Iman Aminuddin

16th April 2025 - 5 min read

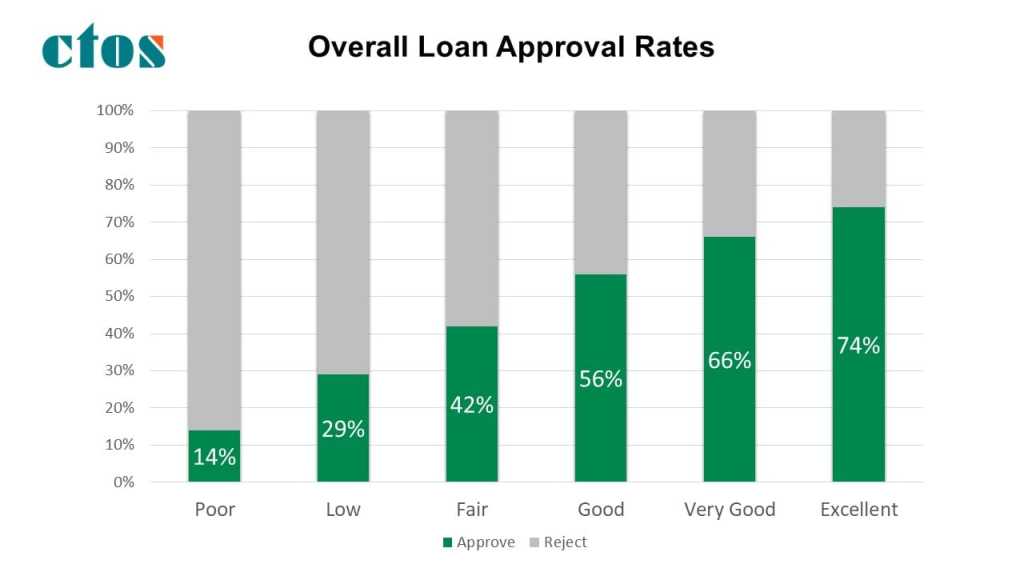

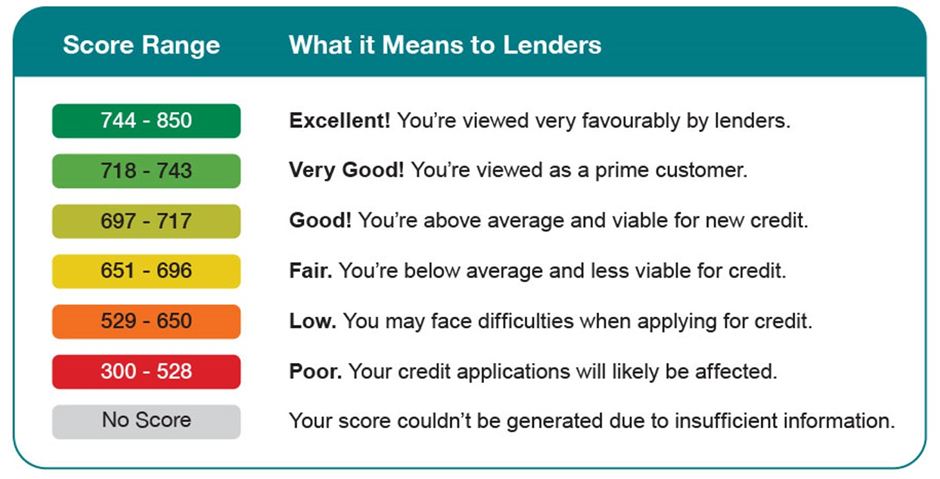

Getting approved for a loan—whether for a home, car, or personal expenses—can be significantly harder if your CTOS score isn’t up to par. A recent CTOS research shows that people with an ‘excellent’ CTOS score are five times more likely to have their loan applications approved compared to those with poor scores. A solid credit score not only boosts your chances of approval but also helps you secure better loan terms and lower interest rates, which can save you thousands over the life of your loan.

However, despite its importance, 53% of Malaysians don’t fully understand how their CTOS score affects their loan approval chances, according to the RinggitPlus Malaysia Financial Literacy Survey 2024. This lack of understanding can lead to missed opportunities, higher borrowing costs, and frustration when applying for loans or credit cards.

