Samuel Chua

24th March 2025 - 3 min read

GX Bank Bhd, Malaysia’s first digital bank, held the largest share of customer deposits among the country’s operational digital banks, with RM2.16 billion in deposits as of September 2024, according to RAM Ratings.

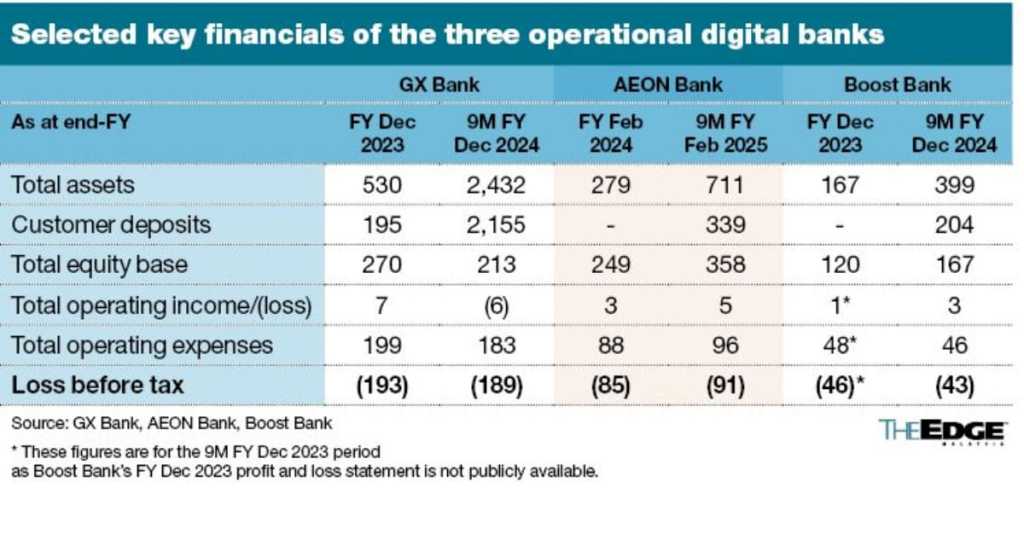

Among the three digital banks currently operating, GXBank also reported the largest asset base, standing at RM2.4 billion as at September 2024. In comparison, AEON Bank’s total assets amounted to RM711 million as at November 2024, while Boost Bank’s totalled RM399 million at the end of December 2024. Collectively, the assets of these three banks remain well below 1% of the total assets in the banking sector.

Customer deposits followed a similar trend. AEON Bank recorded RM339 million in deposits as at November 2024, while Boost Bank posted RM204 million as at September 2024, according to RAM Ratings’ banking insights report.

None of the three banks has reached breakeven, as anticipated, mainly due to substantial setup costs and a reliance on income from low-risk asset investments. GXBank reported a pre-tax loss of RM189 million for the nine-month period ending December 2024. AEON Bank recorded RM91 million in losses over the nine months leading up to the end of its financial year in February 2025, while Boost Bank posted RM43 million in losses for the nine-month period ending December 2024.

Digital banks in neighbouring Singapore have also yet to achieve profitability after two years of operations, offering a regional point of comparison.

GXBank, which launched in December 2023, gained strong early traction through aggressive promotional campaigns, although these efforts have since been scaled back as it moves into its second year. AEON Bank and Boost Bank, both launched in mid-2024, introduced high-interest savings accounts to attract customers. However, Boost Bank has adopted a more selective strategy, resulting in a significantly lower cost of funds at 1.7%, compared to 3% for its competitors, RAM Ratings noted.

A key challenge for these digital banks remains the retention of tech-savvy, price-sensitive customers, alongside managing acquisition costs and scaling up operations without incurring excessive risk. To support expansion, shareholders injected additional capital into all three banks in 2024.

Lending activities have commenced across the board. Boost Bank is concentrating on financing small and medium enterprises, leveraging RM120 million in loans transferred from its Boost Credit platform. GXBank offers quick-approval loans to both retail and business customers, although its business lending is currently limited to Grab merchants. AEON Bank, meanwhile, is focusing on personal financing, which was launched this month.

As of February 2025, three out of five licensed digital banks in Malaysia are operational. KAF Digital Bank and RYT Bank have yet to launch, although RYT Bank has initiated marketing promotions.

Due to a regulatory cap limiting asset size to RM3 billion per bank during their first three to five years of operation, digital banks are not expected to pose a near-term threat to traditional banks, which continue to invest heavily in digitalisation and enhancing user experience, according to RAM Ratings.

(Source: The Edge)

Comments (0)