it easier for members to contribute. For instance, members who are employed can choose to contribute beyond the standard 11% rate, as well as make voluntary contributions at any time (maximum RM60,000 per year).

Similarly, self-employed members and members with no fixed income or are outside the labour force can also contribute to the EPF voluntarily at any time under the i-Saraan programme. “As an incentive to encourage this group to save under i-Saraan, the government provides a contribution of 15% of the total contribution, or up to RM250 per year,” said Datuk Mohd Shahar.

Eligible housewives under the eKasih database, too, can make voluntary EPF contributions under the Program Kasih Suri Keluarga Malaysia (previously known as the i-Suri programme). Those who contribute at least RM5 per month under this programme are eligible to receive an incentive of RM40 per month from the government.

Finally, Datuk Mohd Shahar said that the EPF will continue to emphasise the importance of financial planning among its members, so that they can balance their financial needs for the present, and their retirement in the future.

(Source: The Edge Markets)

Comments (0)