How Your Credit Score Affects Loan Approval

The CTOS research, based on the analysis of over 250,000 credit applications, revealed a strong correlation between CTOS scores and the likelihood of loan approval. The data highlights how your CTOS Score plays a crucial role in determining whether you’ll be approved for credit and the terms you’ll receive. To stay on top of your CTOS Score, it’s important to regularly check your MyCTOS Score Report, which provides a detailed breakdown of all the factors affecting your score.

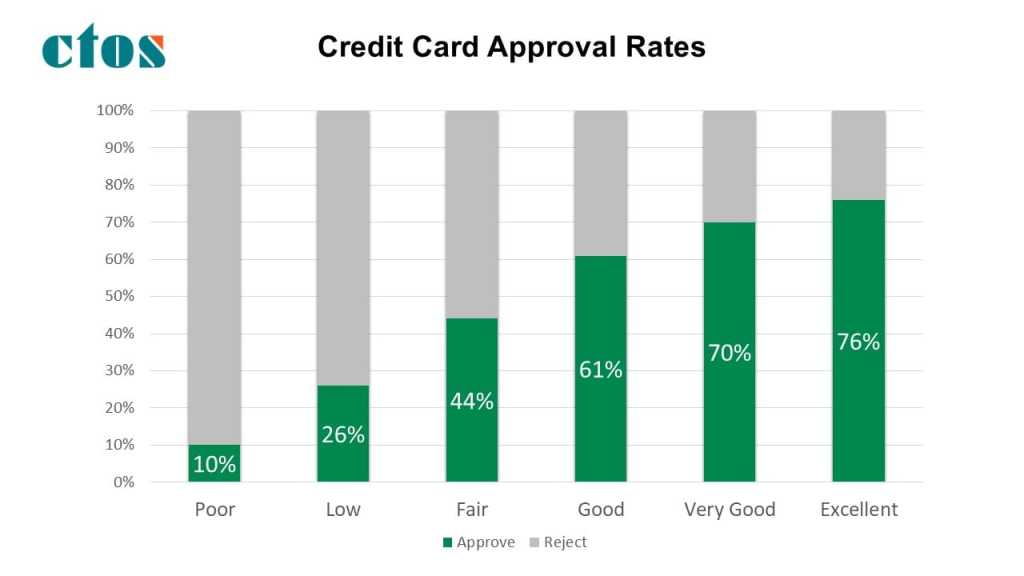

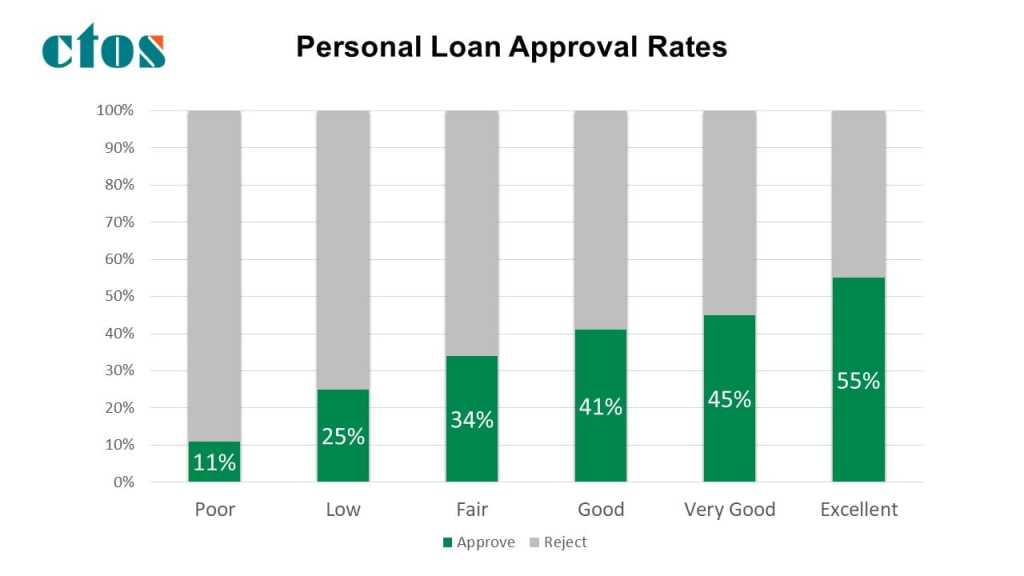

Here’s a breakdown of the findings:

