Iman Aminuddin

25th March 2025 - 3 min read

Managing finances as a millennial can often feel overwhelming. With work commitments, family responsibilities, and saving for the future, it can be tough to stay on top of it all. And when the weekend rolls around, many are looking forward to a little relaxation—whether it’s grocery shopping, dining out, or just unwinding. However, even during downtime, it’s crucial to manage spending wisely to keep financial goals on track.

This is where the Hong Leong Bank (HLB) Wise Visa Credit Card steps in. With its attractive cashback features, millennials can earn rewards on everyday purchases, such as groceries, dining, petrol, and e-wallet top-ups—things they’re already spending on. This allows you to continue managing your financial responsibilities while earning cashback that can be saved or used to offset future expenses. It’s a simple way to make your routine purchases work harder for you.

How The HLB Wise Visa Credit Card Maximises Everyday Spending

Whether it’s filling up at the petrol station, doing your weekly grocery shopping, or even reloading your e-wallet, you’ll be rewarded for the things you already spend on.

This means you can continue to manage your financial responsibilities while earning cashback that directly benefits you. The more you use the card for everyday expenses, the more rewards you earn, which can be used to offset future purchases or saved for other financial needs.

Key Benefits Of The HLB Visa Credit Card

The HLB Wise Visa Credit Card offers several key benefits to help you manage your finances effectively. First and foremost, it allows you to earn cashback on purchases you already make regularly, such as groceries, dining, petrol, online shopping, and e-wallet top-ups. By earning rewards on these everyday expenses, you’re able to make smarter financial decisions without having to alter your lifestyle.

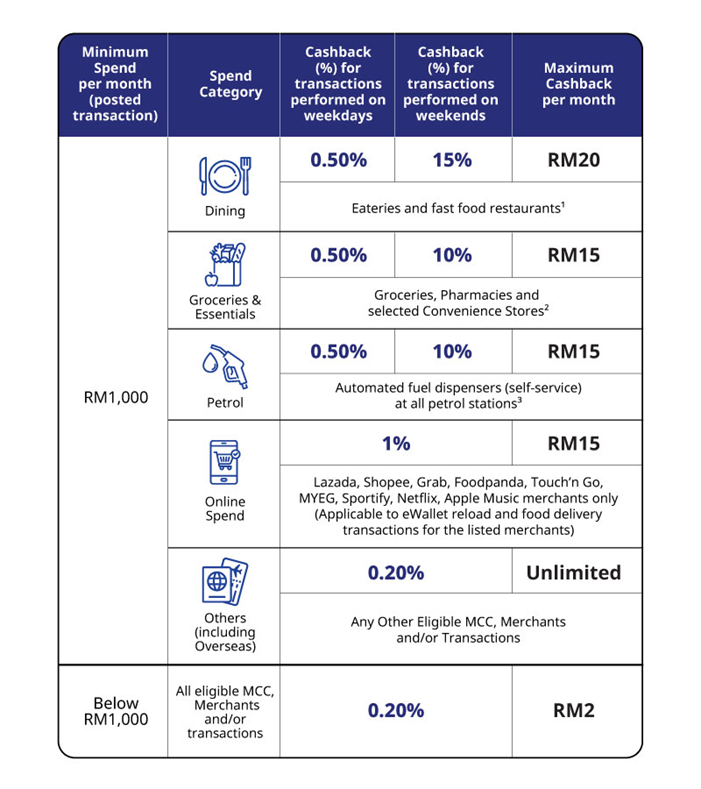

One of the standout features of the card is that it offers up to 15% cashback on select categories, including dining, groceries, pharmacies, petrol, online purchases, and e-wallet reloads. With a minimum transaction of RM1,000 per month, you can earn up to RM65 cashback monthly. This allows you to stretch your Ringgit further, easing financial pressures and offering more flexibility in managing your monthly expenses. Whether you’re out enjoying a weekend meal or doing your weekly shopping, the HLB Wise Visa Credit Card makes it easy to turn those moments into opportunities for rewards.

Additionally, for those looking to make long-term financial strides, the HLB Wise Visa Credit Card helps build better spending habits. By consistently using the card for routine purchases, you’ll be rewarded for your responsible spending, which aligns with your long-term financial goals. The cashback you earn can be saved or reinvested, helping you build a stronger financial future.

Ready To “Wise Up” And Take Control Of Your Financial Future?

The HLB Wise Visa Credit Card is more than just a financial tool—it’s your partner in helping you “wise up” to smarter financial decisions. By leveraging cashback, you can manage your finances more effectively, turning everyday purchases into opportunities for savings and rewards. Whether you’re focused on reducing everyday expenses or building a stronger financial future, this card helps you stay on track with your goals.

Empower your spending today and start earning cashback on your regular purchases. Click here to discover how you can “wise up” and make the most of your finances with the HLB Wise Visa Credit Card.

Comments (0)