Chee Jo-Ey

14th November 2022 - 4 min read

Consumers are spoiled for choice when it comes to financial products nowadays. From expense tracking apps to automated investment services, there are many ways to manage and grow your money. Shouldn’t it be the same when it comes to bank accounts?

According to Maybank, 41% of their customers hold a generic savings account. However, there are other types of accounts designed for saving and investing that come with more benefits. Depending on where you are financially, it’s important to choose a bank account based on your goals.

You may consider the following accounts that reward you with higher interest/profit, diversify your investments, and streamline your finances. All of these accounts can be easily opened online via Maybank2u.com.my from within the safe comforts of your home.

Read on to find out how these accounts can benefit you.

- Save And Earn Interest/Profit

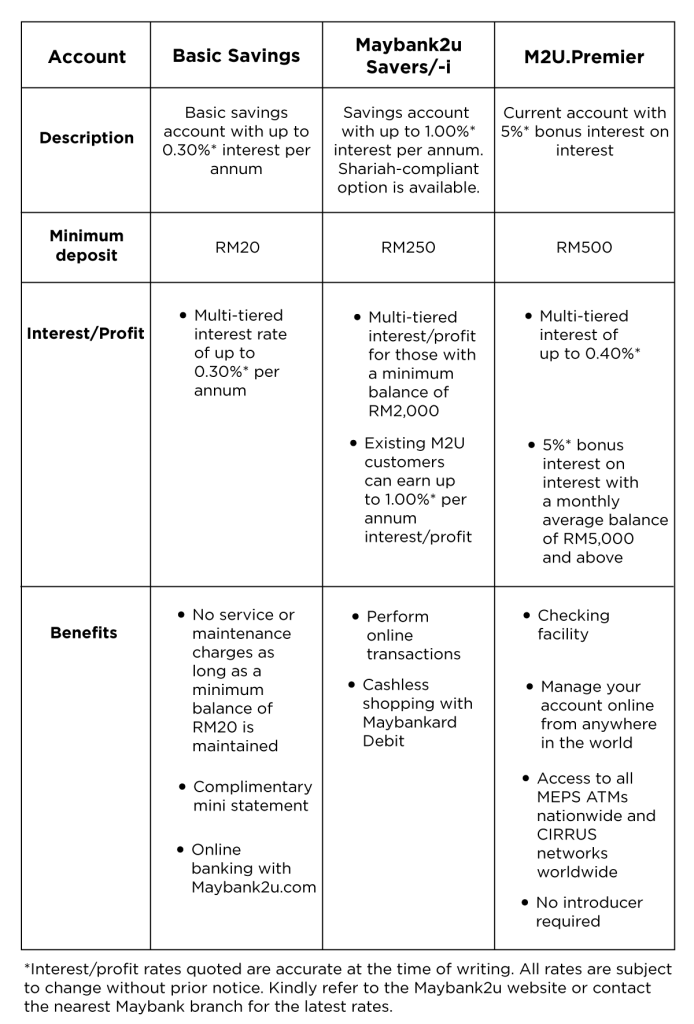

Many people first open a regular savings account to keep their money safe and secure. Most are unaware that there are other options available that do more than just hold their savings and have cash withdrawal services. Some savings accounts reward you with higher interest/profit rates like Maybank2u Savers/-i, where you can enjoy a multi-tiered attractive returns, which means that the more you save, the higher the interest/profit rates that you’ll get.

You’ve probably noticed that most savings accounts however, do impose a limit on your daily withdrawal amounts. If you tend to make larger transactions on a daily basis for your business or issue cheques frequently, you might want to consider a current account like M2U.Premier, which lets you make payments and withdraw money without limit. In addition, you can also access overdraft services, Interbank GIRO services, and more.

The table below outlines the features of the Maybank2u Savers/-i and M2U.Premier accounts compared to the Basic Savings account.

2. Grow Your Wealth

With the continual increase of living expenses, it’s good to look for ways to safeguard our financial future. According to projections by Bank Negara Malaysia, the average inflation rate hovers between 2.2% and 3.2% for 2022.

