Samuel Chua

18th November 2024 - 2 min read

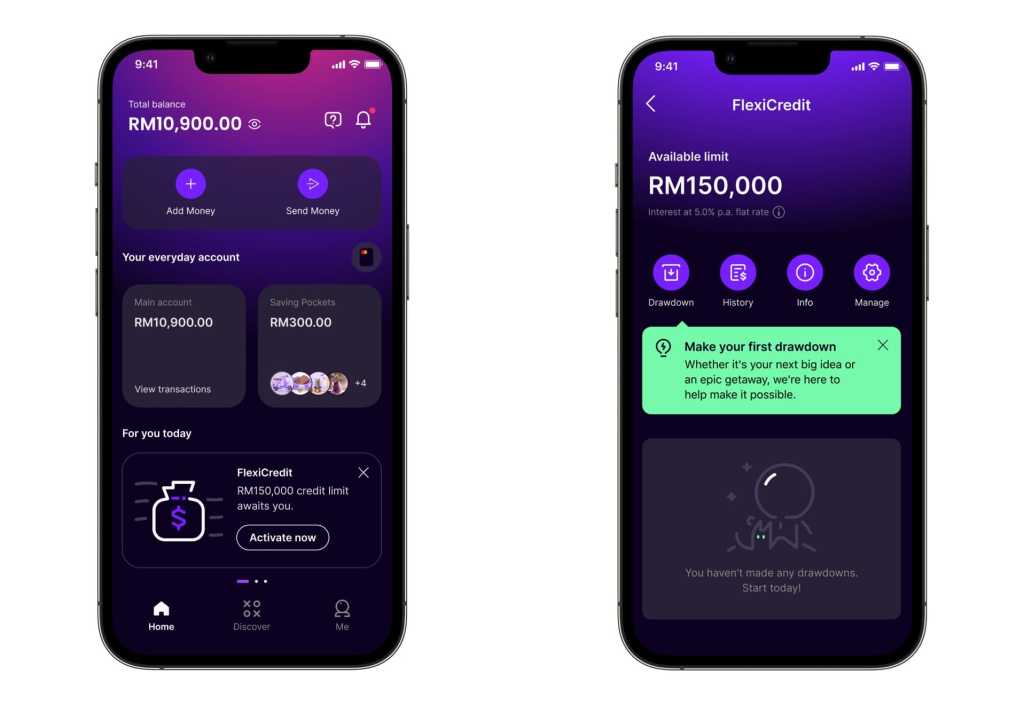

GXBank has started rolling out its new FlexiCredit feature to selected users, offering flexible and instant credit access as part of the next phase of the digital bank’s operations.

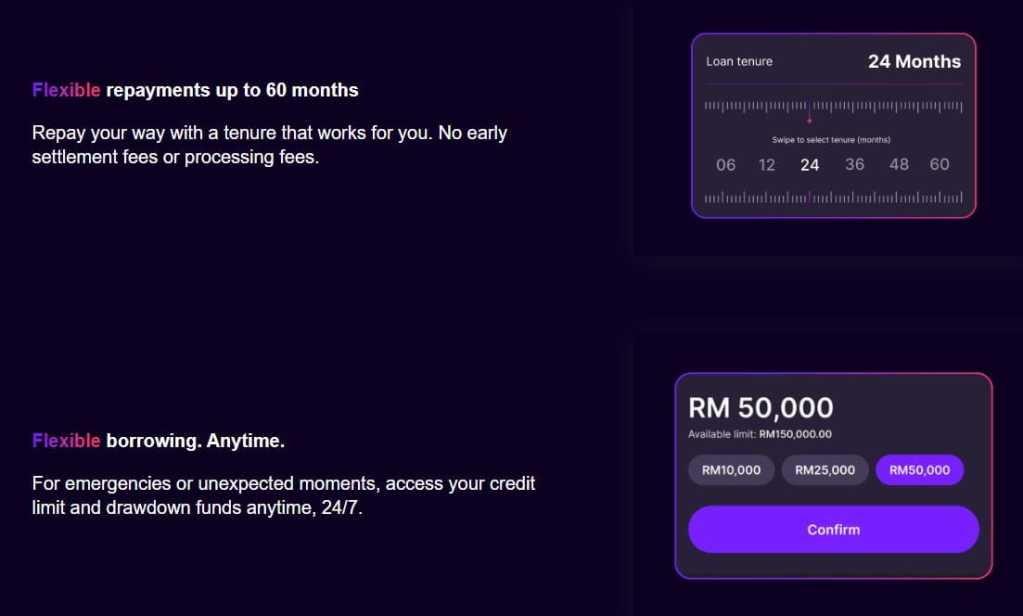

As its name implies, GXBank FlexiCredit allows users with instant access to a credit limit which users can withdraw (or technically, “draw down”) at any time and repay them in fixed monthly instalments over time. Like any other financing solution, the amount drawn down will be charged interest at a flat rate.

The digital bank is also aiming to simplify the application process with FlexiCredit. Users are pre-approved for a credit line ranging from RM1,000 to RM150,000, and for income verification, GXBank encourages users to log in to their EPF i-Akaun to automatically retrieve their EPF statements for the best experience. However, users can still choose to manually upload these documents; note that users are required to upload the past two years of EPF statements as part of the application process.

What’s interesting here is that the “decisioning” process will be instant after the income verification process – at this point of the application, users will be able to review the interest terms offered to them.

As for interest rates and charges, FlexiCredit adopts a flat interest rate that starts at 3.88% p.a. (EIR 6.62%), with repayment terms from 6 to 60 months. GXBank is also transparent in the fee structure, with zero fees for early settlement and a 1% late charge for overdue payments. In addition, a one-time “Odd Day Interest” (ODI) is applied daily if there is a gap between the loan drawdown and repayment start date.

As part of the launch, GXBank is running a FlexiCredit Reward Campaign from now until 31 December 2024. During this period, eligible customers who activate their FlexiCredit limit will receive a one-time RM20 cashback reward within two days of activation. The full terms and conditions can be found here.

More information about GXBank FlexiCredit, including the product disclosure sheet (PDS), can be found on the updated product page.

Comments (0)