Jasen Lee

18th July 2024 - 2 min read

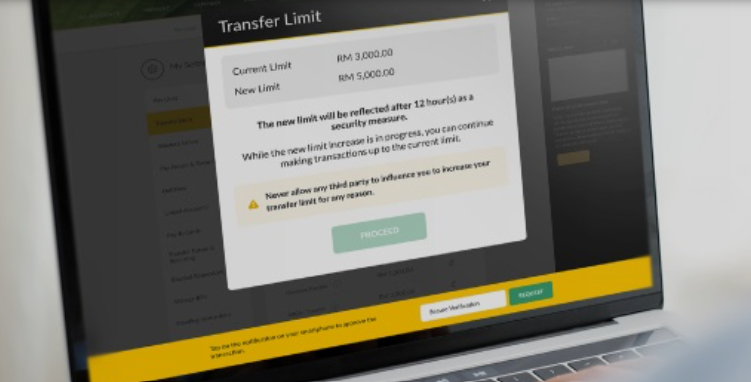

Maybank will implement a 12-hour cooling-off period for any transfer limit increase request via the Maybank2u website, aimed at preventing online frauds or scammers from increasing transfer limits before carrying out unauthorised transfers. This will be implemented from 31 July 2024.

The 12-hour cooling-off period begins when you submit a request to increase your transfer limit, and ends when the change takes effect for the following online services:

- Third-party transfers (Maybank to Maybank).

- Interbank transfers (DuitNow, DuitNow-Transfer, and GIRO).

- FPX & DuitNow Online Banking/Wallets

Throughout the cooling-off period, you can still make transfers as long as you don’t exceed the current transfer limit. And once the cooling-off period ends, you’ll be able to transfer up to your new limit.

Do note that you will receive push notifications from the MAE app or SMS alerts indicating the start and end of the cooling-off period. This also means that if you receive an unexpected notification from Maybank about an increase in your transaction limit, you can take immediate preventive measures, such as contacting Maybank’s Customer Care hotline at 1300-88-6688 or activating the Kill Switch through the Maybank2u website or the MAE app to temporarily suspend your online banking account.

(Source: Maybank)

Comments (0)