Iman Aminuddin

18th September 2024 - 7 min read

Moomoo MY is now allowing your idle cash for investments to earn returns as you prepare your next move with the new Moomoo Cash Plus feature. Designed to offer convenience for investors to “park” their investment allocation directly on the moomoo platform, Moomoo Cash Plus provides a low-risk option to grow your savings.

Moomoo Cash Plus invests your idle cash in three curated money market funds by reputable asset management firms. All three funds offered in Moomoo Cash Plus have competitive rates, low deposit requirements, and highly liquid withdrawal options – all without requiring investors to move their funds around different apps or platforms. The funds invest in secure financial instruments like government short-term bonds and bank fixed deposits, ensuring a low-risk approach in generating returns.

Benefits Of Moomoo Cash Plus

Moomoo Cash Plus is tailored to meet the needs of investors seeking a safe place to “park” their idle cash while still earning meaningful returns. Here’s a closer look at the advantages it offers:

Daily Returns

Moomoo Cash Plus offers an indicative return rate of 3.5%* per annum, positioning it at the top tier of cash management products. This rate is nearly 1 percentage point higher than the average annual interest rate of traditional bank fixed deposits, giving you the opportunity to maximise your returns on your idle cash every day, including weekends.

*1-year past returns on Maybank Retail Money Market-I Fund and United Money Market Fund-Class R as of 31 May 2024. Past performance is not indicative of future performance.

Low Barrier of Entry

Subscribing to Moomoo Cash Plus is easy and accessible to everyone. You can begin investing from RM0.01, and there’s no upper limit on how much you can deposit. This makes it suited to all investors – no matter how much idle cash is in your moomoo account, it can work harder for you.

Unmatched Flexibility

With Moomoo Cash Plus, you’re in control. The product allows you to deposit and withdraw funds at any time without penalties. Interest is calculated daily, and your Cash Plus deposits can also be redeemed for stock investments at any time, providing you with the flexibility to quickly react to market opportunities.

Zero Fees

All you earn is yours to keep. Moomoo Cash Plus charges no fees, ensuring that your returns are maximised without any deductions.

Shariah Compliant

Muslim investors can subscribe to the Maybank Retail Market-i Fund in Moomoo Cash Plus, which is a Shariah-compliant option with similar rates as the other conventional Malaysia-focused money market fund available.

Safe and Secure

Deposits placed in any of the funds in Moomoo Cash Plus are protected by the CMC fund, where eligible individual investors can claim up to RM 100,000 for qualified Malaysian securities/related assets.

Three Types Of moomoo Funds

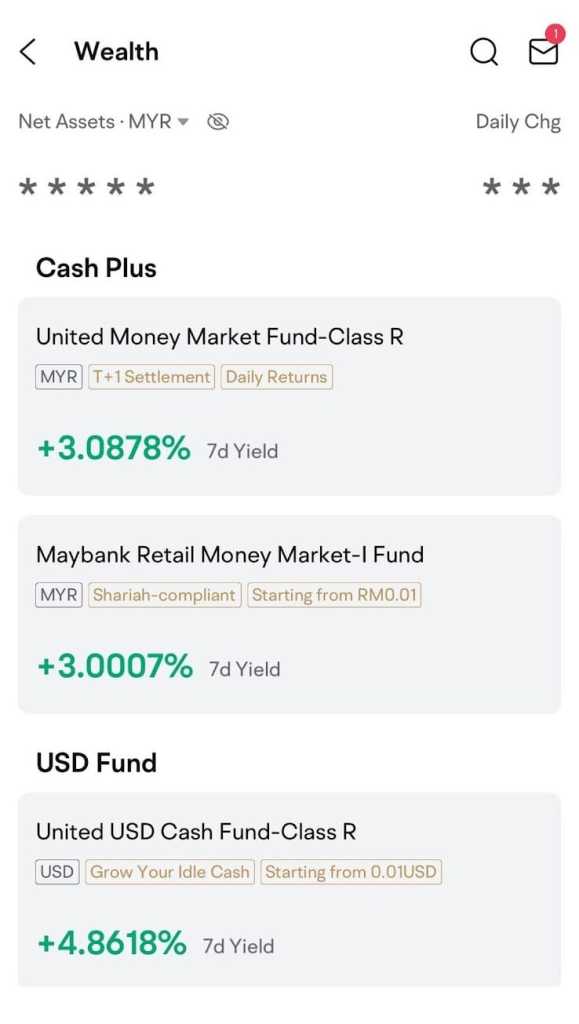

Moomoo Cash Plus offers three distinct funds: two MYR money market funds and one USD cash fund: the United Money Market Fund-Class R, the Maybank Retail Market-i Fund, and the United USD Cash Fund-Class R.