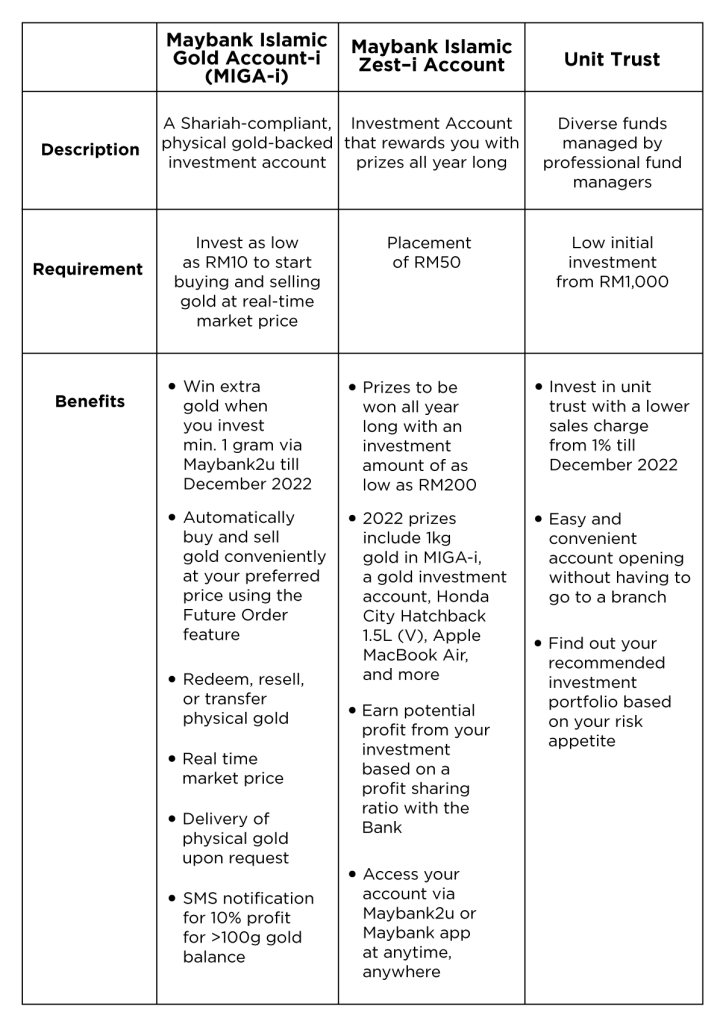

If you’re thinking of investing to potentially earn returns and hedge against inflation, you can consider opening an investment account with Maybank. Both the Maybank Islamic Gold Account-i and Maybank Islamic Zest–i Account let you invest with minimal requirements. While these accounts are Shariah-compliant, they are also available to non-Muslims. For those looking to diversify their investments, open a unit trust account to access funds managed by professional fund managers.

3. Manage Your Business

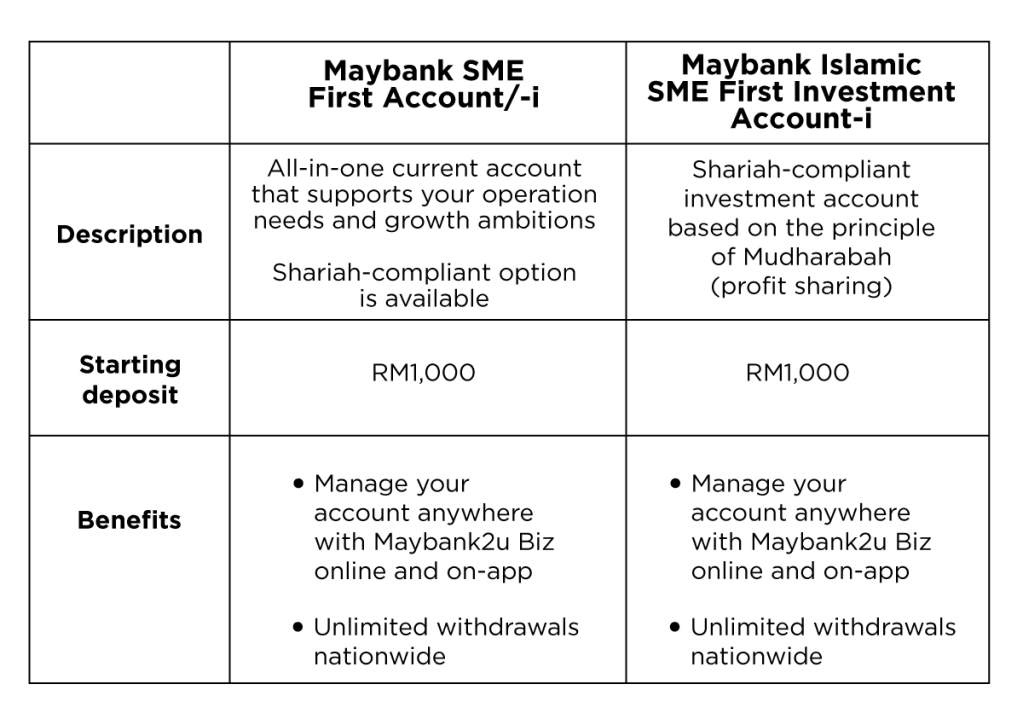

Starting a business can get overwhelming and you will need all the support you can get. Having a solid banking partner will help smoothen your everyday business banking processes. On top of that, you will also be able to access business solutions and other exclusive benefits that will help your business thrive.

If you’ve just started your business and want to open a business account easily, consider Maybank’s SME First Account-i with a deposit of only RM1,000. Meanwhile, the SME First Investment Account-i lets you manage your account and perform transactions on-the-go via the Maybank2u Biz online banking platform. Conveniently create and send invoices as well as check your recent transactions with just a few clicks from anywhere, anytime.

***

A regular savings account might be great for kickstarting your financial journey but now that you’ve learned more about other types of accounts, you may consider them if you’re looking to maximise your money with better interest/profit and benefits. Maybank customers can apply easily online via www.maybank2u.com.my.

To learn more about the Maybank accounts, click here.

All Maybank products mentioned above are subject to terms & conditions.

Interest/profit rates quoted are accurate at the time of writing. All rates are subject to change without prior notice. Kindly refer to the Maybank2u website or contact the nearest Maybank branch for the latest rates.

Maybank and Maybank Islamic are members of PIDM. Protection by PIDM is subject to insurability criteria. Please refer to the list of insured deposits displayed at http://www.maybank2u.com.my for further details.The contents of this article do not constitute financial advice. Readers should conduct their own research before making a financial decision.

Comments (0)