Alex Cheong Pui Yin

11th August 2020 - 3 min read

OCBC has shared the details of its post-moratorium financial relief packages, offering aid to its home loan and home financing customers who may need more time to get back on their feet when the current moratorium ends in September 2020.

The three post-moratorium financial relief packages offered by OCBC are as follows:

Unemployed individuals

You are allowed a moratorium extension of three months, from 1 October to 31 December 2020. When the extension is over, your subsequent monthly instalment amount will be adjusted to repay the loan across the original tenure of your loan. In other words, the tenure of your loan will not be revised.

Individuals who suffered a drop in income

OCBC has outlined two financial relief packages to meet the needs of this group. Customers within this category can tap into either of the following assistance:

- Lower instalments with subsequent step-up payments

Your monthly instalment will be reduced by 50% for 12 months once the current moratorium ends in September 2020. Subsequently, when the 12-month period of lowered instalments is up, your monthly payment will be increased to re-amortise your loan/financing. The tenure of your loan will remain unchanged.

- Tenure extension

You can also opt to extend the tenure of your loan/financing instead, allowing you to make lower monthly instalment payments. Note that the tenure of the loan cannot be extended beyond 35 years from the date of its first disbursement (i.e. the maximum loan tenure), or past the maximum age of 70 for the borrower – whichever is earlier.

How to apply

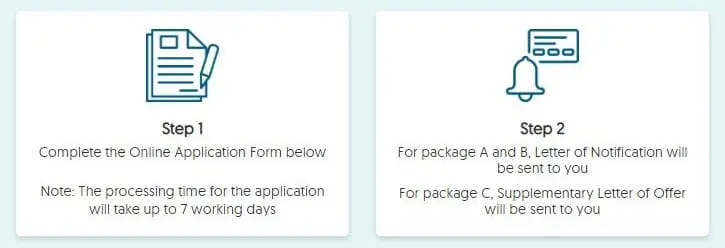

You can apply for the financial packages through OCBC’s online application form or by calling the bank’s dedicated Consumer Post-Moratorium Hotline at 603-83175011. Otherwise, you can also visit any of OCBC’s branches nationwide to enquire.

Be sure to attach the following supporting documents with your application:

- Salaried individuals

- Retrenchment letter

- Salary slips (before and after pay cut)

- Self-employed individuals

- Bank statements of your business income (before and after it was impacted)

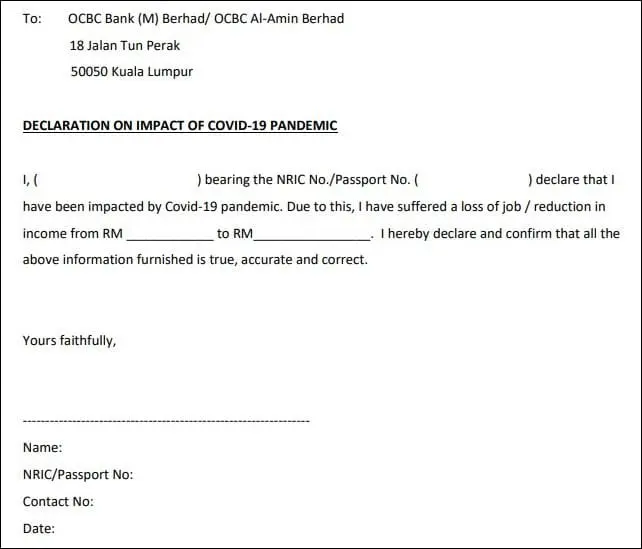

Alternatively, you can submit a downloadable statutory declaration if you are unable to provide any of the above supporting documents.

Upon submission of your application, you can expect a response from OCBC within 7 working days through email, SMS, or post. Following that, individuals who successfully applied for a moratorium extension or for lower instalments with subsequent step-up payments will receive a letter of notification. Meanwhile, those who opted for a tenure extension will be provided with a supplementary letter of offer.

Applications are open from now until 30 June 2021.

***

For more information, head on over to OCBC’s post-moratorium financial relief page on its website.

Comments (0)