Alex Cheong Pui Yin

9th November 2022 - 3 min read

Standard Chartered Bank has introduced a new savings account called the JumpStart savings account-i, which comes with its own debit card and perks that would “reward the smart traveller”. These include 5% cashback for online retail purchases performed via the JumpStart debit card-i, zero foreign exchange (FX) mark-up fees when you shop abroad, as well as zero charges on ATM withdrawals made overseas.

The JumpStart savings account-i itself offers 0.05% profit on all account balances – which differs from most savings accounts that typically adopt a tiered interest system – but if you make a minimum deposit of RM3,000 fresh funds each month, you will be able to enjoy a few exclusive benefits.

Chief of all is the opportunity to earn 5% cashback on any local and international online retail purchases that you make through the JumpStart debit card-i if you meet the minimum monthly deposit requirement. Offered via an exclusive campaign that is set to run until 30 September 2023, the total cashback that you can earn is capped at RM50 per month, although you must also ensure that your account is active (defined by the bank as having regular transactional activities). Note as well that the offer excludes transactions such as e-wallet reloads, as well as petrol and insurance payments.

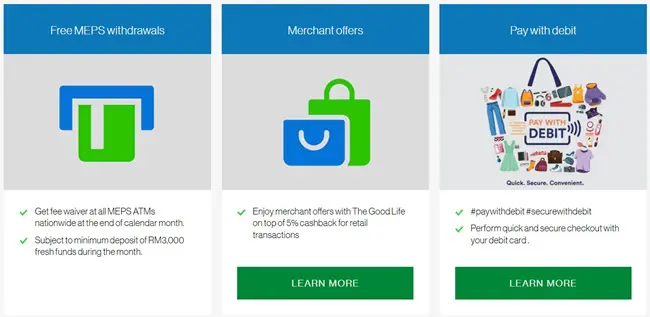

Additionally, you can enjoy a fee waiver at all MEPS ATMs nationwide at the end of each calendar month if you make a deposit of RM3,000 fresh funds into your account during the month.

Aside from these, the JumpStart debit card-i that comes with the account also lets accountholders benefit from 0% FX mark-up fees when they conduct overseas transactions or spend in foreign currencies; this would, of course, appeal to those of you who are frequent travellers. You can also enjoy zero charges on ATM withdrawals made overseas via the card, provided the transaction is performed on SCB or Mastercard/Cirrus network (Standard Chartered typically charges RM12 for each overseas withdrawal).

No minimum deposit is required to open a JumpStart savings account-i. As for charges, there is an early account closure fee of RM20 (within 3 months), and the usual annual debit card fee of RM8. There is also a paper statement fee of RM2, if you require this service.

All applicants who wish to apply for the JumpStart savings account-i online must be 18 years of age and above. Applications can be made either online via the SC mobile banking app, or at any Standard Chartered and Standard Chartered Saadiq bank branches.

Upon checking with Standard Chartered’s customer service, we found out that the JumpStart savings account-i has actually been quietly made available in Malaysia since October 2022. Coincidentally, the bank also has a similarly named JumpStart account in Singapore, but it offers vastly different benefits, and is available only to young adults aged between 18 to 26 years old.

(Source: Standard Chartered)

Comments (1)

Previously was 1% on any balance, and now after 1st October 2022, 0.05% only.