Katrina Balan Quiroz

8th December 2021 - 3 min read

It’s no secret that in the past year, most of us were constantly reviewing our finances. Many of us finally saw the importance of an emergency fund while some of us were finding ways to improve our cash flow for current expenses – from cutting down on shopping expenses, generating side incomes, consolidating our high-interest debts or even refinancing our current home loans.

Solutions such as refinancing and debt consolidation may seem similar on the outside but there’s a difference. Mortgage refinancing is the act of replacing your existing home loan with a new loan that typically offers shorter tenures or better interest rates.

On the other hand, debt consolidation involves combining multiple loans into one single payment – either through a new loan, a balance transfer credit card, or cashing out on the value of your property.

These solutions offer borrowers a way to reduce and manage monthly payments, lower the overall accrued interest over time, and if possible, shorten the loan tenure.

If you’re handling a few high-interest debts and would like to reduce your monthly payments, consider consolidating your debt. But if you’re looking to enjoy lower interest or a shorter repayment period on your current mortgage, then refinancing would be a good idea.

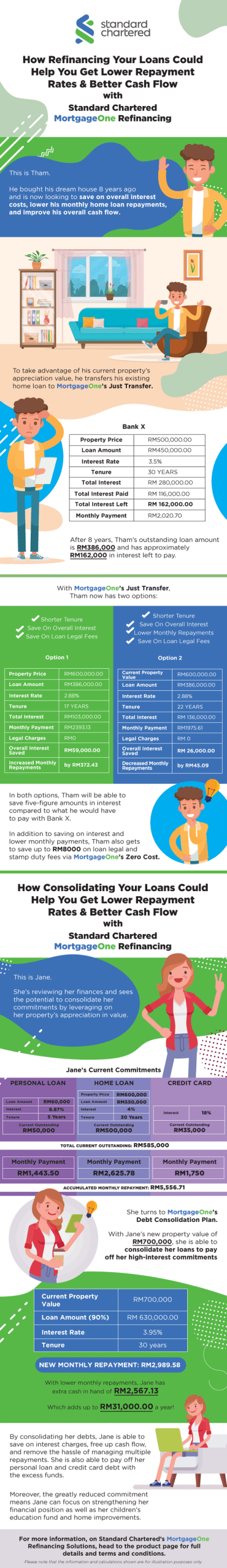

Standard Chartered MortgageOne Refinancing offers existing homeowners flexible mortgage refinancing solutions that include benefits such as having a reduced overall interest and lower monthly repayments. They offer two solutions, namely Just Transfer and Debt Consolidation Plan.

Just Transfer is a mortgage refinancing solution that allows you to transfer your existing mortgage to Standard Chartered Bank while enjoying interest rates from as low as 2.88% p.a*.

On the other hand, the Debt Consolidation Plan, allows you to leverage your existing property’s value appreciation to pay off other commitments such as personal loans and credit card debt.

Not to mention, homeowners will also get to save on loan legal fees, stamp duties and valuation report charges via the MortgageOne Zero Cost campaign.

For a better understanding, let’s dive into how Standard Chartered MortgageOne Refinancing solutions work with Tham and Jane.

***

So, if you’re looking to refinance your mortgage to save on interest, enjoy lower interest from as low as 2.88%*, and gain additional funds to pay off other commitments, consider Standard Chartered’s MortgageOne Refinancing Solutions: Just Transfer and Debt Consolidation Plan, where you can explore the benefits and flexibility of a home loan. To apply or to learn more, head to Standard Chartered’s MortgageOne website.

*The contents of this article do not constitute financial advice. Readers should conduct their own research before making a financial decision.

Comments (0)