Balkish Rosly

23rd October 2014 - 8 min read

Clueless, fearful, and in doubt about the forthcoming GST? Keyboard warriors and fear mongers are having a field day spreading rumours on the GST implementation in Malaysia; the most fearful one is of course, the possible price hike of, well, E-V-E-R-Y-T-H-I-N-G!

But how do we separate the GST facts from fiction?

Since most Malaysians are still in the dark about GST and its implementations, we present a guide that will hopefully give you a clearer a picture on the execution of GST in Malaysia!

What is GST?

Would you believe it if we say that GST is not an evil scheme drafted by the bad boys? Known across the world as GST (Goods and Service Tax) or VAT (value added tax), it is a type of consumption tax levied on your purchases. There are currently 160 countries in the world that use GST as a form of tax collection. The government has been trying to implement GST since 2011, but the proposed plan was greeted by plenty of backlash by the public. But here it comes now; as announced by the Prime Minister during the annual budget 2014 presentation, GST will be implemented in 2015 at 6% to replace the current sales and service tax.

GST vs SST

Hang on, aren’t we paying for the GST already? When eating out, you’d notice the glaring 6% tax on your receipt; and of course the calculator friend will insist on splitting the tax cost between the group. However, the 6% that you grudgingly fork out is not the GST.

Currently, there are 2 other indirect taxes already present in our tax system: the 10% Sales tax (sometimes known as manufacturer’s tax) and the 6% Service tax. Combined, they are usually referred to as the SST.

Err…what is Sales Tax?

We’re largely unaware of the sales tax, because it doesn’t occur on the consumer level. The 10% sales tax is collected only from manufacturers and importers with a yearly profit of RM100,000 and above. There are quite a few items which have a special tax rate of 5%, and there’s even some that are exempted from this sales tax (0% or no tax). Some of these items include:

• All exports are exempted from sales tax.

• Live animals, fish, seafood and certain essential food items including meat, milk, eggs, vegetables, fruits, bread, etc.

• Medical and educational equipment including sports equipment, books, etc.

• Photographic equipment and films.

• Motorcycles not exceeding 200cc capacity, bicycles for adult use.

• Machinery for textile industry, food preparation industry, paper and printing industry, construction industry, metal industry, etc.

• Primary commodities including cocoa, rubber, etc.

• Naturally occuring mineral substances, chemicals, etc.

• Helicopters, aircraft, ships and other vessels.

For example, if the manufacturer purchased an item from the supplier for RM10, they will be taxed at RM1 (10%). What happens here is that these manufacturers are to charge 10% sales tax on sales value of their manufactured products and to collect the tax from their customers, and remit to Customs every 2 months.

Err…what is Service Tax?

Remember the 6% tax on your receipt, or the RM50 you pay annually for your credit card (RM25 for supplementary cards)? That’s what the government calls service tax. Previously 5% and raised to 6% in January 2011, the service tax applies to certain items in the service industry including food and drink outlets, and tobacco.

This tax also applies to professional and consultancy services such as accountants, lawyers, engineers, architect, insurance companies, etc. and is also remitted to Customs authorities every 2 months. This one is easier to calculate: If you are buying a cup of Starbucks coffee for RM14, you will be taxed at 6% = so your final bill is RM14.84. Starbucks will then remit RM0.84 to the authority.

How Does GST Work in Malaysia?

Both the sales and service tax are added at one stage of the chain only: the 10% Sales Tax is added at the manufacturer level, while the 6% Service Tax is added at the consumer level (that’s you). On the other hand, the GST will affect all parties in a multi-stage taxation system across the value chain from manufacturing to sales.