This allows you to earn interest or returns in either MYR or USD, so your idle cash in both currencies are able to earn returns.

Get Started And Subscribe To Cash Plus

Interested in boosting your savings with Moomoo Cash Plus? Follow these simple steps to subscribe:

Step 1: Open the Moomoo app, go to the ‘Accounts’ section, and select ‘Cash Plus.’

Step 2: Tap on ‘Discover,’ then navigate to ‘Wealth’ to find available investment options.

Step 3: On the fund details page, tap the ‘Subscribe’ icon, enter the amount you wish to invest, and confirm your subscription.

Let Your Idle Cash Work Harder For You With Moomoo Cash Plus

With your subscription process complete, you’re all set to enjoy the benefits of Moomoo Cash Plus.

Moomoo Cash Plus is designed to provide you with a secure, flexible, and rewarding investment experience. With its low-risk profile, high return rates, and the ability to manage your funds with ease, it’s a smart choice to earn some returns while waiting for your next investment opportunity.

If you don’t have a Moomoo account yet, there’s more good news! Sign up for Moomoo via RinggitPlus to start your Cash Plus journey and receive RM50 in guaranteed Touch ‘n Go Wallet Credit. Plus, you’ll have a chance to win an iPhone too! Get started by chatting with our chatbot here and watch your savings grow effortlessly!

This article is brought to you by Moomoo Securities Malaysia Sdn Bhd.

Disclaimer:

This is an advertisement.

The information provided herein is not intended for general circulation but for discussion purposes only. It does not take into account the specific investment objectives, financial situations or particular needs of any particular person. This does not constitute an offer, solicitation or recommendation to buy or sell or subscribe for any security or financial instrument or to enter into any transaction or to participate in any particular trading or investment strategy. Information contained herein should not be relied upon when making investment decisions. You should seek independent legal or tax advice before making any investment decisions. Investments are subject to investment risks, including the possible loss of the principal amount invested. Value of the investments and the income, if any, may fall or rise.

No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by Moomoo Securities Malaysia Sdn Bhd (“Moomoo MY”) and it should not be relied upon as such. Moomoo MY does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. Moomoo MY shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. The information provided herein is based on certain assumptions, information and conditions available as at the date of this advertisement and may be subject to change at any time without notice.

Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same. Moomoo MY does not guarantee that all risks associated to the transactions mentioned herein have been identified, nor does it provide advice as to whether you should enter into any such transaction. The contents hereof may not be reproduced or disseminated in whole or in part without Moomoo MY’s written consent.

The distribution of this advertisement may be restricted in certain other jurisdictions. The above information is for general guidance only and it is the responsibility of any persons in possession of this advertisement to observe all applicable laws and regulations of any relevant jurisdictions.

This advertisement has not been reviewed by the Securities Commission Malaysia.

For more information, please visit https://www.moomoo.com/my/.

Comments (4)

Hi, is Cash Plus really zero fee? I checked the prospectus for United Money Market Fund-Class R, it stated a RM15 transfer fee and annual management fee of up to 0.75%, please help to clarify on this.

You’re right, the United Money Market Fund – Class R does have a RM15 transfer fee and annual management fee up to 0.75%.

When we say Cash Plus is “zero fee”, we mean no account opening or monthly fees for the Cash Plus account itself. Fees for investment products like this fund are separate.

please show steps by steps in moomoo destop app

Here’s a quick guide to using the Moomoo desktop app:

Download & Install: Get the app from the Moomoo website.

Log In: Open the app and sign in with your credentials.

Search Stocks: Use the search bar to find stocks.

Place Orders: Select a stock and choose “Buy”” or “”Sell.”

View Portfolio: Check your holdings under “Portfolio.”

Let me know if you need more help!