Alex Cheong Pui Yin

13th May 2024 - 2 min read

While Malaysia’s first shariah-compliant digital bank AEON Bank has revealed that it will be officially launching its app in about two weeks from now, on 26 May 2024, not much else is known about its offerings as of yet. However, a recent screenshot shared by one of the bank’s beta-testers has indicated that the bank may offer an upsized profit rate of 3.88% p.a. for its customers’ deposits.

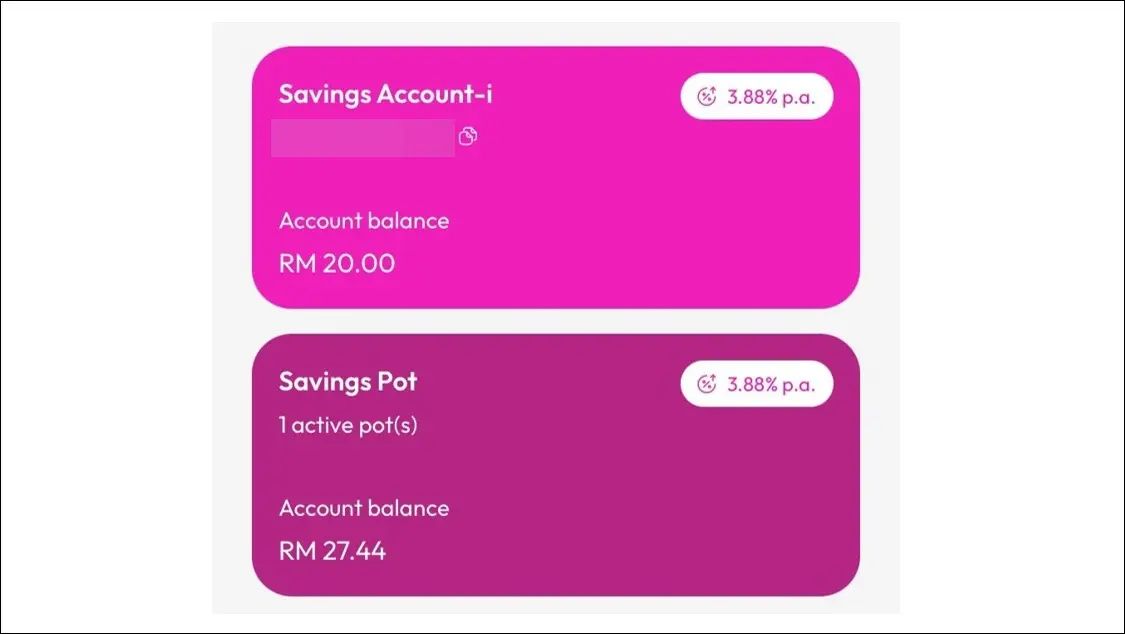

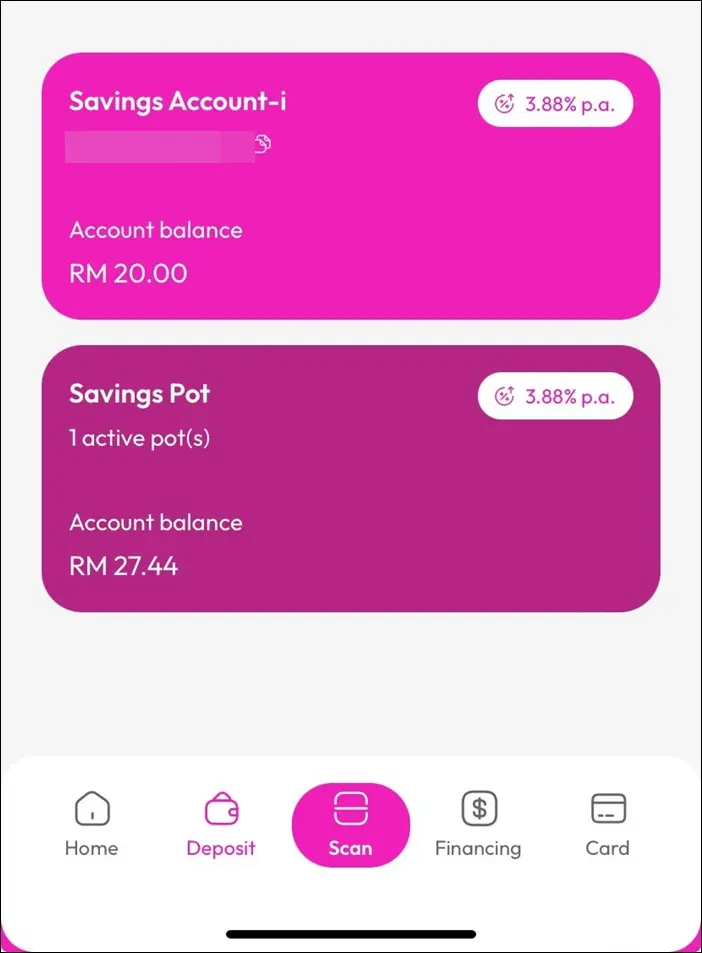

Shown in a post on X by @frhysn – who is an AEON staff member beta-testing for the bank and who had commented that the rate is the “highest rate among all” – the screenshot revealed a savings account-i and a Savings Pot, with both enjoying 3.88% p.a. profit rate on their account balances. This is somewhat similar to what GXBank has been doing, where users are able to earn 3% p.a. daily interest on both its savings account balance and Pockets balance.

Aside from the profit rate, the image also showed that there are tabs for Card and Financing on the navigation bar of the AEON Bank app. This is also in line with comments that have been made previously, where AEON Bank said that it has partnered with Visa to roll out various payment solutions, including an AEON Bank x Visa debit card-i. Financing options will be gradually added in time as well, along with banking products for the business segment.

While this is definitely an exciting development, Malaysians will need to wait until 26 May for the official launch to confirm whether they will actually be able to enjoy this same increased profit rate for their deposits with the bank. It is, however, undeniably appealing, given the fact that the most competitive rate currently offered for savings accounts in the market stands at 3.8% p.a., offered by Rize.

We will continue to keep an eye out for any updates on AEON Bank and its offerings in the meantime. To note, this upcoming digital bank is one of five applicants who successfully obtained the digital banking licence from Bank Negara Malaysia (BNM) in 2022, and received approval to commence operations early this year. Since then, it has been undergoing a beta-testing stage, involving AEON Group employees.

(Source: @frhysn on X)

Comments (0)