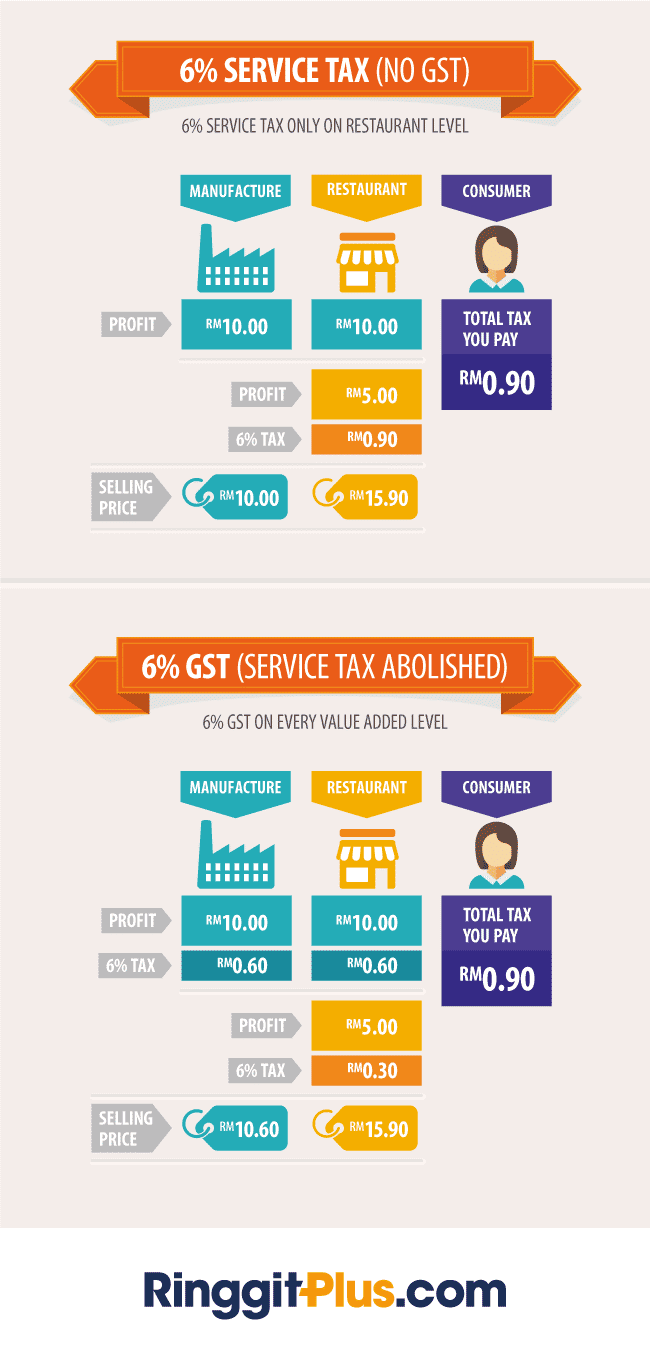

So in short, the previously 10%, 5%, or 0% Sales Tax will be replaced with 6%, and the 6% service tax will now be called as the Goods and Service Tax. Here’s a simplified example of how 6% GST vs 6% Service Tax works:

6% Service Tax

Step 1 – Starbucks buy coffee beans from its manufacturer at RM10, lets’ call the company KOPI. KOPI gets a profit of RM10. There is no tax involved here.

Step 2 – You buy a latte from Starbucks at RM15. The total price is RM15.90 (6% service tax). Starbucks gets a profit of RM5, and passes RM0.90 to the government.

Total tax to government: RM0.90

6% Goods and Service Tax

Step 1 – Starbucks buy coffee beans from KOPI at RM10. The total price is RM10.60 (6% GST). KOPI gets a profit of RM10, and passes RM0.60 to the government.

Step 2 – You buy a latte from Starbucks at RM15. The total price is RM15.90 (6% GST). Starbucks gets a profit of RM5, and passes RM0.30 to the government.

Why RM0.30 and not RM0.90 as shown on the first example? That’s because they’ve paid RM0.60 to the government when they bought coffee beans from KOPI (RM0.90 – RM0.60 = RM0.30).

Total tax to government: RM0.90

As you can see, the government did not make any extra money, so why bother with GST? Well, the GST unit of the Royal Malaysian Customs Department gives us the following reason ‘method of collecting taxes which works better than others’ to explain the need for GST.

Economists, meanwhile, believe the government has very rightly approached the GST as a new source of income with a broad tax base as a means to begin to diversify tax revenue sources.

Prices and GST

The number one concern of the public when it comes to GST is the prices of everyday goods. What will happen to our beloved kangkung after GST has been introduced to the market? To put your mind at ease, we’ve designed three infographics to show the possible scenarios: (1) for items charged with Service Tax, (2) for items charged with Sales Tax, and (3) for items with no Service or Sales Taxes:

6% Service Tax to 6% GST: No changes in price

As per our earlier example, there shouldn’t be any price increase, and you pay the same amount of tax at 6% to the government.

