Jacie Tan

2nd January 2019 - 2 min read

Here’s some good news for Citi Cash Back cardholders or those on the lookout for a rewarding cashback credit card. The Citi Cash Back Credit Card’s minimum spend requirement has been halved, from RM1,000 a month to just RM500 – making it a whole lot easier to unlock the sweet 10% cashback.

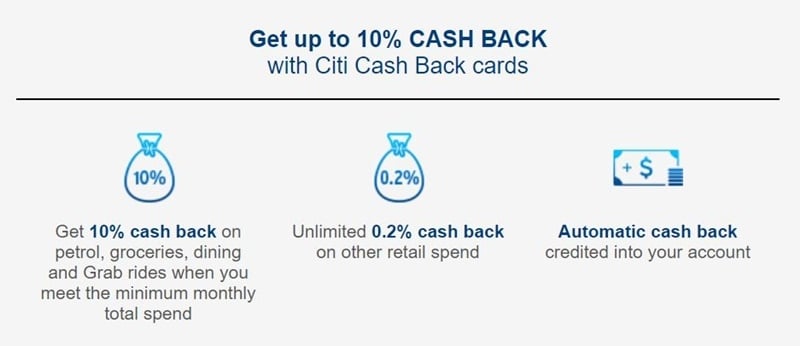

Previously, you would have to spend RM1,000 and above to unlock the Citi Cash Back credit card’s main cashback benefit, which was 10% on petrol, groceries, dining, and Grab rides (GrabPay wallet counts too!), capped at RM10 for each category. If the cardholder does not hit the minimum spend on the card, the cashback rate is only 0.2% for all categories.

With this change, which was actually in effect since 5 December 2018, the Citi Cash Back becomes a much more attractive cashback credit card – especially for those who do not spend much every month. Hitting RM500 in the four categories is a lot more realistic than RM1,000, allowing you to be able to a theoretical total of RM40 worth of cashback each month. Over a year that’s RM480 in cashback, more than enough to cover the RM120 annual fee and RM25 SST.

Interestingly, Citibank has only lowered the minimum spend requirement for the classic version of the Citi Cash Back Credit Card. The Citi Cash Back Platinum, which offers a higher monthly cap of RM15 for each category, retains its minimum spend of RM1,500 required to unlock the 10% rate.

With this change, the Citi Cash Back Card becomes arguably one of the best cashback credit cards for first-time cardholders. We’ll be updating Citi Cash Back Credit Card review or you can apply for the Citi Cash Back Credit Card on our website and receive additional rewards!

Comments (0)