Samuel Chua

25th August 2025 - 4 min read

Ryt Bank has officially launched in Malaysia, positioning itself as the world’s first AI-powered bank built by Malaysians, for Malaysians. Backed by YTL Group in partnership with Sea Limited, the bank brings together artificial intelligence innovation and everyday financial services in a single app.

Dato’ Seri Yeoh Seok Hong, Managing Director of YTL Power International, highlighted that Ryt Bank reflects Malaysia’s potential to lead in financial technology.

“By combining homegrown AI with the values and diversity of our people, we’ve created a bank that Malaysians can proudly call their own.”

Everyday Credit with Ryt PayLater

Among its headline features is Ryt PayLater, a credit facility designed for everyday use. Customers can access instant credit of up to RM1,499 without the need for documents. Payments made within the first month are interest-free, and no late fees apply.

Spending through Ryt PayLater also comes with rewards. Customers earn 1.2% cashback when making DuitNow QR payments, and those who shop with selected ecosystem partners such as Yes stores will receive double cashback. Eligibility checks are required before activation.

Smarter Banking with Ryt AI

At the core of Ryt Bank is Ryt AI, an intelligent assistant powered by ILMU, Malaysia’s first homegrown large language model. Ryt AI supports Bahasa Malaysia, English, and Manglish, with Mandarin scheduled to be added by September 2025.

The assistant allows customers to manage their daily banking through simple conversations. It can read and pay bills, track spending habits, and explain financial terms in plain language. Ryt AI also works with bill uploads, including receipts, utility statements, or even WhatsApp messages, by extracting the payment details automatically.