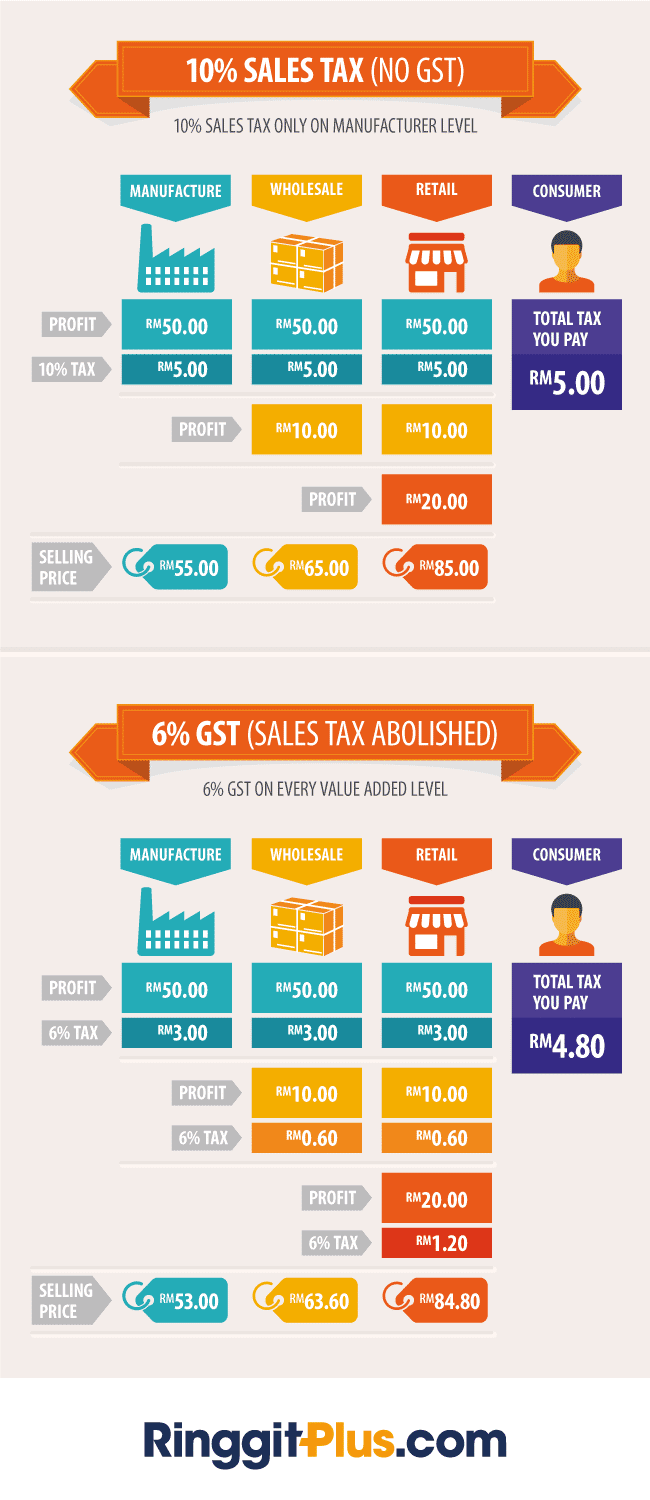

10% Sales tax to 6% GST: Possibly a decrease in prices

Similar to the earlier example, you may end up paying less if a product manufactured or imported now is subject to 6% GST rather than 10% Sales Tax.

