Lisa Ameera Azman

28th March 2022 - 2 min read

Over the years, technology has become increasingly significant in the financial journey of people all around the world. With just a few taps or clicks, we could get professional advice from Licensed Financial Planners on how to improve our financial health, apply for financial products, make a purchase through a variety of e-wallets, and use bank apps to do things we used to need to physically head to a bank for.

Saving and investing has also gotten far more convenient than ever before. Gone are the days when you’re required to fill up forms at physical offices to keep your money secure or have it invested. These days, you can do all that and more with a mighty few clicks.

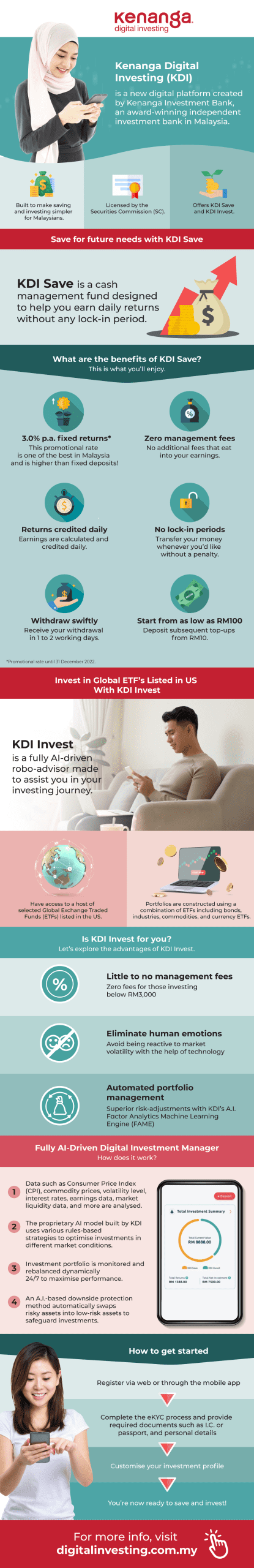

For those looking to earn daily returns at low risk, KDI Save is a great option to look into. The promotional rate of 3% p.a. for the first RM200,000 makes it a great option to store your emergency funds or savings, as it is one of the highest rates in the market today. Not only that, there are no lock-in periods, management fees, and you get to enjoy daily returns. Withdrawals are processed as quickly as one working day, ensuring you get your money faster than other money market funds.

As for investing, KDI Invest provides an easy entry into the world’s most liquid, deepest, and widest range of ETFs listed on the USA stock exchange. Whether you choose to be very conservative or prefer aggressive growth, you’ll be able to diversify your investments in the global market with little to no fees. KDI Invest is also great for those who may not have a lot of time or knowledge on how to invest.

Saving and investing need not be complicated. KDI has dismantled the hurdles to traditional investing and streamlined the process for you so that you can continue living your daily routine while your money works hard for you through KDI.

Try KDI Save or KDI Invest via Kenanga Digital Investing. Register online or download the mobile app today – available on Apple App Store and Google Play Store.

Comments (0)