Hann Liew

29th July 2020 - 8 min read

In last week’s column, I gave a summary on what Malaysia’s Covid-19 driven Prihatin 6-month automatic loan moratorium is all about, when it’s going to end unless something new gets announced, and how we can all manage the situation after the moratorium period ends, including “discussing” with our banks with regards to R&R.

Having previously advised the Malaysian government on economic and financial (and youth/digital) matters, I’d like to share my views on what should be done by a combination of Bank Negara Malaysia (BNM), the Ministry of Finance (MoF), and the banks, after the loan moratorium period ends on 30 September 2020.

Don’t let the moratorium end on 30 September without a solution

Assuming no further announcements are made, the Prihatin 6-month loan moratorium will officially end on 30 September 2020. This is basically a hard landing with no other solution than to “discuss with your bank on Rescheduling & Restructuring (R&R) if you need further assistance”. I don’t think this should be the way forward to handle the delicate situation we’re in – both for consumers and the banking industry.

The obvious damage that has been widely reported in the news will be a potential spike in loan defaults from October onwards. Consumers and SMEs who have not fully recovered from the various MCOs (and the global Covid-19 crisis) will still struggle to continue surviving financially with those commitments ramping back up. Bankruptcies for individuals, insolvencies for SMEs, and increasing impairment losses for banks will set alarm bells ringing across the nation, resulting in a devastating ripple effect to the Malaysian economy.

Currently, the response given by most leaders and industry players is “if you are struggling, speak to your bank to do R&R of your loans”. This means a case-by-case R&R plan that will be a mix of three possible outcomes: tenure extension, consolidation, and personal moratorium.

On the face of it, this sounds like a useful solution for those who still need help, but there are a couple of key reasons why this will be a huge challenge to execute.

Firstly, the sheer number of R&R exercises that will need to be conducted will result in tremendous process delays with the banking industry. This should be straight forward: even if “just” 1 million borrowers needed to do R&R post-moratorium, that’s 1 million “discussions” or “negotiations” to be conducted. Imagine 1 million face-to-face meetings or calls between borrower and banker – it is just not practical without an automated solution. That said, an “automated” solution will still need to be customised to each situation/borrower if the post-moratorium options are “targeted” to those who need it the most (and thus, will not be easily customisable).

Besides that, we will also see differences in treatment among banks. We saw this with the initial moratorium guidance, where banks were told to apply their own methodologies when it comes to interest and tenure, and the subsequent difficulties there (where customers were frustrated with differing treatment) and eventually resulting in the blanket “no accrued interest” announcement by the Finance Minister on Hire Purchases.

Given what’s at stake, the current “speak to your bank” advice is simply not good enough.

An extension to the automatic loan moratorium isn’t the answer, either

To be clear, I think all borrowers should have the ability to extend the 6-month moratorium period to December or even next year if they need it. In fact I did suggest it last week as a technique which Malaysians can use within the R&R process (all useful techniques without an AKPK-style impacting of your credit standing) assuming the automatic 6 month moratorium does not extend past 30 September.

BUT I don’t think it is wise to just (simply) extend the current Prihatin-announced automatic opt-in moratorium mechanism, for both customers and the banking industry.

For starters, the “automatic opt-in” mechanics resulted in a take-up rate of 88% according to a poll by AKPK, which was way higher than what it probably needed to have been. Many opt-out (like this moratorium) vs opt-in studies have been conducted over the world across industries with consistent outcomes (90:10 results vs 10:90 results with the opposite opting), telling us that while there would have been some people that really needed the moratorium, many Malaysians who didn’t actually need the moratorium took it anyway.

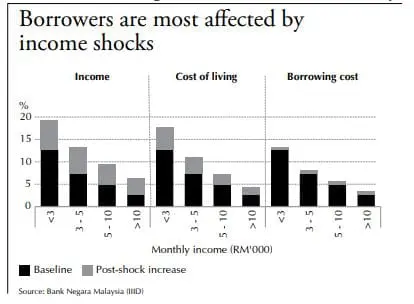

To put it in better perspective, a study done by BNM in 2018 on the resilience of Malaysian households against financial shocks revealed that only 11.7% of households will be “underwater” should there be a decline in household incomes of 10% for the year (for reference, household incomes declined 8.7% during the Asian Financial Crisis in 1997).

