Jacie Tan

12th August 2021 - 3 min read

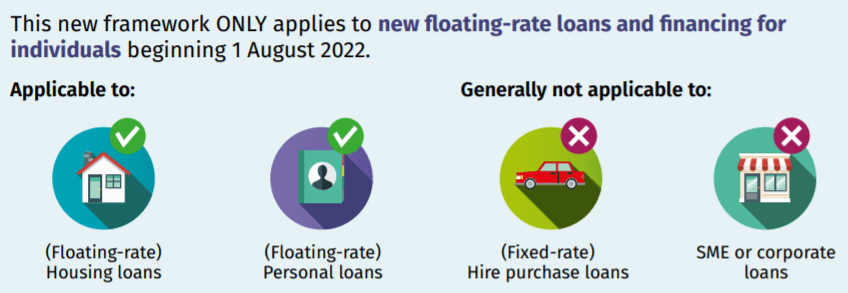

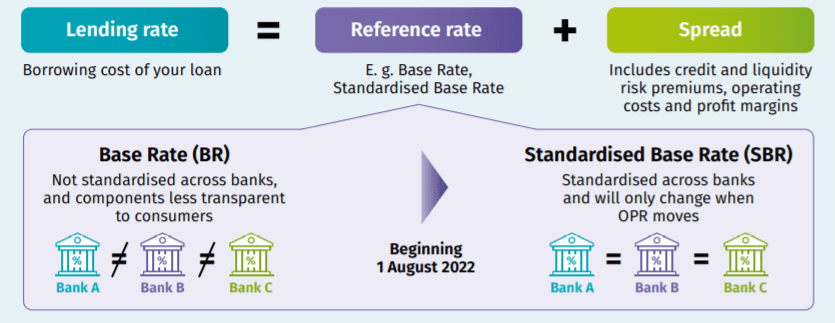

Bank Negara Malaysia (BNM) has determined that the Standardised Base Rate will replace the Base Rate (BR) as the reference rate for new retail floating-rate loans for individuals, effective 1 August 2022. This comes under the revised Reference Rate Framework that has been released by the central bank.

The Standardised Base Rate will be used as the common reference rate for all financial institutions for their new retail floating-rate loans and the refinancing of existing loans from 1 August next year. According to Bank Negara, this date will provide sufficient time for financial institutions to undertake the necessary preparations and system enhancements to ensure a smooth implementation of the revised framework.

The Standardised Base Rate is linked solely to the overnight policy rate (OPR), and therefore changes to it will only occur following changes in the OPR. BNM governor Datuk Nor Shamsiah Mohd Yunus said that consumers will find it easier to understand changes in their loan repayments since the OPR is the only driver of the Standardised Base Rate. The move improves comparability and is more transparent to consumers.

“The Standardised Base Rate will also facilitate effective monetary policy transmission as complete adjustments to retail loan repayments will take effect following a change in the OPR,” she said. However, the move towards the Standardised Base Rate does not represent a change in the monetary policy stance of BNM’s monetary policy committee.

Bank Negara said that the new shift will have no impact on the effective lending rates of existing retail loans, which will continue to be referenced against the Base Rate (BR) and Base Lending Rate (BLR). After the effective date, the BR and BLR will move exactly in tandem with the Standardised Base Rate as any adjustments will be simultaneously reflected in corresponding adjustments to BR and BLR. As such, financial institutions will continue to display the BR and BLR in addition to the Standardised Base Rate for customers’ reference.

“New retail borrowers should also be largely unaffected by this revision, as effective lending rates for new borrowers would continue to be competitively determined and influenced by multiple factors, including a financial institution’s assessment of a borrower’s credit standing, funding conditions and business strategies,” BNM said in its statement. “Other components of loan pricing such as borrower’s credit risk, liquidity risk premium, operating costs, profit margin, and other costs will continue to be reflected in the spread above the Standardised Base Rate.”

(Source: Malay Mail, BNM)

Comments (0)