Alex Cheong Pui Yin

24th November 2022 - 2 min read

CIMB Bank has announced a partnership with software integration company ModulEight Technologies Sdn Bhd, which enables the bank to offer integrated mobile business management solution, MESINKIRA, as part of its digital solutions provided for micro, small, and medium enterprises (MSMEs). This is with the aim of supporting the growth and digitalisation journey of MSMEs across Malaysia.

In a statement, CIMB explained that MESINKIRA is a commercial platform that offers point-of-sale software. It includes various functionalities that will aid businesses in key operation areas, including inventory management, payment and accounting, as well as reporting services. Of note is its integrated in-house financial analysis and reporting function, which not only enables precise data management, but also maintains accounting best practices and abides by regulatory compliance.

By offering MESINKIRA as its latest solution to MSME customers, CIMB hopes to help lower the entry barrier and ease the transition process for businesses that wish to digitise their operations. Once onboarded, MSME customers will also be invited to complimentary webinars and workshops that include tutorials on how to use MESINKIRA’s functions to optimise their businesses, as well as on the importance and methods of digitising business operations.

The chief executive officer of group commercial banking for CIMB Group, Victor Lee Meng Teck said that the addition of MESINKIRA is a “highly practical value-add” for the bank’s MSME customers, which will help them to become more competitive in e-commerce. “This latest offering also reaffirms CIMB’s continued commitment to support the development of MSME businesses, which form the backbone of the Malaysian economy, as they continue to accelerate their business growth post-pandemic,” he added.

Meanwhile, chief executive officer of ModulEight Technologies, Syed Omar Syed Abu Bakar Almohdzar said that MESINKIRA is set to support MSMEs’ growth by digitalising their operations and boosting their net income and creditworthiness. “This is achievable through our Retail Operations Support System (ROSS) which is truly end-to-end, easing business operations and reconciliation,” he further stated, adding that the partnership is also aligned with the principles of environmental, social, and governance (ESG).

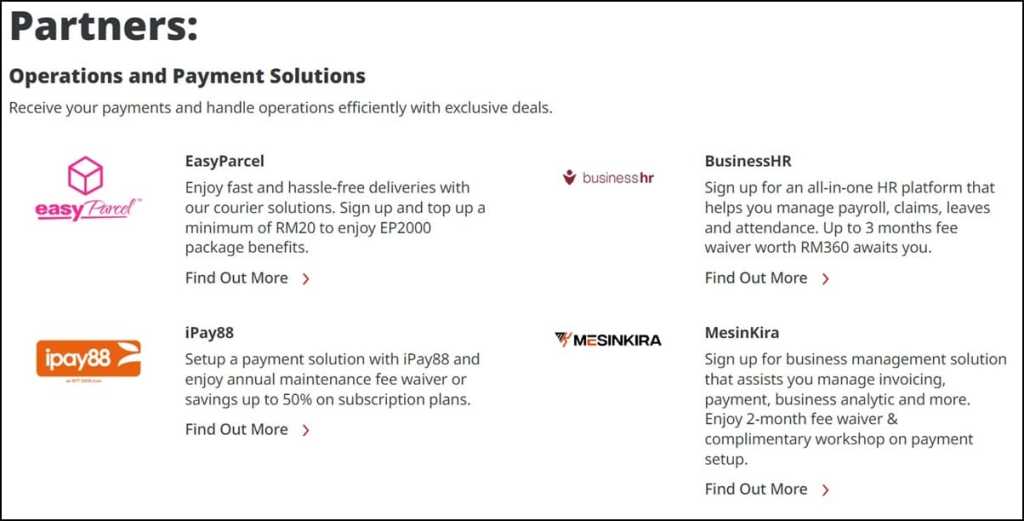

To celebrate this partnership, CIMB is currently offering a special deal to existing SME customers, providing them with a three-month fee waiver on any MESINKIRA subscriptions made between today to 31 December 2023. Meanwhile, MESINKIRA’s existing merchants can also open a CIMB business current account-i with a minimum deposit of RM500 instead of the usual RM1,000.

(Source: CIMB)

Comments (0)