What should be more worrying is that continued automatic deferments may result in the wrong kind of debt habits being built up by consumers who don’t need it. A study found that habits may be formed in as little as 66 days (just over two months), so imagine a loan which you have already deferred for six months and having the option to defer it even further (with the small inconvenience of accruing interest) even if you don’t need it.

Finally, there’s the question of liquidity in the banking system. It’s a bit technical, but essentially if 90% of us are not resuming our installment payments, there may not be enough money going back into the banking system to give new loans to customers. Of course, this is a worst case scenario and BNM has already stated there is enough liquidity in the onshore banking system, but a second blanket moratorium will raise this concern.

While it’s never happened in the banking industry before, we’ve seen a similar issue with PTPTN, which struggled to recoup the loans given to tertiary students and resulted in stricter terms for new loan applications – and meant that fewer young Malaysians were able to afford tertiary education.

If the last two paragraphs sound overly dramatic to you, let’s take a look at what our Finance Minister revealed in a recent Parliamentary reading: “The banking sector is estimated to suffer the Malaysian Financial Reporting Standards (MFRS) losses of RM1.06 billion for every month the moratorium is in place. In total, the loss will be about RM6.4 billion, equivalent to the reduced capacity for banks to provide new loans to borrowers,” he said (emphasis mine). Note the second part of the final sentence – this isn’t a worst-case scenario, but one that is already happening.

What is the most viable solution, post-moratorium?

(Image: Malay Mail)

So, on one hand, not everyone has been impacted so heavily that they need an automatic moratorium (definitely not ~90% of borrowers who took it up), but on the other hand, leaving those who need it to “have a R&R discussion with the banks” will be bad for consumers (inconsistency between banks and general confusion) and banks (processing of individual restructuring in the hundreds of thousands or millions). What should the industry do?

My personal opinion: the best compromise would be a 3-month Pre-Arranged Opt-in Moratorium for those 3 product lines (Home loans, Personal Loans and Hire Purchases). So, if you need the moratorium, there is one ready for you already pre-arranged and therefore no need for discussion with your bank, BUT you have to opt-in (rather than it be automatic).

There are multiple benefits to this option which I believe works best for both borrowers and banks. For instance, this pre-arranged setup with fixed terms means there is no need to “discuss” with your bank, saving plenty of time and valuable resources (plus the added benefit of social distancing!) Either BNM or MoF can give a directive to the banks, similar to the one done in April-September 2020.

By making the arrangement “opt-in” and not “opt-out” (i.e. not automatic opt in), borrowers simply need to fill up a form (online or offline depending on the banks) to inform the bank. Fortunately, most banks would already have a similar form ready from the May 2020 Hire Purchase situation (it wasn’t used after the intervention of the Finance Minister).

Next, a three-month period is short enough to be less damaging to the banking industry, while still being long enough to offer an additional reprieve for borrowers. Plus, the situation can always be reviewed at the end of each deferment if another pre-arranged extension is required.

Finally, the previous arrangement of accrued but not compounded interest was confusing for many borrowers. It also encouraged those who did not need the moratorium to pick it up anyway (since it made sense to do so). In order not to build uncontrolled debt habits among borrowers, introducing accrued and compounded interest to the new moratorium extension is an appropriate compromise that borrowers may have to bear in exchange for more time. The low OPR environment in the foreseeable future will also make this more palatable for borrowers.

Overall, I believe that a short-term pre-arranged opt-in moratorium offers the best balance in terms of fairness to consumers and risk exposure to banks, while still maintaining the positive trajectory of the economy’s recovery.

The Prime Minister, Tan Sri Muhyiddin Yassin, is expected to make an announcement regarding the loan moratorium on 29 July at 3pm.

Comments (0)