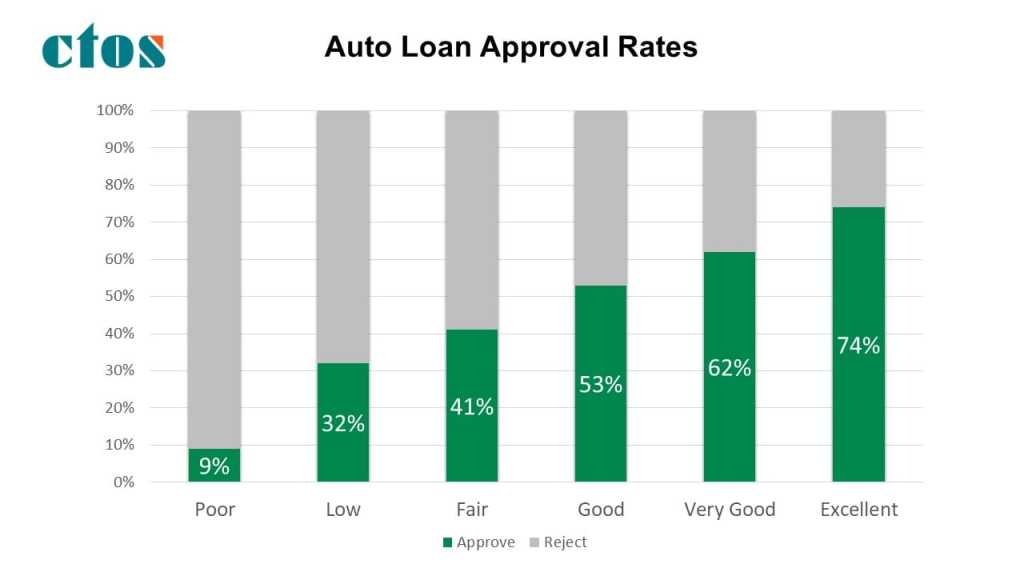

Auto Loans: Consumers with high credit scores have a 74% approval rate for car loans, compared to only 9% for those with poor credit scores.

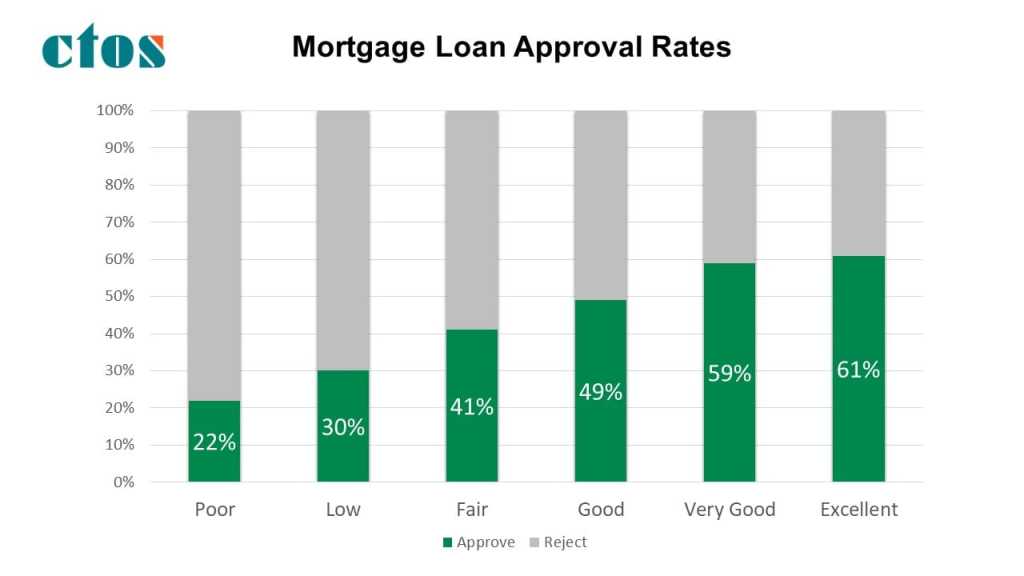

Home Loans: Similarly, 61% of individuals with excellent credit scores are approved for home loans, whereas only 22% of those with poor scores are successful.

