Samuel Chua

12th February 2025 - 2 min read

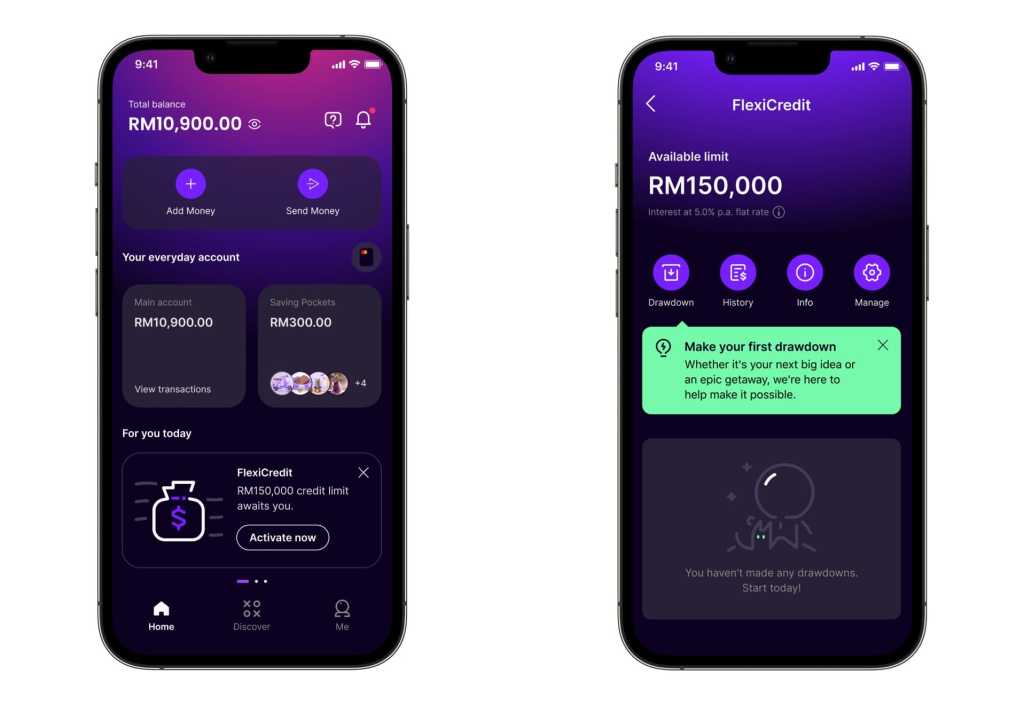

GXBank has announced that FlexiCredit is now available to all Malaysians, following the successful completion of its pilot phase. The bank stated that feedback from early users has been incorporated to refine and enhance the lending product, ensuring a better experience for borrowers.

Recap: What is FlexiCredit?

First introduced in November 2024, FlexiCredit was initially made available to selected users as part of a gradual rollout. The digital credit line offers a pre-approved borrowing limit, allowing users to withdraw funds on demand and repay at their own pace. Unlike traditional personal loans, FlexiCredit does not require borrowers to apply for a fixed loan amount upfront. Instead, they can draw down only what they need, as and when required, providing greater financial flexibility.

What FlexiCredit Offers

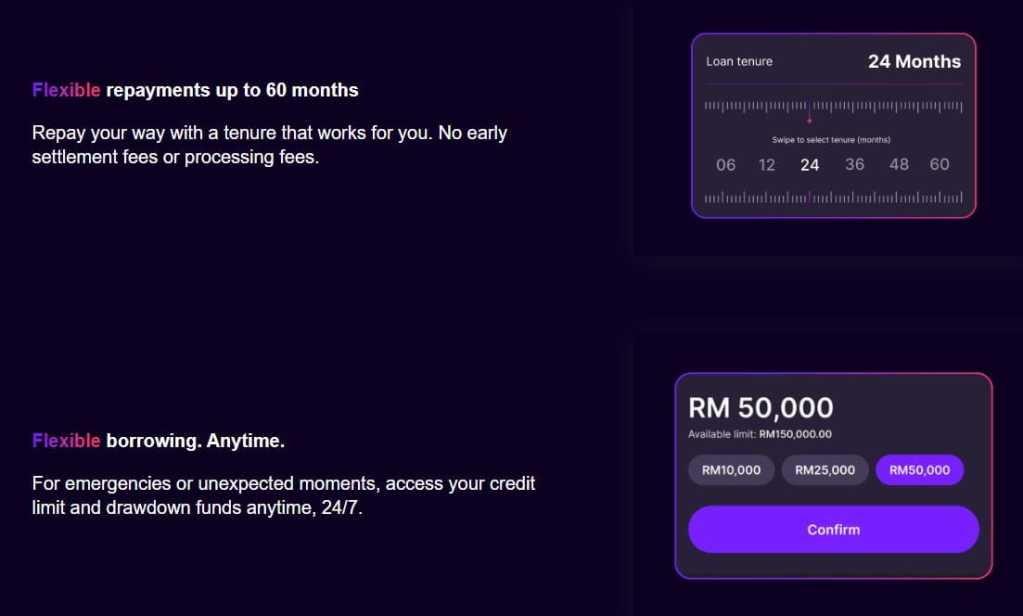

- Pre-approved credit limit that users can access at any time.

- On-demand withdrawals, allowing users to borrow only what they need.

- Interest charged only on the amount withdrawn, not the total limit.

- Fixed monthly instalments for repayment flexibility.

- No collateral required, making it accessible to more users.

Eligibility Requirements for FlexiCredit

To be eligible for FlexiCredit, applicants must meet the following criteria:

- Be a Malaysian citizen.

- Aged between 21 and 60 years old.

- Have a minimum monthly income of RM1,500.

- Own a GXBank savings account.

- Have a good credit score (subject to bank approval).

Application Process:

For Existing GXBank Customers:

- Log in to the GXBank app.

- Locate the FlexiCredit banner under the ‘For you today’ section on the ‘Home’ tab or in the ‘Discover’ tab.

- Follow the guided steps to complete the application.

For New Customers:

- Download the latest GXBank app and create a Savings Account (a process that takes less than four minutes).

- Ensure that consent for credit product offers is enabled.

- Access FlexiCredit through the ‘Discover’ tab or the ‘For you today’ section in the ‘Home’ tab.

- Follow the guided steps to enter your details and upload the required documents.

Required Documentation

- For Salaried Individuals:

Latest 2 years’ EPF statements (PDF) with consecutive contributions for the recent 6 months.

- For Self-Employed Individuals:

6 months’ business bank statements (PDF).

More information about GXBank FlexiCredit, including the product disclosure sheet (PDS), can be found on the updated product page.

Comments (0)