Samuel Chua

14th March 2025 - 3 min read

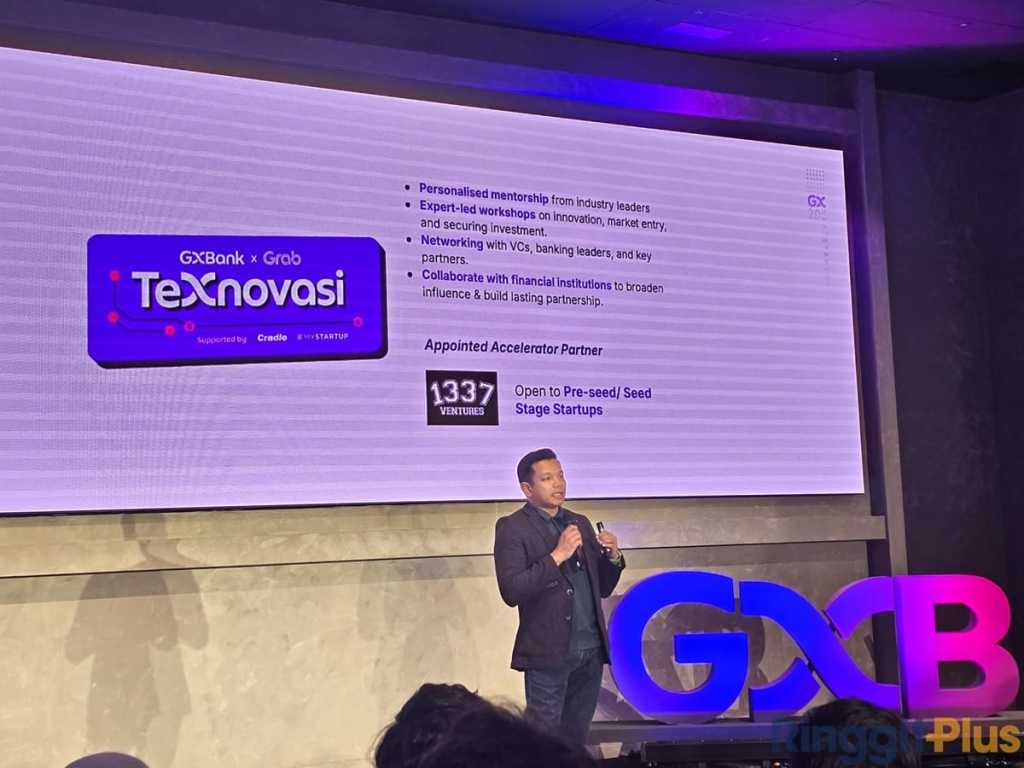

GXBank and Grab Malaysia have unveiled the eight fintech startups selected for the inaugural TeXnovasi Accelerator Programme, a six-month initiative designed to bolster Malaysia’s fintech landscape. Supported by Cradle Fund and 1337 Ventures, TeXnovasi aims to equip local startups with mentorship, resources, and expertise, fostering a technology-driven, financially empowered nation while positioning Malaysia as a leader in digital finance innovation.

The selected startups—Cashku, Du-it, Enprivacy, FinDoctor.my, Finory.tech, Kapitani, PulseLink, and Swipey—span various aspects of financial inclusion. Their solutions address critical issues such as digital fraud protection, financial access for micro, small, and medium enterprises (MSMEs), and the development of sustainable social protection frameworks to support business growth.

Fadrizul Hasani, Chief Technology Officer of GXBank, welcomed the startups to the GXBank family, highlighting their innovative potential in tackling three key financial challenges in Malaysia: accessibility, security, and customer experience. He underscored the need for financial access in underserved communities and MSMEs, the importance of strengthening cybersecurity and fraud detection, and the role of personalised solutions in enhancing customer satisfaction.

“Our nation’s startup ecosystem is brimming with potential, especially in the fintech space. However many often face obstacles when trying to scale such as regulations, balancing the complexity of data, tech and compliance, and also lack of funding. I am cognisant of the support we received in our early years, and even today, as a pioneering digital-only bank. Having the right guidance has helped shape my path as well as the organisation’s,” Hasani said.

He further emphasised that GXBank, alongside Grab Malaysia, seeks to cultivate fintech innovators who can address Malaysia’s financial challenges. “While GXBank aims to drive financial inclusion and resilience through technology-driven solutions, we also want to nurture like-minded innovators. This commitment to entrepreneurship is part of our shared vision to transform Malaysia into a thriving tech hub,” he added.

The participating startups will receive tailored mentorship and direct guidance from key experts at Grab Malaysia and GXBank, including Hassan Alsagoff, Regional Head of Loyalty and Marketing at Grab; Hildah Hamzah, Chief Operating Officer; Prasanna Rao, Chief Commercial Officer – SME; and Ashish Gaurav, Head of Cards.

Bikesh Lakhmichand, Chief Executive Officer of 1337 Ventures, highlighted the firm’s dual role as a venture capital investor and lead accelerator partner for the programme. He stressed the importance of equipping startups with the necessary skills to scale within Malaysia’s financial sector.

“Through the mentoring sessions, we aim to equip startups with the critical skills and insights needed to scale their business within Malaysia’s financial sector. Exclusive workshops will cover key areas such as market entry, innovation, and scaling, providing startups with the essential tools for growth. They will also gain access to a vast network of public and private investors, corporate partners, and experienced professionals, fostering opportunities for accelerated success,” Lakhmichand said.

Echoing Hasani’s sentiments, Lakhmichand expressed optimism that initiatives like TeXnovasi will cultivate a dynamic and resilient startup ecosystem in Malaysia, ultimately propelling the country’s fintech sector to new heights.

Comments (0)