Credit Cards: The difference is even more striking when it comes to credit cards, with 76% of those with excellent scores being approved for new credit cards, compared to just 10% for those with poor scores.

Personal Loans: When it comes to personal loans, 55% of individuals with high credit scores are approved, compared to only 11% for those with poor scores.

These statistics clearly demonstrate that a higher CTOS Score increases your chances of securing a loan, while a low score can significantly reduce your chances of approval, especially for credit cards and unsecured loans.

Make Monitoring Your MyCTOS Score A Priority

Regularly reviewing your MyCTOS Score Report is essential to strengthen your financial standing and improve your chances of loan approval. It provides you with a comprehensive understanding of your creditworthiness, including your CTOS Score and all the other factors that influence it. By staying informed, you can take corrective action before any issues impact your financial future.

Below are the key benefits of consistently reviewing your MyCTOS Score Report:

1. Boost Your Loan Approval Rate

A high credit score doesn’t just increase your chances of getting approved for loans—it also helps you secure loans with better terms and interest rates. The higher your credit score, the more likely you are to receive favourable offers.

2. Detect Identity Theft And Fraud

Identity theft is a growing concern, and catching it early can save you from serious financial consequences. Monitoring your MyCTOS Score Report regularly allows you to spot any unusual or fraudulent activity, such as new credit applications or accounts opened in your name, so you can take immediate action.

3. Stay Informed About Legal Or Financial Obligations Your credit score is impacted by more than just your spending habits. It’s also affected by legal and financial obligations, such as outstanding debts, bankruptcies, or court judgments. Regular checks can help you stay informed about any ongoing issues that might hurt your credit score, allowing you to address them before they cause problems.

4. Check For Outstanding Debts

Debts or unresolved trade references on your credit report could impact your borrowing potential. Checking your CTOS Score helps you identify any unpaid debts that could hinder your chances of securing new credit and allows you to take steps to settle them.

5. Ensure Your Information is Updated

Regularly checking your MyCTOS Score Report helps you stay informed about your latest credit details. This ensures your credit score accurately represents your current financial standing, enabling you to maintain a healthy credit score.

Tip: Did you know that even minor errors in your report—such as a missed payment you actually made or an outdated account—could negatively impact your score? Regular monitoring ensures this doesn’t happen.

6. Understand the Impact of Your Financial Habits

Your financial habits, such as paying bills on time, managing credit card balances, or accumulating debt, directly impact your credit score. Regularly monitoring your score helps you track how your habits are affecting your credit health and empowers you to make better financial decisions.

By consistently checking your MyCTOS Score Report, you gain a comprehensive view of your financial standing, which allows you to make informed decisions about managing your credit and taking proactive steps to improve your financial health.

Kredit Kau Hijau – Life On The Green Side

With an excellent, green CTOS Score, you could enjoy up to 5X higher loan approvals (CTOS Score Band vs Loan Approval Rates Study 2024). Whether you’re planning to purchase a new motorcycle, a new home or need additional funds for emergencies, all these are possible when your CTOS is excellent.

To see how an excellent CTOS score can directly influence your financial opportunities, watch the Kredit Kau Hijau? Check Luuu! video here:

***

Your Financial Future Starts With Knowing Your Score

You have the power to shape your financial future—and knowing your CTOS score is the first step. Reviewing your MyCTOS Score Report regularly puts you in control of your financial health, helping you to make better-informed decisions.

See how your score influences your financial journey:

Kredit Kau Hijau? Check Luuu! Click here to check your MyCTOS Score Report today and begin the process of better financial decisions, greater loan approvals, and better terms for all your financial needs.

Comments (0)