Jasen Lee

7th May 2024 - 4 min read

In a world where balancing family, work, and personal commitments have been increasingly challenging, young families often face the daunting task of juggling multiple responsibilities – from nurturing their children and advancing their careers to managing household duties. Amidst this busy routine, finding time for financial planning, such as setting up a savings account for the children, often seems difficult due to the hefty paperwork and processes.

Recognising the importance of early financial education and the busy schedules of today’s parents, Maybank has created the Maybank Yippie/-i Savings Account, which helps to simplify the process of starting a child’s financial journey in under 10 minutes*.

Cultivating Good Financial Habits From Early Childhood

The Maybank Yippie/-i Savings Account is not just a regular children’s savings account but it’s also designed to cultivate financial awareness, as well as good financial habits from an early age. With an attractive profit rate of up to 2.4%, you can encourage a strong saving ethic in your children from an early age using the savings account.

Furthermore, this savings account also rewards children’s academic achievements at major milestones, such as PT3, SPM, STPM, and even at the degree level, with cash bonuses for excellent grades, thereby fostering a commitment to educational excellence, as well as boosting their savings.

Additionally, the Maybank Yippie/-i Account provides a safety net with free Personal Accident (PA) or Takaful coverage up to RM100,000 for your children, offering peace of mind for both you and your loved ones.

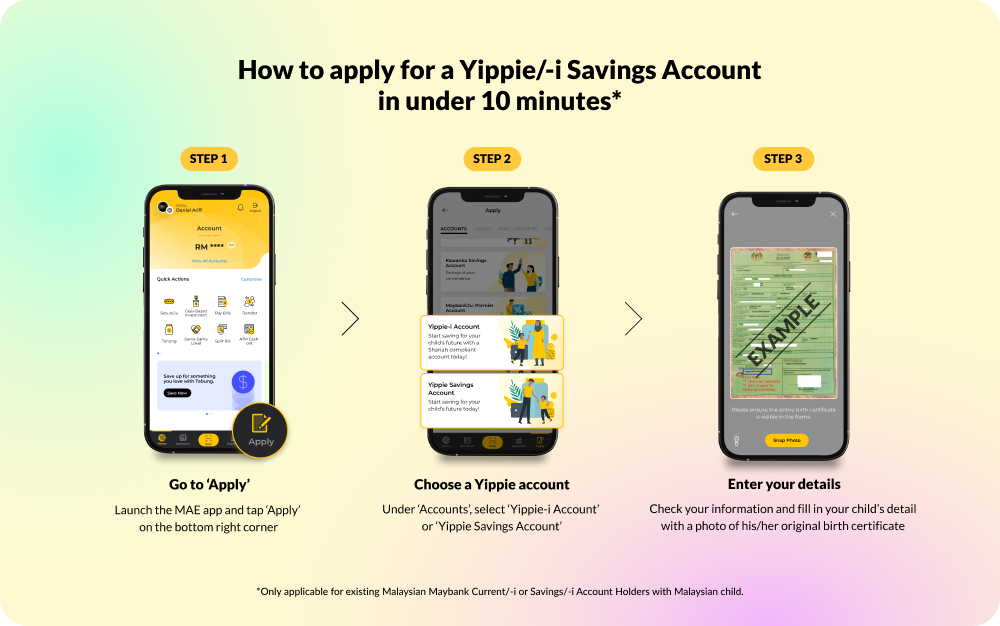

Apply The Maybank Yippie/-i Savings Account Via The MAE App From Anywhere

Understanding the hectic schedules of modern parents, Maybank has designed the application process for the Yippie/-i Savings Account to be quick and straightforward. In

under 10 minutes*, you can open an account from anywhere using just the MAE app, beginning with an initial deposit of only RM1. Here’s how to get started:

- Launch the MAE App: Simply open your MAE app and navigate to the ‘Apply’ section.

- Select the account type: Choose ‘Yippie/-i Account’ or ‘Yippie Savings Account’ from the list of available options.

- Verify your information: Fill in the details, confirm your details are correct and proceed to enter your child’s information as required.

- Take a photo of your child’s birth certificate: Take a clear photo of your child’s original birth certificate. This step is crucial for verifying your child’s identity and age.

- Activate the Yippie/-i Savings Account: Complete the process by depositing as little as RM1 to activate the account.

*Disclaimer: Only applicable for existing Malaysian Maybank customers with a Current/-i or Savings/-i account holders with a Malaysian child.

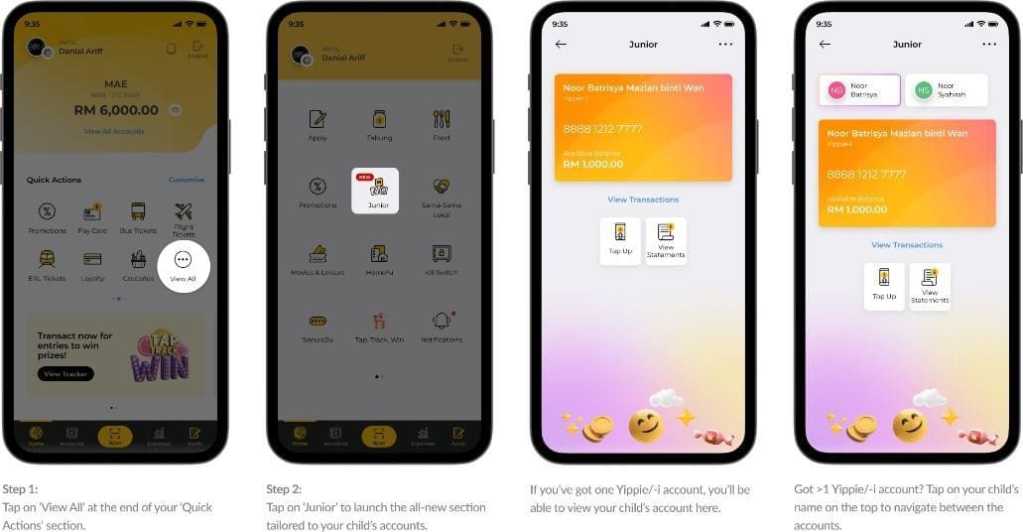

Enhancing Financial Management With The Junior Feature

Access Junior features with these steps:

Once the Yippie/-i Savings Account is set up, the MAE app’s Junior feature further empowers you to effortlessly oversee and manage your children’s savings. With this feature, you can view all the Yippie/-i accounts linked to your M2U ID, effectively separating your child’s account balances from yours, and ensuring clarity and ease of financial tracking.

Here’s how you can create a personalised nicknames:

You can also assign personalised nicknames to each account, which can make the experience more relatable and enjoyable for young savers.

Follow the steps below to set up a recurring savings plan:

Additionally, you can top up your children’s accounts easily, allowing you to contribute to their growth whenever you can. You can even set a recurring savings plan for your children to ensure regular contributions are made towards their future while building a robust financial foundation for your children to start saving young.

***

The Maybank Yippie/-i Savings Account represents an innovative solution for busy parents seeking to efficiently manage their time while providing a solid financial foundation to cultivate their children’s financial habits at an early age.

Interested in opening a Yippie/-i Savings Account for your children? Take this opportunity to do so and you could win cash prizes from a pool worth over RM10,000! Simply open a new account and deposit a minimum of RM250 from now until 24 July 2024 to be eligible for this exciting offer.

Discover more about the Maybank Yippie/-i Savings Account by clicking here.

Comments (0)