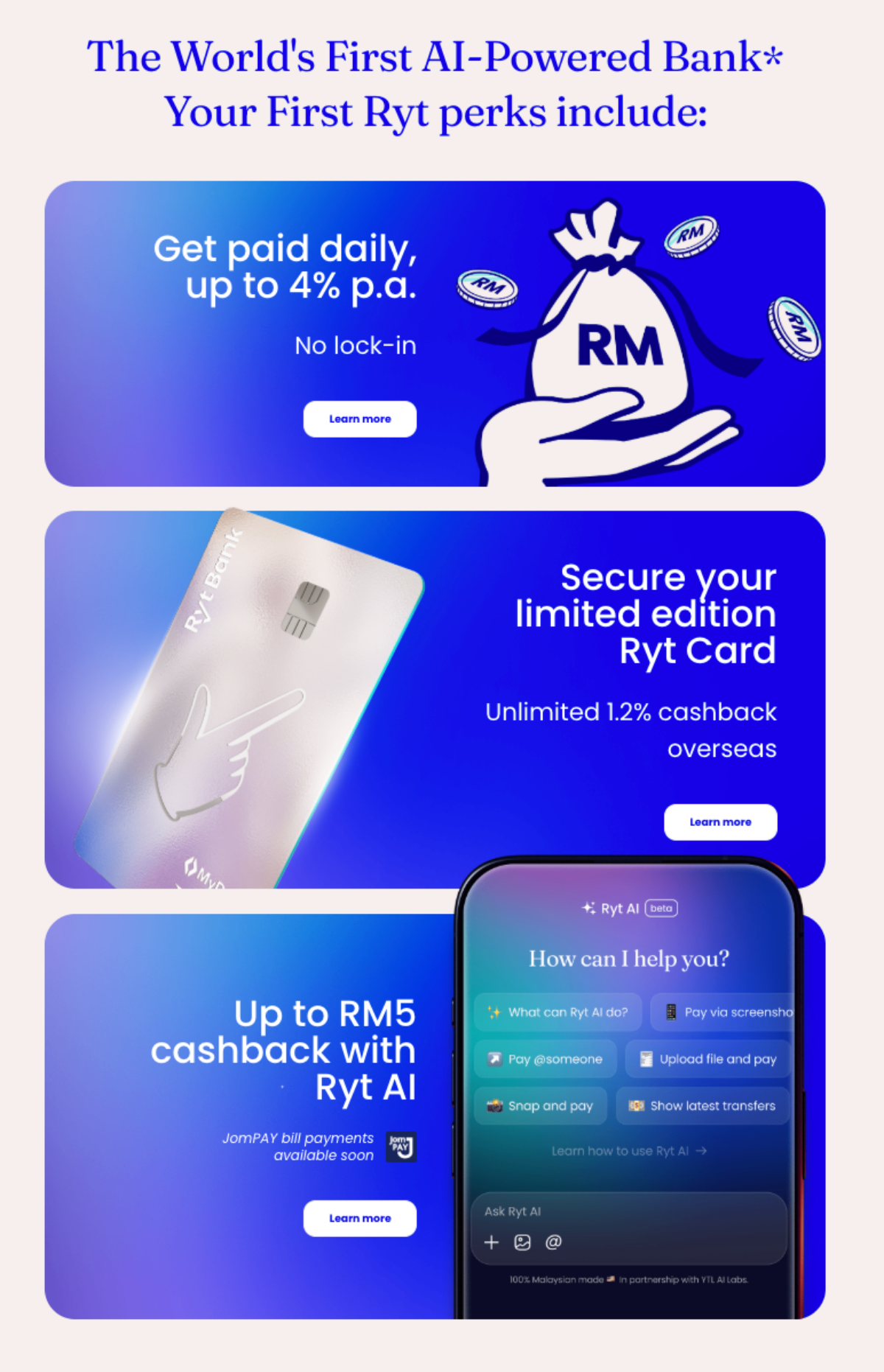

Every action carried out by Ryt AI is verified and encrypted, combining convenience with enterprise-grade security. To encourage adoption, customers who try the feature during the launch period can earn rewards of up to RM5.

Savings That Grow Daily

Ryt Bank offers a savings feature known as Ryt Save Pockets, designed to provide steady daily growth without lock-in requirements. Customers earn a base interest of 3% per annum, and balances of up to RM20,000 qualify for an additional 1% bonus interest, bringing the effective return to 4% per annum. The bonus portion is credited into a dedicated Ryt Pocket, while the base interest is added to the customer’s Save Pockets.

Both interest components are calculated daily and paid once the accrued amount reaches at least RM0.01. Balances above RM20,000 continue to earn the 3% base rate only.

This promotional rate runs until 30 November 2025 or until total deposits across all customers reach RM1 billion, whichever comes first. Bonus interest is allocated on a first-come, first-served basis.

Spend Anywhere with the Ryt Card

The all-in-one Ryt Card, powered by Visa, combines debit and credit functions, allowing customers to switch between modes instantly within the app. Early applicants will also be able to request a limited-edition design at no cost.

When used overseas, the Ryt Card provides unlimited 1.2% cashback with no foreign transaction fees. Within Malaysia, customers can withdraw cash at ATMs without any withdrawal charges.

Cardholders also enjoy partner rewards, including an RM8 Shopee voucher and dining privileges at YTL Hotels restaurants. The dining promotion offers 20% off meals at selected outlets until 31 August 2026, excluding festive periods such as Christmas, New Year, and Chinese New Year’s Eve.

Security, Licensing, and Protection

Ryt Bank operates under a licence from Bank Negara Malaysia, with deposits protected by PIDM up to RM250,000 per depositor. Security measures include biometric login, multi-layer encryption, and real-time fraud alerts to safeguard customer accounts.

The Ryt Bank app is now available for download on the App Store and Google Play.

Follow us on our official WhatsApp channel for the latest money tips and updates.

Comments (3)

Saya senang bisa bertemu aplikasi ini

Kami gembira mendengar anda seronok menggunakan aplikasi ini! Memang menarik dengan pelancaran Ryt Bank sebagai bank pertama di Malaysia yang dikuasakan oleh AI

Ya dan byk lagi membantu untuk kemudahan perbankkan dan menarik selagi