Alex Cheong Pui Yin

25th May 2022 - 3 min read

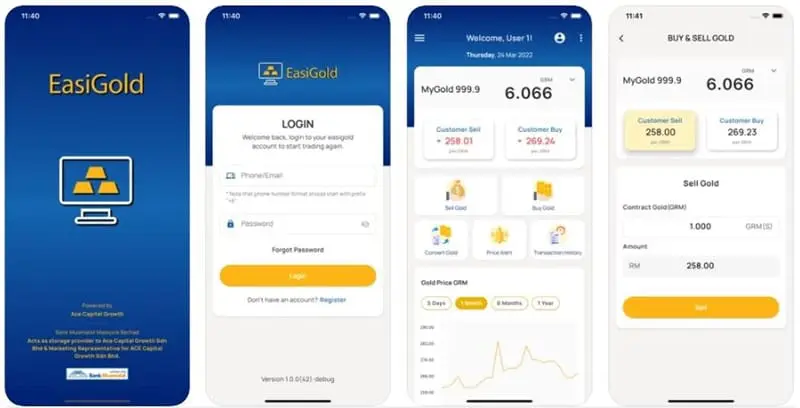

Bank Muamalat customers will now be able to conveniently invest in gold, following the bank’s launch of its shariah-compliant gold investment mobile app, EasiGold. The app is rolled out in collaboration with ACE Capital Growth Sdn Bhd, with the aim to promote gold as a safer investment alternative for the public amidst current economic uncertainties.

“The platform features real-time gold price display which enables customers to buy and sell London Bullion Market Association (LBMA)-certified 999.9 gold purity at real-time spot prices,” said the director of Bank Muamalat’s retail banking division, Zury Rahimee Zainal Abiden, adding that it will have a tiered pricing with a spread of as low as 1.5%, depending on market conditions.

EasiGold also has a “price alert” feature that informs customers of their preferred and targeted “Buy” and “Sell” prices. Additionally, it allows for conversion to unique physical denominations of 1g minted gold, as well as one- or five-dinar gold coins.

Zury Rahimee also said that Bank Muamalat will be the sole marketing agent for the platform, with no involvement by third parties, and that the gold is also kept by the bank. This offers both a measure of security and a peace of mind for its customers.

“Customers’ details are kept secure in accordance with the Personal Data Protection Act 2012, and the entire process is shariah-compliant. Therefore, we believe that the public will have more confidence to buy gold online via EasiGold, as the security features are more reliable and guaranteed,” said Zury Rahimee.

Additionally, Zury Rahimee clarified that EasiGold will complement Bank Muamalat’s existing gold investment offerings, which are provided through the Muamalat Gold-i range of products. EasiGold is primarily meant to cater to the needs of customers with a preference for mobile transactions.

Meanwhile, the chief marketing officer and executive director of ACE Capital, Fong Pok Yee said that this collaboration is a worthwhile venture. “With this platform, gold trading is now at your fingertips, and we hope the platform will appeal to millennials and the Gen Z demographics,” he said.

Bank Muamalat hopes to attract between 300,000 and 350,000 signups for EasiGold from existing and new customers within a year. The platform is only for Bank Muamalat customers, so individuals who do not have a Bank Muamalat account but wish to utilise the platform will need to open an account with the bank.

Bank Muamalat’s EasiGold app can be downloaded for free from Google Play or the App Store.

(Sources: The Edge Markets, The Malaysian Reserve)

Previously covered recruitment-related stories and had a short stint as a copywriter for the property industry. She subsequently developed an interest in investment and robo-advisors.

Comments (0)