Alex Cheong Pui Yin

18th June 2021 - 3 min read

Standard Chartered Malaysia has rolled out the DuitNow Request feature on its mobile banking app, allowing customers to send payment requests to another person by keying in their mobile or MyKad number. It is the first bank in the country to adopt the latest DuitNow service.

According to Standard Chartered, the person requesting for payment (payee) can submit a request by tapping on the DuitNow Request tile – which can be found on the login page of the mobile app or in the Transfer & Payment tab. From there, go ahead and input the payer’s information, as well as the amount that they wish to collect. Once the request is submitted, they will receive a confirmation SMS, containing the reference number of their transaction and transaction details.

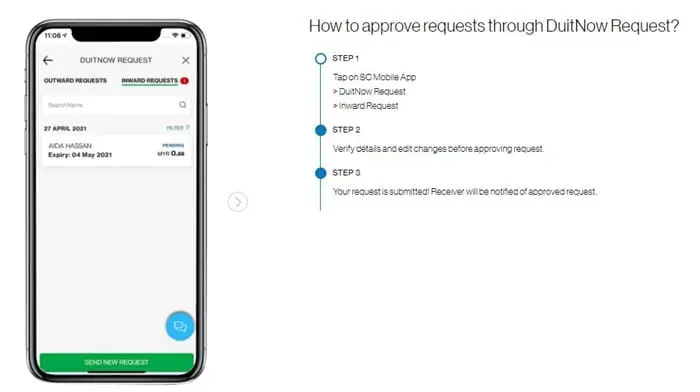

Meanwhile, on the payer’s end, they will need to approve the DuitNow Requests that are sent to them. This can be done by heading to the Inward Request section, found in the DuitNow Request tab. Payers can approve the requests by making the necessary payments, and they are also allowed to edit selected details if need be.

Standard Chartered further emphasised that the DuitNow Request service is free, and that no additional registrations are required. Customers will only need to download the Standard Charterd mobile banking app to use it. Note as well that each payee is only allowed to send out 20 active requests at any one time. Meanwhile, payers who are approving their DuitNow Requests will be limited by their daily DuitNow Mobile limit.

The head of consumer, private, and business banking of Standard Chartered Malaysia, Lai Pei Si said that the DuitNow Request feature will provide a more seamless payment and collection process for the bank’s customers. It will also contribute to the government’s push for the people and public sector agencies to adopt cashless transactions.

“With digital payments recording exponential growth, services such as DuitNow Request will be crucial in enabling real-time payments and high-volume transactions. We’ve witnessed an 87% year-on-year growth in digital payments and found that four out of every five Malaysians expect the nation to go fully cashless,” said Lai.

Standard Chartered also said that it expects the DuitNow Request feature to be adopted by more financial institutions soon; at present, only two institutions have enabled support for the DuitNow Request feature: Standard Chartered and Standard Chartered Saadiq. The widespread usage of the feature will allow for a better ease of reconciliation for users, whereas payers will be notified of successful transactions in real time.

For context, DuitNow is an umbrella service that aims to simplify the process of transferring funds by utilising details that are easy to remember. Instead of using your bank account number to transfer money – which you often don’t remember – DuitNow lets you use your mobile or MyKad number instead. Under DuitNow, there are several features that cater to various banking needs, such as DuitNow Transfer and DuitNow QR. DuitNow Request is the latest to be launched.

To find out more about Standard Chartered’s adoption of DuitNow Request, head on over to the bank’s website. Alternatively, you can check out the FAQ for the feature here.

(Source: The Edge Markets)

Comments (0)