Alex Cheong Pui Yin

23rd November 2021 - 3 min read

Affin Bank has rolled out its digital bank proposition, A1addin, which aims to provide customers with the convenience of a fully digital banking experience. It is targeted at the digital-savvy generation, who often prefer to fulfil their banking needs at anytime and anywhere without having to visit a bank branch.

According to Affin Bank, its new digital bank will allow both individual and business banking customers to access various products and services 24 hours every day, as long as they have a smartphone and internet access. Among other things, you will be able to open and access your bank accounts within minutes without having to visit any of Affin Bank’s branches. There is also an upcoming feature where you can choose to own a modern-designed A1addin debit card or go totally cardless.

Other services provided by A1addin include being able to transfer money and make JomPAY bill payments instantly, as well as perform cashless transactions via QRPay. You wil also enjoy preferred rates, lower fees, and various banking promotions that will be featured in the A1addin digital bank app once you’ve downloaded it and signed up.

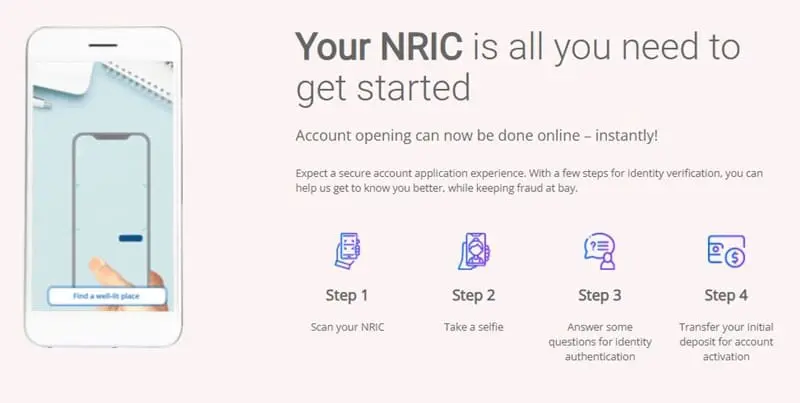

If you’re interested in registering for an A1addin account, you will need to be a Malaysian citizen residing within the country who is aged 18 years old and above. On top of that, you must have the new MyKad (containing the 80K chip and a ghost image), as well as a savings or current account with another Malaysian bank. The registration process will then require you to carry out the standard electronic Know Your Customer (eKYC) procedure, including a selfie verification.

Current Affin Bank customers who do sign up for A1addin should also note that the A1addin account is not linked to their existing Affin Bank accounts; it is a separate entity altogether. Accordingly, A1addin bank accounts cannot be accessed via the AffinOnline internet banking portal.

During the launch of A1addin, the president and group chief executive officer of Affin Bank, Datuk Wan Razly Abdullah Wan Ali said that the pandemic has vastly accelerated the demand for digitalised product offerings, as shown by the uptick in online transactions during the movement control order (MCO) period. “With our new digital banking proposition, the bank will be ready to embark and move towards the Internet of Things (IoT),” he said, adding that A1addin’s tagline of “A Touch of Wonder” signifies its desire to bring a wonderful customer experience.

Customers who wish to check out Affin Bank’s A1addin can download it for free from Google Play and the App Store.

(Sources: Affin Bank, New Straits Times)

Comments (0)