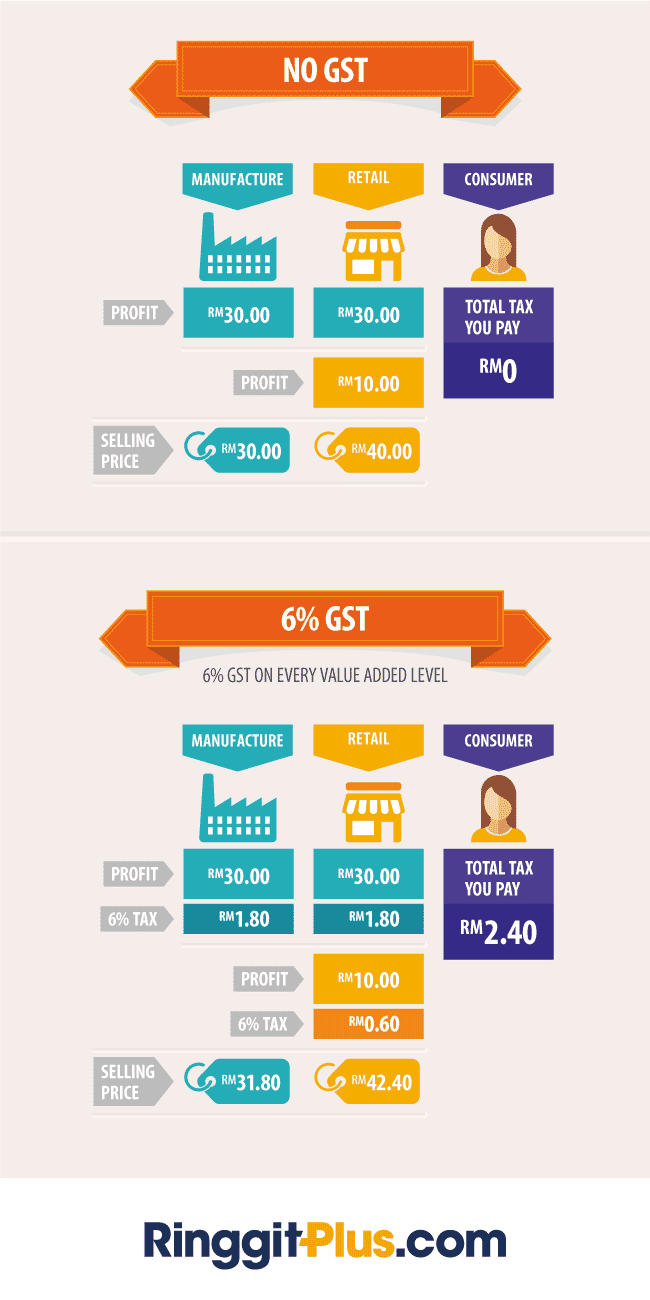

No SST to 6% GST: Increase in Prices

With that in mind, sectors of the economy which were not covered under the Sales and Service Taxes may now be under the coverage of GST, as it is a broad based tax measure. Unless these things are zero-rated, prices of goods not previously covered under those 2 tax systems will now be affected by the broad based GST and cost more.

How does the GST affect SMEs in Malaysia?

As the total GST amount is paid for by customers (parts of it effectively paid across the value chain, through GST input credits etc), businesses are not affected directly by price increases due to GST. The added cost through the implementation of GST will be due to administration of GST input credits and accounting for GST. Because of this, businesses with an annual turnover of less than RM500,000 are exempted from being GST registered and will thus not be required to collect or pay GST.

GST Exemption List

During the tabling of Budget 2015, the exemption list has been expanded to include more items. This list is by no means exhaustive, but you can expect to not pay any GST for these goods and services:

Food: Most meat, chicken, seafood, vegetables; all types of fruits, white and wholemeal bread, coffee and cocoa powder, tea dust, and noodles (yellow mee, kuey teow, laksa, and meehoon), cooking oil, margarine spread, flour, sugar, milk, salt, and many more.

Petrol: RON95, diesel, liquefied petroleum gas

Other goods: medicines, reading materials, and newspapers, among others

Services:Transport, education, healthcare, finance, and plenty more.

The obvious concern here is to make sure that businesses do not take advantage of just the fact that GST has been introduced as a reason to raise prices of goods and services indiscriminately. To this end, the Anti-Profiteering Act has been tabled to enable enforcement against such practices. In theory though, the multi-stage tax nature of the GST should allow the Customs department to aggregate pricing information far more accurately than they do currently, the implied monitoring of this should serve as a deterrent to unscrupulous businesses.

With effect on June 1, 2018, the regular GST rate of 6% will be reduced to zero percent as per the government directive.

Comments (0)