Iman Aminuddin

11th December 2024 - 6 min read

As 2024 draws to a close, now is the ideal time to review your financial checklist and tick off those remaining boxes. Have you maximised your RM3,000 tax relief and taken the step to boost your retirement savings? One way to do so is through Private Retirement Schemes (PRS), which offer both financial benefits and long-term growth potential.

While Employees Provident Fund (EPF) contributions are mandatory, PRS offers a valuable opportunity to complement your EPF savings and boost your total retirement savings. In addition, PRS offers investment flexibility, the potential to earn higher returns over time, and provides tax relief on contributions, with the tax incentive extended through 2030. This makes it a timely opportunity to invest and optimise your retirement savings.

Through its partnership with TNG Digital Sdn. Bhd. (TNG Digital), Principal Asset Management (Principal) has made the process of investing in PRS simpler and more accessible. You can now access and invest in PRS funds directly through the Touch ‘n Go eWallet app (TNG eWallet app), integrated within the Gofinance-Principal feature—making the experience more straightforward and efficient.

Additionally, Principal is running the Laburia Promotion alongside your retirement investments, where you can earn up to 8% p.a.* reward for 30 days on your total net investment amount, with a minimum contribution of just RM100, available from now until 31 December 2024.

Principal’s Target Date Funds: Simplifying Investment Decisions For Your Retirement

What sets Principal apart is that Principal is the only PRS provider in Malaysia offering the Target Date Fund (TDF), a simple and straightforward and hassle-free solution to ease your retirement planning journey. TDF is a lifecycle-based fund which will automatically adjust its investment mix over the years, corresponding to your age. You may choose a suitable TDF based on your expected year of retirement and remain invested in the same TDF until retirement.

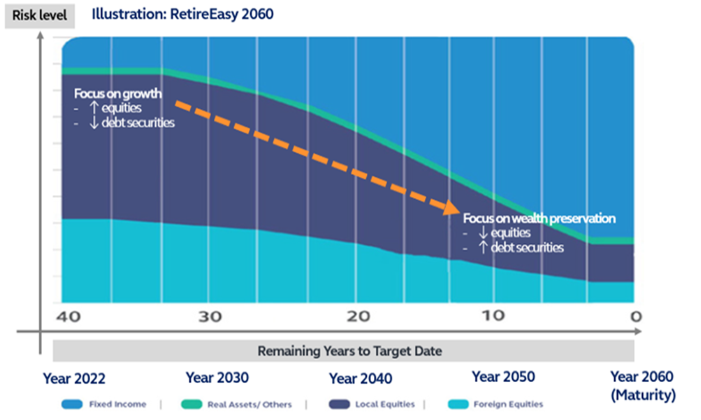

The TDF’s asset allocation glidepath strategy will adjust its investment mix automatically and gradually to evolve with your age and risk tolerance, making it easier for you to stay on track without needing frequent adjustments.

For example, when you’re further from retirement, the TDF portfolio is allocated to more growth-oriented assets like equities. However, as you approach retirement, the TDF gradually transitions to more conservative investments, such as bonds, to help preserve your savings. This natural progression is designed to reduce risk as your retirement date nears, making it easier to stay on track with your retirement objectives.

By choosing the TDF, you can trust Principal to manage your retirement investments, allowing you to focus on other aspects of your financial life. It’s a simple, automated way to invest for the future, with the confidence that your portfolio will evolve in line with your needs over time.

*TDF are neither capital guaranteed nor capital protected funds.

Earn Up To 8% p.a.* Of Your Investment Amount With The Laburia Promotion

Just invest RM100 or more in Principal’s PRS funds or unit trust funds through GOfinance-Principal via the TNG eWallet app, and earn rewards of up to 8% p.a.* on your total net investment amount for 30 days. This offers a flexible, low-barrier way to start building your retirement savings while taking full advantage of the tax relief available and earning extra rewards alongside your retirement investments—your enrolment in the campaign is automatic. T&C apply.

Follow these easy steps to get started:

- Launch Touch ‘n Go eWallet app, click on the GOfinance icon.

- Tap on Investment and select ‘Principal’.

- Click on ‘Retire’.

- Perform eKYC verification and select the desired option.

- Begin contributing with as little as RM100 to kickstart your retirement savings.

***

By investing through GOfinance-Principal via the TNG eWallet app, you not only gain access to a user-friendly platform and simple customer journey, but also enjoy the added benefit of low fees and no hassle retirement planning. Don’t miss out on the Laburia Promotion and RM3,000 tax relief—start investing for a secure financial future!

Interested? Learn more about the Principal’s Retire feature here.

*Investment involves risk. Please read our disclaimer before investing.

This article is brought to you by Principal Asset Management Berhad (“Principal Malaysia”).

Disclaimer: This is an advertisement. The information provided herein is not intended for general circulation but for discussion purposes only. It does not take into account the specific investment objectives, financial situations or particular needs of any particular person. This does not constitute an offer, solicitation or recommendation to buy or sell or subscribe for any security or financial instrument or to enter into any transaction or to participate in any particular trading or investment strategy. Information contained herein should not be relied upon when making investment decisions. You should seek independent legal or tax advice before making any investment decisions. Investments are subject to investment risks, including the possible loss of the principal amount invested. Value of the investments and the income, if any, may fall or rise. No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by Principal Asset Management Berhad (“Principal Malaysia”) and it should not be relied upon as such.

Principal Malaysia does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. Principal Malaysia shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. The information provided herein is based on certain assumptions, information and conditions available as at the date of this advertisement and may be subject to change at any time without notice. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same. Principal Malaysia does not guarantee that all risks associated to the transactions mentioned herein have been identified, nor does it provide advice as to whether you should enter into any such transaction. The contents hereof may not be reproduced or disseminated in whole or in part without Principal Malaysia’s written consent. The distribution of this advertisement may be restricted in certain other jurisdictions. The above information is for general guidance only and it is the responsibility of any persons in possession of this advertisement to observe all applicable laws and regulations of any relevant jurisdictions.

This advertisement has not been reviewed by the Securities Commission Malaysia.

For more information, please visit https://www.principal.com.my/.

Comments (0)