RinggitPlus

29th December 2023 - 4 min read

Following the pandemic, people have become more vigilant in taking better care of their personal hygiene, eliminating unnecessary physical contact with others and avoiding large crowds. Although the pandemic is now largely under control globally, the experience has impacted the way in which we interact with one another, and how we carry out our daily tasks, including how we make payments.

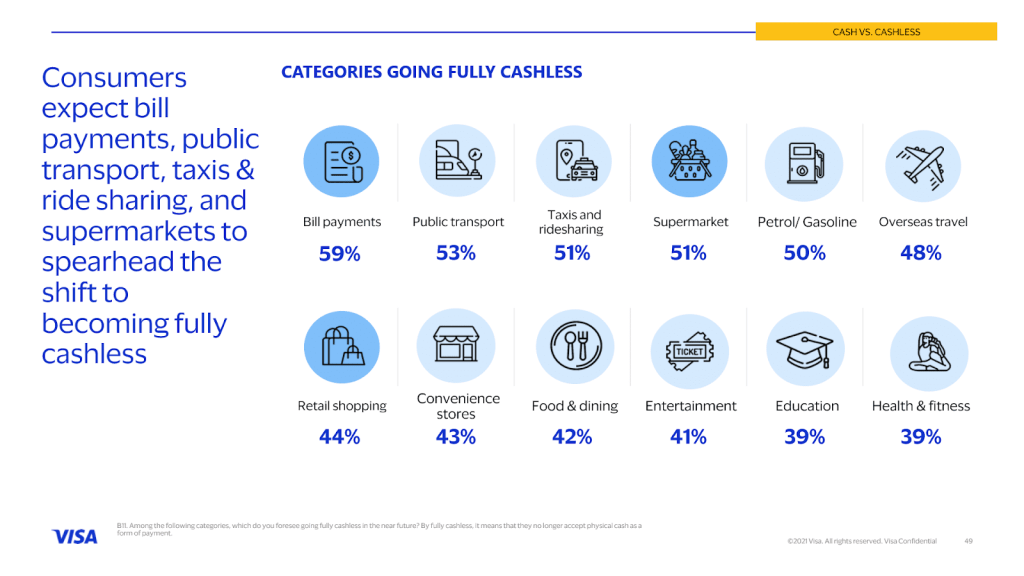

According to the latest edition of the Visa Consumer Payment Attitudes (CPA) Study, Malaysians have shifted from using only traditional payment methods and are making good progress towards supporting the nation’s goal of becoming a cashless society.

Malaysians’ Shift to Contactless Payments

Conducted as a regional research project in Southeast Asia, the Visa CPA Study surveyed 1,000 Malaysians aged 18 to 65, alongside 6,550 consumers across seven markets. The study was conducted by CLEAR on behalf of Visa across Cambodia, Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam.

Based on the study, close to seven in 10 consumers in Malaysia surveyed are using contactless payments and they indicated they intended to increase their usage of this payment method over the subsequent six months.

Malaysian consumers also indicated that contactless payment is their preferred payment method when paying for their groceries at supermarkets, retail shopping and making purchases for entertainment.

8 Out Of 10 Visa Transactions Made By Malaysians Were Contactless

Malaysia has become one of the most developed contactless payments markets in the Asia Pacific region, where eight in 10 Visa transactions are contactless payments, Visa country manager for Malaysia Ng Kong Boon, said.

“Compared to 2019, when only three in 10 Visa transactions made in the country were contactless payments, the immense growth in the usage of contactless payments in Malaysia clearly demonstrates the high level of preference and enjoyment Malaysians have for this payment method.”

Mr Ng said Visa has collaborated with retailers to increase acceptance of contactless payments across everyday spending categories in Malaysia and with issuers to inform customers about the advantages of contactless payments, providing excellent results.

“Our mobile pay partners launching mobile contactless payments in Malaysia have also supported this growth in usage,” he said. “Consumers value the convenience of being able to tap and pay using their mobile devices and embrace it as a secure way to pay, given every transaction is tokenised.”

Benefits Of Using Mobile Contactless Payments

Mobile contactless payment is a newer, more convenient, method of making payments. Instead of reaching for a debit or credit card when paying for goods or services, mobile contactless allows people to pay by simply tapping their mobile phones or wearable devices on a payment terminal.

There are a number of benefits in using mobile contactless payments:

1. Convenient and speedy: With mobile contactless payments, transactions can be completed in seconds with ease, without the need to reach for cash or look for cards. Just enjoy the benefits of Visa on your mobile phone or wearable device.

2. Enhanced security: Mobile contactless payments come with advanced security features that safeguard sensitive data. The Visa Token Service protects your information with a unique digital identifier, or a ‘token’ – letting you conduct your payments with peace of mind.

3. Widely accepted: Mobile contactless payments now are widely accepted by numerous merchants locally and globally. Simply look for the contactless symbol on the terminal before you pay.

4. Compatible for all: This payment method is accessible to all, catering to a broad user base. As long as you have a compatible mobile phone or wearable device, anyone can pay using the mobile contactless method.

From the convenience of making payments to the advanced security benefits, mobile contactless payment has clear benefits that transform the way we conduct transactions. Just remember to add your Visa card to your payment-enabled mobile phone or wearable device before making payments.

Comments (1)

Old news